Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

- Global crypto products shed $1.7 billion last week, bringing their outflows in the past five weeks to $6.4 billion.

- Bitcoin products witnessed the highest outflows in the past five weeks, totaling $5.4 billion.

- On-chain data reveals that long-term holders are still accumulating Bitcoin despite recent market corrections.

Crypto exchange-traded funds (ETFs) extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday. However, CryptoQuant data suggests that long-term investors are still acquiring Bitcoin despite recent market corrections.

Bitcoin and crypto products record outflows, long-term holders show resilience

Crypto products witnessed another week of outflows, totaling $1.7 billion last week. This marks the 17th straight day and a fifth consecutive week of outflows. As a result, investors have scaled dpwn their holdings by $6.4 billion over the same period, per CoinShares weekly report.

CoinShares also noted that crypto products assets under management (AUM) have declined to $48 billion from a height of $134 billion last year.

On the national scale, the US saw the highest outflows last week, totaling $1.16 billion and representing 93% of all outflows during the negative period. A combination of macroeconomic factors and tariff attacks may be responsible for the negative investor behavior towards digital asset ETFs.

Switzerland and Germany also contributed to the outflows, recording $528 million and $8 million, respectively.

Meanwhile, Bitcoin ETFs witnessed outflows of $978 million last week, bringing total outflows to $5.4 billion in the past five weeks. The top crypto dropped below $80,000 last week as macroeconomic factors continued to weigh on the crypto market.

However, long-term Bitcoin holders have continued to accumulate BTC despite its recent drawdown.

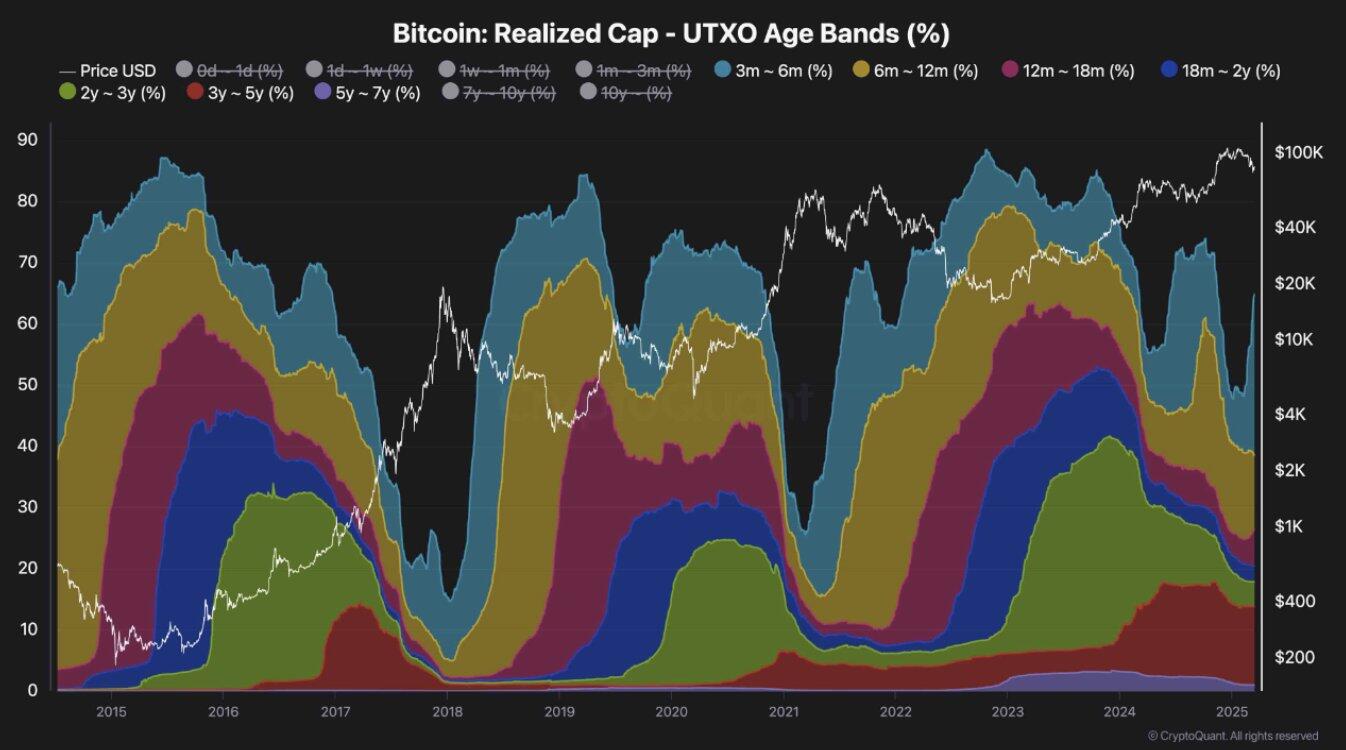

According to CryptoQuant, the number of BTC held for the past three to six months has rapidly increased, per the Realized Cap UTXO Age Bands — a metric that shows the percentage of Bitcoin distributions based on the duration they've been held.

BTC realized cap UTXO age bands. Source: CryptoQuant

The growing accumulation signals resilience among long-term investors to maintain their positions and accumulate more BTC. This reflects a similar pattern demonstrated during the prolonged correction last year.

"Historically, this type of resilience among Bitcoin holders has played a crucial role in forming market bottoms and igniting new uptrends," CryptoQuant noted in a report on Monday.

The trend also suggests that Bitcoin is experiencing a healthy correction rather than entering a bear market phase. This comes as companies like Strategy accumulated BTC despite recent price swings.

Strategy announced a minor purchase of 130 Bitcoin for $10.7 million at an average price of $82,981 per BTC last week.