GHIBLI Token Secures Multiple Exchange Listings as Trend Gains Momentum

Ghiblification (GHIBLI), a Ghibli-themed meme coin, has successfully secured listings on several exchanges following its recent launch.

The move comes as the cryptocurrency market experiences a surge in the launch of similar tokens.

Ghiblification (GHIBLI) Gains Traction with Listings on Gate.io, BingX, and More

Inspired by the viral Studio Ghibli AI art trend, the Ghiblification token has quickly gained attention, attracting major exchange listings despite being only two days old. Gate.io, in particular, has added the meme coin to its Pilot Section.

“New Listing: GHIBLI from Gate.io Pilot Section. Trading Pair: GHIBLI / USDT. Trading Starts: 02:00 AM, March 28th (UTC),” the announcement read.

For context, the Pilot Section provides users with early access to trending on-chain projects. This independent trading board allows users to discover and trade high-potential, early-stage tokens not available in the main marketplace. BingX also listed the token in its Innovation Zone.

“The Innovation Zone is designed to provide users with secure and fast trading of trending on-chain tokens. However, newly issued tokens may experience significant price volatility or even a rapid loss of all value,” the exchange cautioned.

In a similar move, BeInCrypto reported earlier that GHIBLI and another token called GhibliCZ were listed on Binance Alpha.

Yet, OXFUN took a different approach. It listed the meme coin for trading with the option to use leverage of up to five times. This move allows traders to amplify their positions, potentially increasing both their profits and risks.

“GHIBLI up 42% and traded more than ETH on OXFUN,” the exchange noted.

Similar announcements followed from HTX, AscendEX, and CoinEx, each confirming the token’s availability on their platforms between March 27 and March 28.

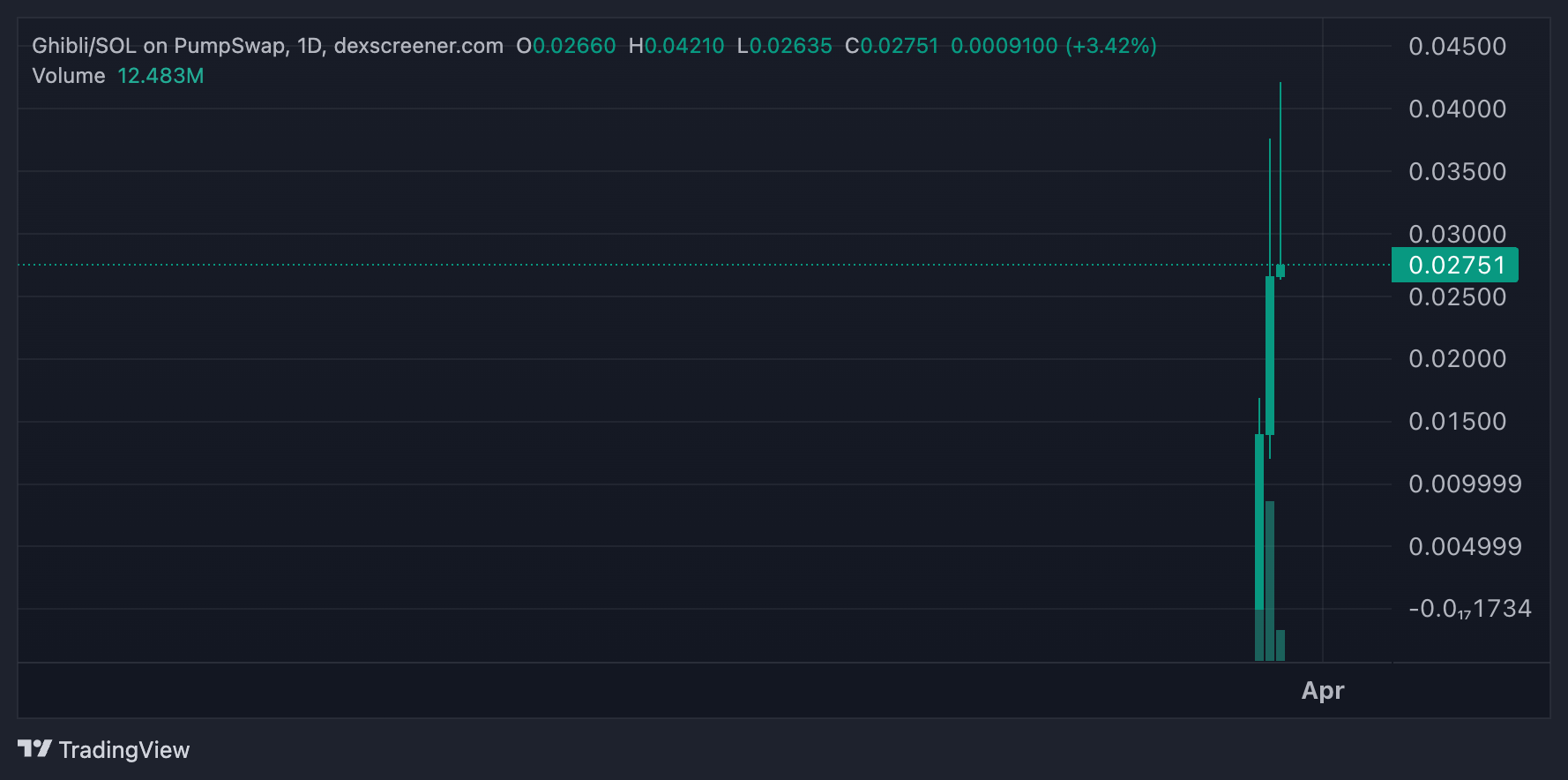

The listings have fueled trading activity. According to the latest data, GHIBLI’s value has increased 44.4% over the past day. At press time, the meme coin traded at $0.027, boasting a market capitalization of $27.5 million.

GHIBLI Price Performance. Source: DEXScreener

GHIBLI Price Performance. Source: DEXScreener

The rise of GHIBLI and similar meme coins is deeply intertwined with the viral art trend. It began with OpenAI’s GPT-4 update. This update introduced text-to-image technology that allowed users to generate Studio Ghibli-style artwork, sparking a viral movement across social media. As the trend grew, high-profile figures, including Elon Musk and Michael Saylor, joined in, amplifying its reach.

On March 26, Musk posted a Ghibli-style image on X, humorously depicting himself as a character from The Lion King holding the Dogecoin (DOGE) mascot with the caption “Theme of the day.”

Meanwhile, Saylor also joined the trend, advocating for not selling Bitcoin—but in true Ghibli style.

Industry Leaders Participating in the Viral Ghibli Trend. Source: X/MichaelSaylor

Industry Leaders Participating in the Viral Ghibli Trend. Source: X/MichaelSaylor

“You do not sell your Bitcoin,” he wrote.

For now, the Ghibli trend has overtaken crypto X (formerly Twitter), with Ghiblification riding the wave of this viral movement. Whether this trend is fleeting or will continue to drive momentum in the meme coin market remains to be seen.