Ethereum price risks decline as increasing exchange supply raises chances of profit taking

- Ethereum price failed to sustain above the $3,000 level, several times this week.

- 1.03 million wallet addresses bought ETH between $3,016 and $3,200, these traders are sitting on unrealized losses.

- Ethereum price slipped to a low of $2,932 on Friday, ETH faces the risk of further correction from likely increase in selling pressure.

Ethereum price crossed $3,000 several times this week but the altcoin failed to sustain above this key level, raising concerns regarding its price trend. ETH price faces the risk of decline as the supply of the altcoin on exchanges is on the rise.

Also read: XRP price approaches support levels amid Kraken's legal dispute referencing SEC v. Ripple lawsuit

Two catalysts that could trigger decline in Ethereum price

Ethereum price is back below the $3,000 mark after repeated attempts to sustain above this psychologically important level. The second largest cryptocurrency’s failure to sustain its uptrend past $3,000 makes it susceptible to a decline.

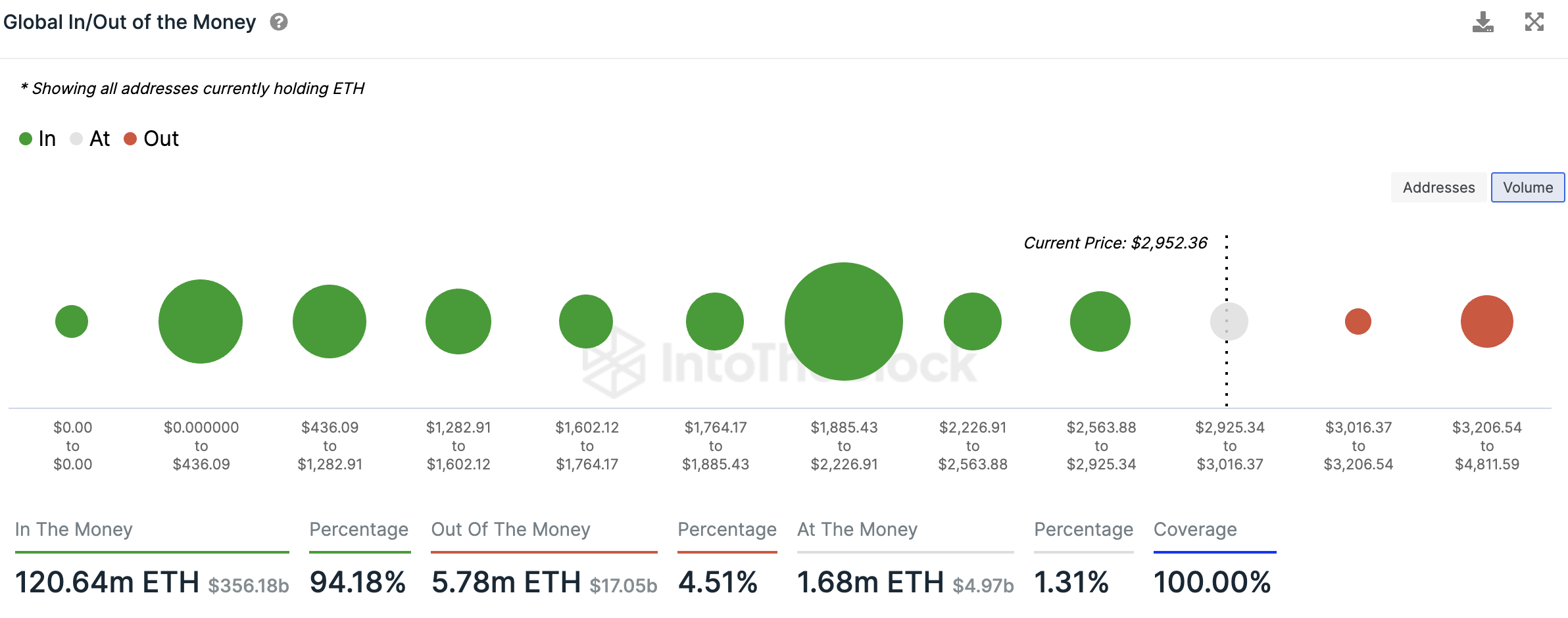

According to data from IntoTheBlock, 1.03 million wallet addresses scooped up ETH in the price range of $3,016 and $3,200. This implies that these ETH holders are currently sitting on unrealized losses. If Ethereum price repeatedly fails to rally above the $3,000 mark, these ETH wallet holders are likely to shed their holdings and realize losses.

Ethereum holders that purchased ETH above $3,000. Source: IntoTheBlock

This move could increase the selling pressure on Ether. The second leading catalyst is the consistent increase in Ethereum’s exchange supply. ETH Supply on Exchanges has climbed from 11.17 million to 12.71 million in the past month. This is a steep increase in Ethereum reserves on exchanges and increases the likelihood of a rise in selling pressure on the asset.

%20[13.13.24,%2023%20Feb,%202024]-638442753151437547.png)

ETH Supply on Exchanges. Source: Santiment

Data from on-chain intelligence tracker Lookonchain shows that four large wallet addresses sold over $100 million in Ether (34,134 tokens) near the $3,000 level. This observation is likely to negatively impact ETH price since it implies large wallet investors that deposit their Ether holdings on exchanges are likely to shed it and realize losses, contributing to a decline in ETH.

Ethereum price could drop to support at $2,500

Ethereum price could crumble and hit support at $2,500 if the altcoin is hit by mass profit-taking by ETH traders. ETH has yet to break past resistance at the 2024 peak of $3,033 and the altcoin has corrected lower following a rally to $3,000, four times this week.

Ethereum has yet to see a resurgence in demand or buying pressure since exchange wallets have observed a climb in ETH reserves and nearly 95% ETH wallet holders are currently profitable. If the uptrend is exhausted, ETH price could suffer a correction and sweep support at $2,500 before resuming its climb towards the $3,000 target.

The Awesome Oscillator and the Moving Average Convergence/ Divergence indicators show that ETH price could sustain its uptrend on the daily timeframe.

ETH/USDT 1-day chart

Ethereum price could find support at the 23.6%, 38.2% or 50% Fibonacci retracement of its rally to its 2024 peak, at $2,831, $2,705 and $2,602 respectively. A daily candlestick close below the 23.6% Fibonacci retracement at $2,831 could validate the bearish thesis for the altcoin.