UNI price jumps more than 50% after new Uniswap governance proposal update

- Uniswap DEX posted the new governance proposal update, featuring technical changes to invigorate and strengthen Uniswap’s governance system.

- The proposal has sent UNI price up over 50%, more than $3 million in short positions were liquidated.

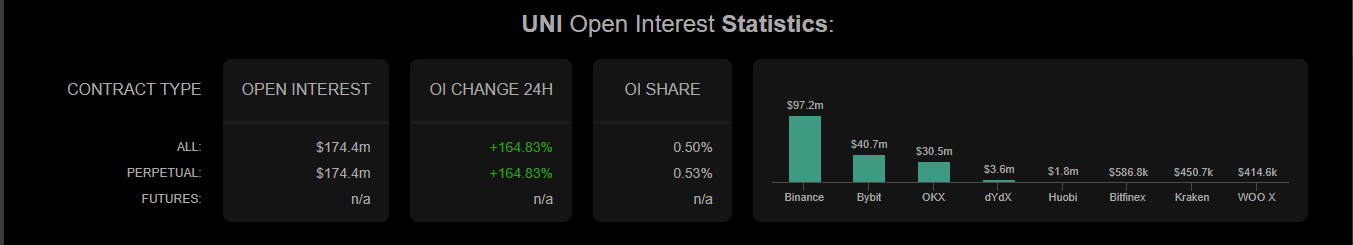

- UNI open interest has soared to $174.4 million as Binance exchange leads with nearly $100 million.

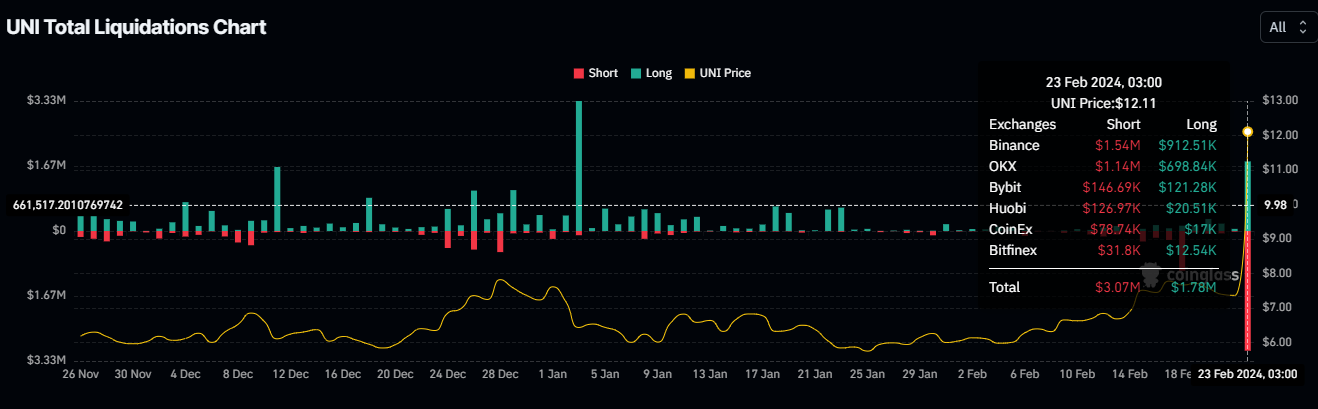

Uniswap (UNI) price finally broke consolidation with an impressive god candle on Friday, catching traders off guard as seen on the liquidations chart. The strong move north follows an update on the Uniswap network that will see community members rewarded.

Also Read: Uniswap launches v2 on Arbitrum, Polygon, Optimism, Base, Binance Smart Chain and Avalanche

UNI open interest nears $175 million following Uniswap governance proposal update

The Uniswap decentralized network posted details of its new governance proposal on Friday, seeking “to invigorate and strengthen Uniswap’s governance system.” The proposal looks to incentivize active, engaged, and thoughtful delegation by upgrading the protocol.

If the upgrade is approved, its fee mechanism would be such that UNI token holders who have delegated and staked their tokens will be rewarded. The initiative will go into voting if governance supports it.

Meanwhile, the hype around these potential offerings has seen UNI open interest soar to $174.4 million with Binance exchange taking the lead at $97.2 million followed by Bybit and OKX exchanges at $40.7 million and $30.5 million, respectively.

UNI Open Interest

Alongside the surge in open interest, up to $3.07 million in short positions were liquidated against $1.78 million in long positions as Uniswap price rallied nearly 50%.

UNI liquidations

UNI price outlook after Uniswap governance proposal update

Uniswap price skyrocketed over 50% amid the euphoria to trade for $10.93 as of publishing time. There is a potential for more gains as the Relative Strength Index (RSI) remained northbound. This signified rising momentum. The Awesome Oscillator (AO) was also in positive territory with histogram bars flashing green, which increases the odds for further upside.

Enhanced buyer momentum could see the Uniswap price shatter the $12.00 psychological level. Further, UNI price could extend a neck higher to reclaim the March 29, 2022 high of $12.49. Such a move would constitute a 10% climb above current levels.

UNI/USDT 1-day chart

On the flip side, if UNI holders start booking profits, the Uniswap price could drop, falling back into the range of consolidation below the 50% Fibonacci retracement level at $7.90. Below this base, the DEX token could find support around the strong buyer congestion level demarcated by the confluences between the 200, 100 and 50-day Simple Moving Averages (SMAs) near the $6.00 psychological level.