XRP Whales’ $1 Billion Accumulation Secures Price Rise Above $2

XRP has faced a month-long downtrend that saw it dip below the $2 mark, erasing the gains made earlier this year.

However, despite the recent challenges, XRP’s price has now moved back toward recovery, showing signs of upward momentum, largely supported by whale accumulation and broader market shifts.

XRP Whales Are Attempting To Benefit

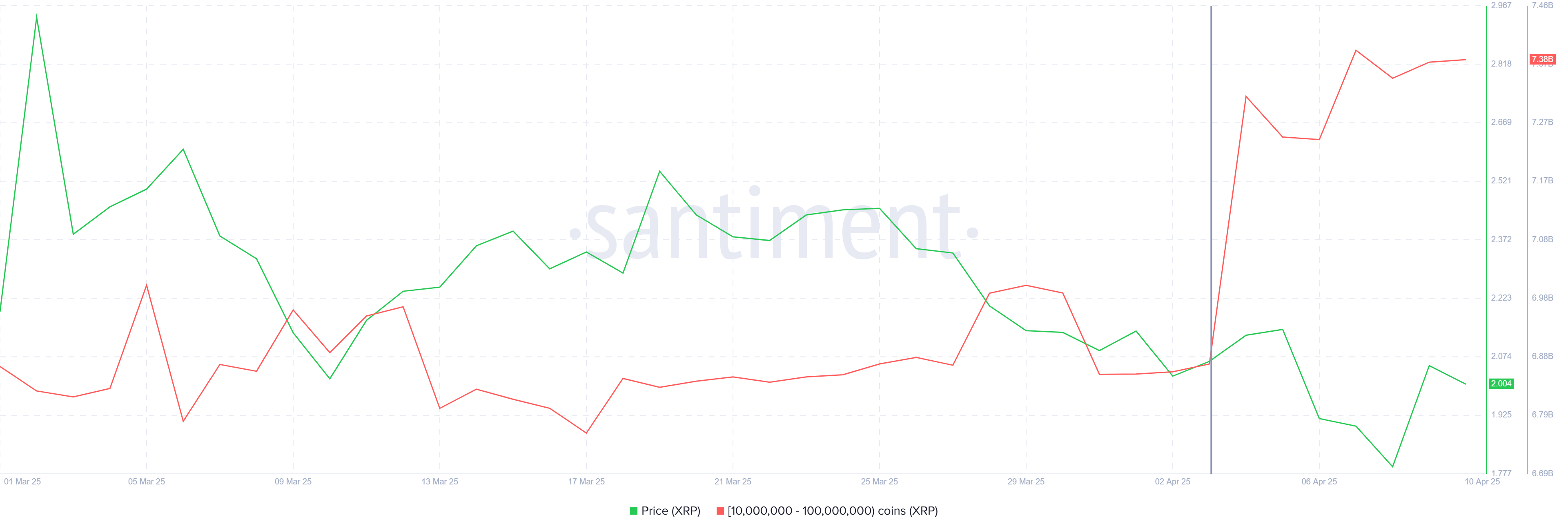

XRP whales have been actively accumulating tokens over the past week, showing a clear signal of confidence in the altcoin. In just seven days, addresses holding between 10 million and 100 million XRP tokens have collectively purchased over 510 million XRP, valued at over $1 billion.

This significant accumulation has increased the whales’ total holdings to 7.38 billion XRP. If this trend continues, it is likely that XRP’s price will be positively impacted by the conviction and increased demand from these key investors.

This strong support from whales provides a solid foundation for the cryptocurrency’s price, which may push it upwards once the broader market sentiment improves further.

XRP Whale Holding. Source: Santiment

XRP Whale Holding. Source: Santiment

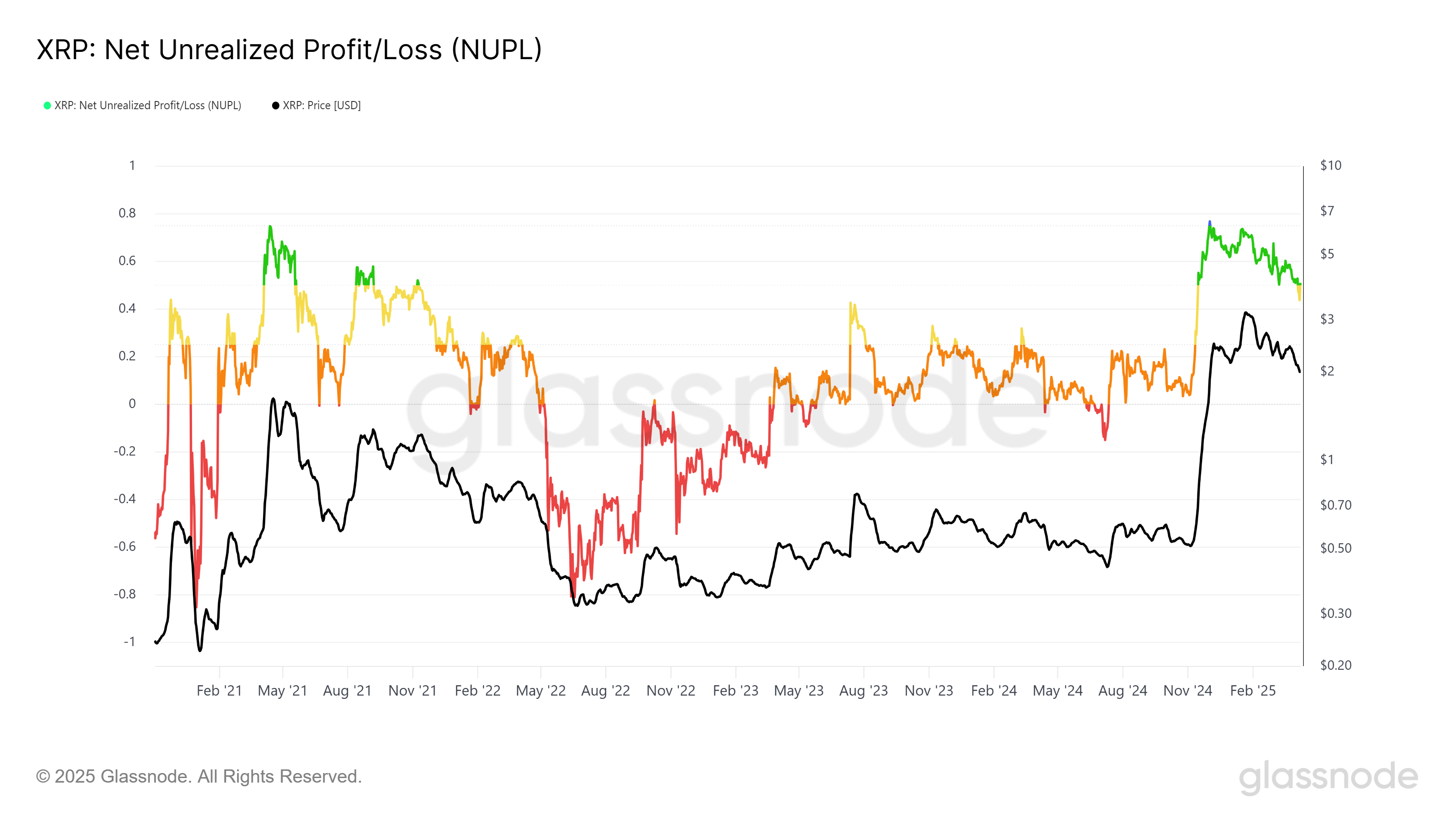

Looking at the broader market sentiment, XRP faces challenges with its NUPL (Net Unrealized Profit/Loss), which recently dipped below the 0.5 mark for the first time in five months. This dip indicates that XRP has entered the “anxiety zone,” an area historically associated with market corrections.

As investor sentiment becomes more cautious, XRP could face short-term price volatility. However, with global market conditions improving, especially after US President Trump paused reciprocal tariffs for 90 days, XRP could defy these bearish signals and start an upward movement.

XRP NUPL. SourceGlassnode

XRP NUPL. SourceGlassnode

Can XRP Price Escape The Downtrend?

At the time of writing, XRP’s price stands at $2.00, marking an 11.7% increase over recent trading days. Although the altcoin has made significant strides, it remains under the influence of a month-long downtrend.

As a result, XRP is still fighting against historical bearish momentum, but the recent price increase indicates potential for a continued rise. Given the current whale support and broader market improvement, XRP has the opportunity to push past the $2.14 resistance and target $2.27, breaking free from its downtrend.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, if the bearish sentiment intensifies, XRP could struggle to maintain its current price. This could lead to a fall through its key support of $1.94, potentially dropping to $1.70, thus invalidating the bullish outlook.