S&P 500 wipes out $3.5T, approaches capitulation as Trump doubles down on World War 3 of trade wars

The S&P 500 has lost $3.5 trillion in just 48 hours as China and President Donald Trump officially kick off World War III of trade wars. We call it that because the last time America started a trade war was in 1930. Before that was in 1828, making 2025 the 3rd.

The S&P 500 fell 2.8% on Friday after dropping 4.84% the day before, bringing the two-day total to an 8% loss. That makes it the worst two-day stretch since the 2020 pandemic crash.

Dow Jones fell more than 1,000 points Friday following Thursday’s 1,679-point plunge. The Nasdaq Composite dropped 2.9% Friday after a brutal 6% fall Thursday.

This comes after Beijing imposed 34% tariffs on every single U.S. product entering China, triggering chaos across Wall Street and sending institutional capital racing to front-run retail.

The S&P 500 futures were down 3% pre-market Friday, putting the index on track for an 8% loss over two sessions. That would be its worst two-day fall since the height of the COVID panic in 2020. From Wednesday’s after-hours peak to Friday’s close, about $4.5 trillion has been erased from the market.

Is the US stock market approaching capitulation?

According to JPMorgan, retail investors poured $4.7 billion into the market on Thursday—marking a ten-year high in daily retail inflows. That was not capitulation. That was retail getting wrecked.

Nvidia, Tesla, and Apple—all with major revenue exposure in China—got hit hard. Apple dropped over 3% Friday, closing the week down 10%. Nvidia lost 5%, while Tesla tanked 6%. Bank stocks followed suit. Morgan Stanley slid 6%. Goldman Sachs dropped 5.7%. Citigroup lost 8%, and JPMorgan Chase fell 6%. Wells Fargo dropped 5%.

Investors flooded into bonds, dragging the 10-year Treasury yield below 4% Friday. JPMorgan analysts raised their odds of a U.S. recession this year to 60%, up from 40% Thursday night. That update hit just as oil collapsed again. Crude prices fell another 6% Friday morning and are now down 15% over the past two days. That’s the steepest two-day oil drop since April 2020.

But, oh, Beijing not only dropped a 34% tariff on all U.S. goods, it also blacklisted 11 American firms as “unreliable entities” and added 16 companies to its export control list. The impact on trade is immediate.

In 2024, the U.S. imported $439 billion from China, while China imported $143 billion from the U.S., making for $582 billion in total annual trade. With the 34% tariff now applied both ways, $198 billion worth of that trade now faces a heavy tax.

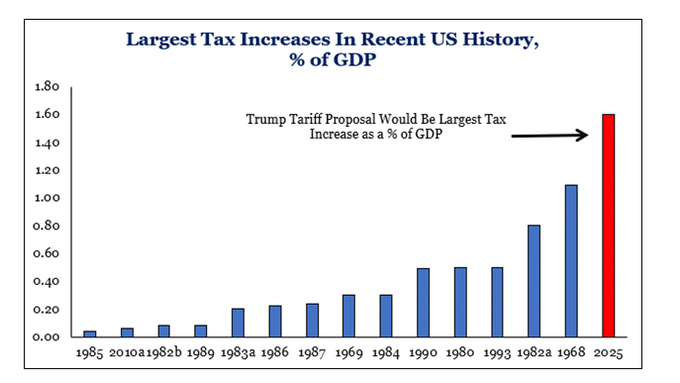

China’s retaliation within 24 hours means the U.S. is now looking at the biggest tax increase in its history, even without counting any future retaliation. The tariffs amount to 1.6% of U.S. GDP, 50 basis points higher than the previous record in 1968.

The White House response has been simple: escalate. Treasury Secretary Scott Bessent said Friday that if countries retaliate, more tariffs will come. “If you retaliate, there will be escalation,” Scott said. Commerce Secretary Lutnick gave the same warning in a separate interview on Thursday night.

Other countries are already getting involved. Mexico confirmed more tariffs are on the way. The European Union announced it has “countermeasures” prepared. Canada has signaled it will also respond.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More