Bitcoin Market May ‘Cool Off’ In 4 To 6 Weeks — But Here’s What Needs To Happen

Over the years, investor sentiment has been one reliable way to analyze the Bitcoin and cryptocurrency market. Based on recent on-chain data, an analyst has pointed out how the changing investor sentiment could affect the world’s largest cryptocurrency over the next few weeks.

Can BTC Price Charge To New All-Time High?

In a recent post on X, crypto analyst Axel Adler Jr explained how the Bitcoin market dynamics could significantly shift in the coming weeks. This projection is based on recent changes in the “Bitcoin Fear and Greed Index.

The Bitcoin Fear and Greed Index refers to a metric that aggregates the average sentiment of investors in the BTC market. The indicator is divided into five zones, including extreme fear, fear, neutral, greed, and extreme greed.

Extreme fear signals that traders and investors are moving with high caution, while extreme greed suggests an overheating market condition with traders flooding in with new positions. Historically, periods of extreme fear have been correlated with market bottoms while price corrections usually occur during extreme greed.

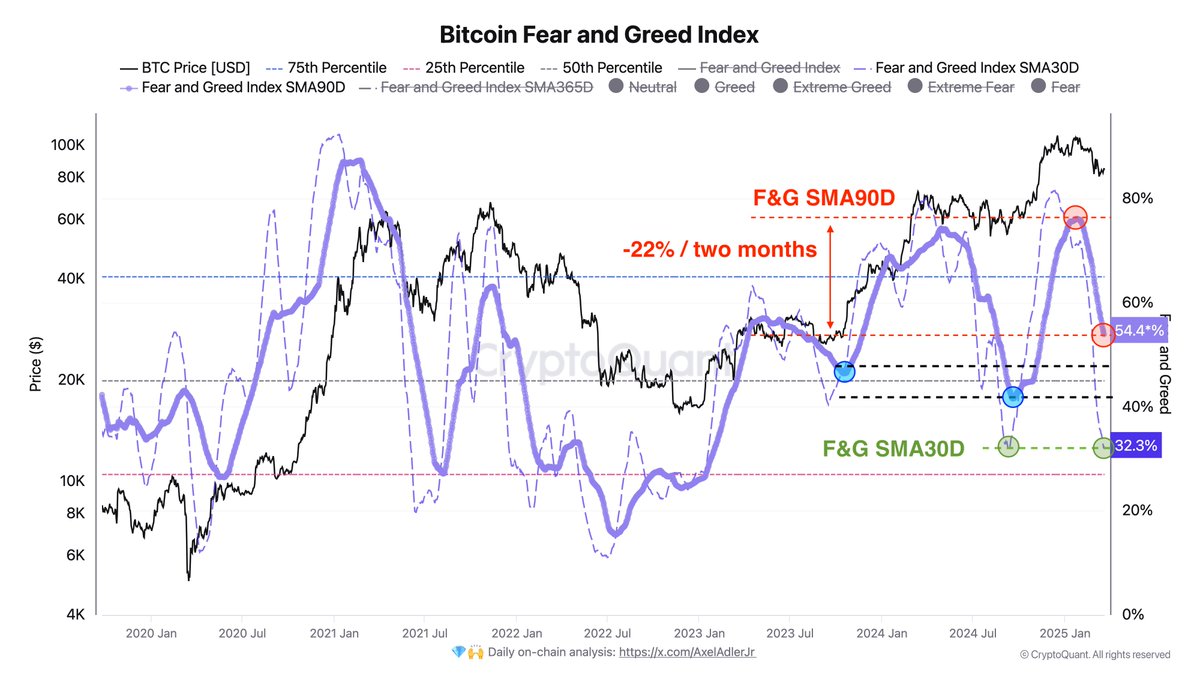

According to Adler Jr., the 90-day simple moving average (SMA) of the Bitcoin Fear and Greed Index has fallen by approximately 22 percentage points over the past two months. This decline has seen the BTC metric shift from extreme greed to a more moderate level of greed.

Going further, the on-chain analyst mentioned that if the Bitcoin Fear and Greed Index drops by another 10 to 15 points in the near future, the market may experience a cooling-off period where participants could have become accustomed to negative factors and emotional price movements may even subside.

Adler Jr added in his post:

At the current pace, it may take approximately 4 to 6 weeks for the index to drop by an additional 10–15 points.

The analyst also highlighted that the 30-day (monthly) moving average appears to be reaching a local bottom, one seen at the end of the Bitcoin price correction to $54,000. The last time the Fear and Greed Index monthly SMA reached this level, the premier cryptocurrency climbed to a new all-time high price. If this historical pattern holds, investors could see the BTC price break out of its consolidation range.

Bitcoin Price At A Glance

As of this writing, the price of BTC is just beneath the $84,000 level, reflecting a 0.5% decline in the past 24 hours.