Toncoin traders target $10B valuation as Elon Musk integrates Grok AI into Telegram

- Toncoin price rose 3% on Wednesday, nearing the $3.7 level with a market capitalization of $9.2 billion.

- On Wednesday, Elon Musk confirmed the integration of AI chatbot Grok into social media giant Telegram.

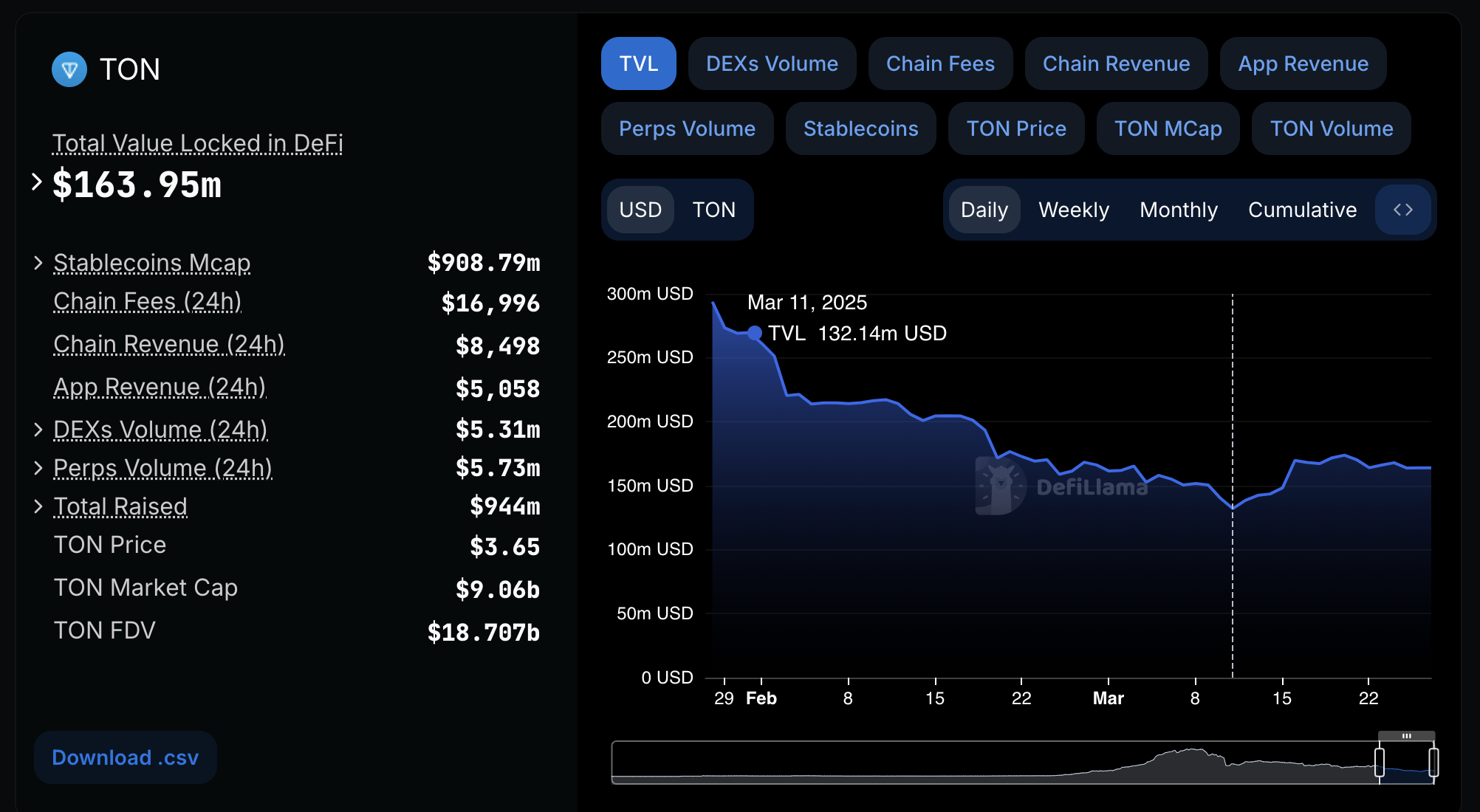

- The TON ecosystem currently holds $163 million in Total Value Locked (TVL), according to data from Defilama.

Toncoin price rose 3% on Wednesday despite crypto market inflows subsiding after a two-day rally. Market reports suggest Elon Musk’s Grok’s integration into the Telegram social network could trigger breakout gains in the weeks ahead.

Toncoin price consolidates as Elon Musk confirms Grok integration with Telegram

Toncoin’s price action has remained subdued this week, despite a favorable macro environment for privacy-focused projects.

The recent decision by the U.S. Securities and Exchange Commission (SEC) to lift sanctions on Tornado Cash has fueled gains for assets such as TORN, Monero (XMR), and ZCash (ZEC). However, TON has yet to capitalize on this positive momentum, trading within a narrow range.

Toncoin price action | Source: Coinmarketcap

Toncoin price action | Source: Coinmarketcap

Toncoin price rose 2.6% on Wednesday to hit $3.68 at press time, with its market capitalization hovering around $8.9 billion.

Recent market reports suggest more gains ahead as a potential bullish catalyst may soon emerge as a result of Telegram’s latest partnership with Grok AI, an artificial intelligence tool developed by Elon Musk.

How could Grok integration impact the TON ecosystem?

On Wednesday, Elon Musk shared a post from Grok’s official account, confirming the AI’s integration with Telegram.

Elon Musk Confirms Grok integration with Telegram | Source: X.com

Elon Musk Confirms Grok integration with Telegram | Source: X.com

This collaboration could significantly enhance the TON ecosystem, as projects built on the TON blockchain—already deeply embedded within Telegram’s social network—can now leverage Grok AI to improve functionality and user engagement.

TON Ecosystem Total Value Locked as of March 25, 2025 | Source: DeFiLlama

According to data from DeFiLlama, the total value locked (TVL) in the TON ecosystem currently stands at approximately $163 million.

If the integration of Grok AI is well-received by users and developers, this figure could see a notable increase in the coming weeks, strengthening the ecosystem’s fundamentals and driving higher demand for TON.

At present, Toncoin remains in consolidation above the $3.50 mark.

However, a breakout above the psychological $4 resistance level could trigger renewed investor interest and push TON’s market valuation past the $10 billion milestone.

As Telegram’s user base continues to expand and Grok AI adoption grows, the Toncoin ecosystem may find itself at the center of a new wave of blockchain-AI convergence.

Toncoin price forecast: TON eyes $4 breakout as bullish momentum builds

Toncoin’s price remains in a consolidation phase above $3.50, with indicators suggesting growing bullish momentum.

The Keltner Channel (KC) highlights a squeeze, with TON currently testing the midline at $3.46 while approaching the upper boundary at $3.91.

A decisive breakout above this resistance could signal a continuation toward the psychological $4 level.

Toncoin price forecast | TONUSD

The MACD histogram shows sustained bullish momentum, with the MACD line (0.071) trending above the signal line (0.010).

This suggests buyers are gaining strength, though the slight decrease in histogram bars signals a potential slowdown in upward momentum.

Volume remains moderate at 3.93M, indicating steady participation but lacking the explosive surge required for a breakout.

If TON fails to break above $3.91, a rejection could trigger a retest of $3.37, marked by the Parabolic SAR support.

A breakdown below $3.37 may push TON toward $3.00, invalidating the bullish scenario.

However, if buyers sustain pressure, a move toward $4 remains likely. A decisive close above $4 could propel TON toward $4.20, reaffirming the bullish case.