Coinbase to introduce 24/7 futures trading for Bitcoin and Ethereum on May 9

- Coinbase Derivatives has announced the launch of 24/7 Bitcoin and Ethereum futures trading for US traders on May 9.

- The launch will allow US-based crypto derivatives investors to trade Bitcoin and Ethereum futures contracts round-the-clock.

- The contracts will be backed by Coinbase Financial Markets and cleared through Nodal Clear, ensuring clear institutional framework.

Coinbase has announced the decision to launch 24-hour trading functionality for US-based traders on May 9 2025, just 24 hours after the US congress advanced a bill for crypto stablecoin regulations.

Coinbase greenlights 24/7 futures trading for Bitcoin and Ethereum Futures

Currently, derivatives account for over 75% of total crypto trading volume globally, according to CCdata. However, until now, US traders have faced limited access due to fixed market hours and contract expiration policies. By introducing 24/7 trading, Coinbase aims to eliminate inefficiencies that prevent traders from reacting to price movements in real time.

Perpetual-style futures to bridge US trading inefficiencies

In addition to continuous trading access, Coinbase is also developing a perpetual-style futures contract. Unlike standard futures, these contracts do not have expiry dates, allowing traders to maintain positions indefinitely.

The new perpetual-style contracts aim to provide US traders with more efficient hedging and strategy execution. Without the constraints of fixed expirations, traders can implement long-term positions without disruptions. Furthermore, the introduction of a regulated perpetual futures market within the US could reduce reliance on offshore exchanges, which have historically offered more competitive alternatives.

Crypto Regulations remain a crucial factor. In recent years, Coinbase has worked closely with the Commodity Futures Trading Commission (CFTC) to ensure compliance while expanding derivatives offerings to altcoins.

The US Congress also advanced a bill for Crypto stablecoin regulations this week as the Trump administration continues to push for crypto reserves, to mitigate mounting national debt.

Key points Coinbase users must note:

- Coinbase Derivatives launches 24/7 Bitcoin and Ethereum futures for US traders on May 9.

- The exchange is developing perpetual-style futures to eliminate contract expirations, enhancing trading flexibility within US markets.

- Coinbase's move is expected to boost institutional crypto adoption while reducing the need for offshore derivatives platforms.

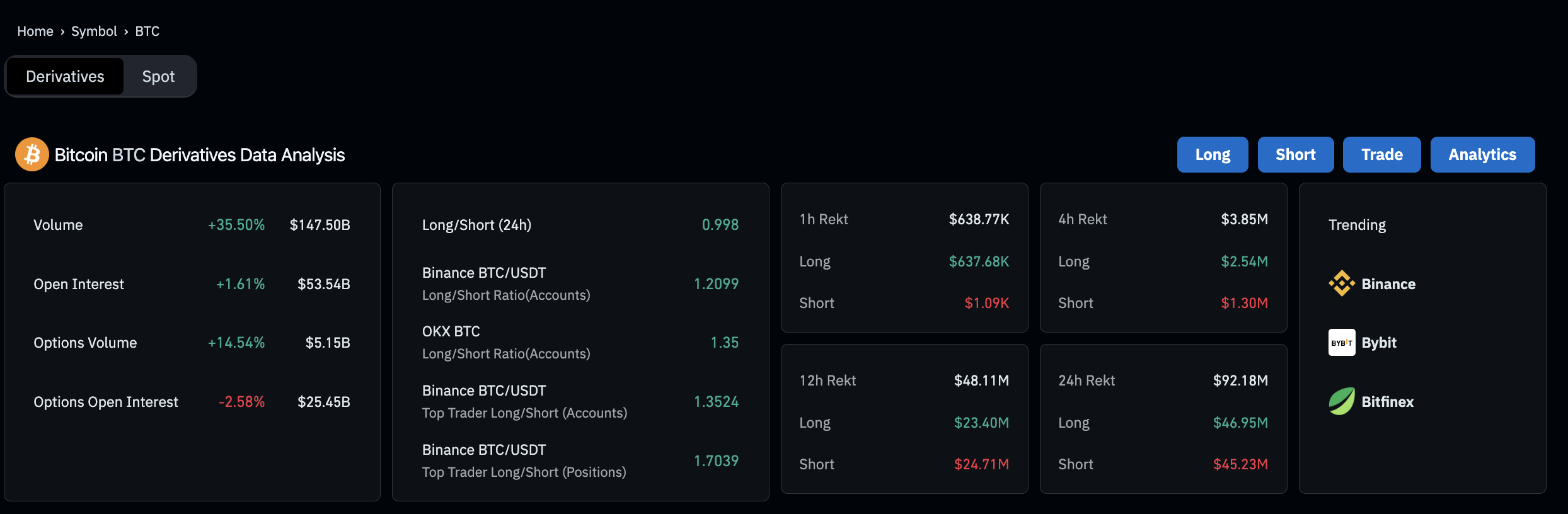

Bitcoin Derivatives Markets Analysis, April 4 | Source: Coingecko

At press time Bitcoin futures open interest stands at $53 billion according to Coingecko data, up 1.6% within the last 24 hours.

Market participants anticipate that the upcoming futures launch and perpetual contract developments will drive greater institutional participation in US-based crypto derivatives.

Perpetual futures lack expiration dates, enabling traders to hold positions indefinitely, providing better flexibility for long-term strategies.