Solana DEX Volume Hits Year-To-Date Low, SOL Under Pressure

The trading volume across decentralized exchanges (DEXes) on the Solana blockchain has plunged to its lowest level since the beginning of the year.

This reflects a decline in network activity and weakening demand for its native token, SOL, whose value has plummeted over 30% in the past month.

Solana Faces Liquidity Crisis as DEX Volume Hits Yearly Low

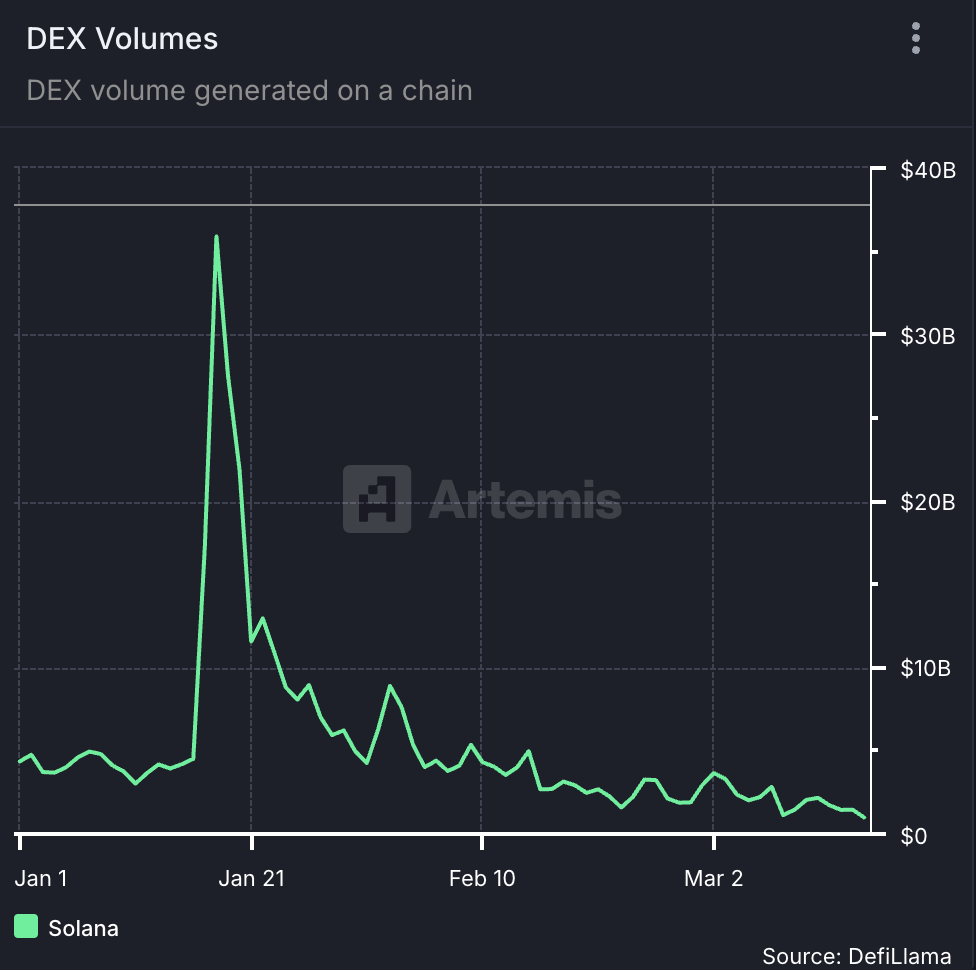

According to on-chain data from Artemis, Solana’s total DEX trading volume sank to a new year-to-date (YTD) low yesterday, extending a downtrend that began on January 10.

Solana DEX Volume. Source: Artemis

Solana DEX Volume. Source: Artemis

That day, the network’s DEX activity surged to a yearly peak of $36 billion. However, the subsequent decline in Solana’s user demand has led to a drop in trading volumes across its DEXes.

By Sunday, the network’s daily DEX volume had fallen to just $988 million, a 97% drop from its peak. The dip in daily DEX activity on Solana suggests waning interest from traders and liquidity providers.

It has also coincided with a broader bearish sentiment surrounding SOL, which has put significant downward pressure on its price.

As of this writing, the altcoin trades at $133.20, noting a 33% decrease in the past month amid falling demand. Its falling open interest in the futures market highlights the weakening buying pressure. It currently stands at $4.04 billion, dropping 24% in the past month.

SOL Open Interest. Source: Coinglass

SOL Open Interest. Source: Coinglass

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not yet been settled. When it declines like this, traders are closing their positions without opening new ones.

This trend signals a weak market conviction around SOL and hints at the possibility of an extended decline period.

SOL Price Teeters Above Critical Support—Is a Drop to $108 Coming?

At press time, SOL trades at $134.67, resting above the support formed at $120.72. If bearish pressure climbs, the coin’s price could fall below this level. In this case, additional selling pressure could be triggered, causing SOL’s price to drop to $108.23.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

On the other hand, a resurgence in SOL demand could prompt a rally toward $136.62. A successful breach of this level could push the coin’s price to $182.64.