Top 3 AI Coins Smart Money Wallets Are Buying

AI coins have been struggling in recent weeks, but smart money wallets are quietly accumulating Virtuals Protocol (VIRTUAL), GrokCoin (GROKCOIN), and AI Rig Complex (ARC). Despite sharp corrections, these three projects have seen notable inflows from experienced traders, suggesting potential rebounds.

VIRTUAL is down 53% in the last 30 days, ARC has dropped 68%, and GROKCOIN fell 33% in the past 24 hours. Yet, on-chain data reveals increasing accumulation. If momentum returns, these AI coins could recover key resistance levels, but further downside remains a risk if the sector fails to regain strength.

Virtuals Protocol (VIRTUAL)

VIRTUAL, once the biggest AI coin in the market, has been in a steep correction, with its price dropping over 53% in the last 30 days. The prolonged decline has weakened market sentiment, as AI-related tokens have lost momentum after their previous hype cycle.

However, despite this heavy sell-off, recent on-chain data suggests that smart money wallets are accumulating, which could indicate that some investors believe the bottom may be near.

If buying pressure continues to increase, VIRTUAL could stabilize and attempt a recovery.

VIRTUAL Price Analysis. Source: TradingView.

VIRTUAL Price Analysis. Source: TradingView.

In the last seven days, 21 crypto smart money wallets had a net inflow of $213,430 into VIRTUAL, suggesting renewed confidence from experienced traders.

This accumulation could be the first sign of a potential trend shift, but the price still needs to reclaim key resistance levels to confirm a reversal.

If VIRTUAL regains momentum, it could test $0.80 and $0.97, with a breakout above those levels opening the door for a move toward $1.24. However, for a sustained rally, AI coins need to regain market attention, as recent trends have shifted focus away from this sector.

GrokCoin (GROKCOIN)

GrokCoin (GROKCOIN) is a meme coin that gained rapid popularity due to its origins tied to Elon Musk’s AI, Grok.

The token was initially introduced as a joke following a tweet from Musk but quickly caught the attention of the crypto community.

GROKCOIN Price Analysis. Source: TradingView.

GROKCOIN Price Analysis. Source: TradingView.

Despite a 33% drop in the last 24 hours, smart money wallets have shown interest, with 54 wallets accumulating a net total of $133,049 in GROKCOIN over the past week.

This suggests that experienced traders may be positioning for a potential rebound. If GROKCOIN can reverse its current downtrend, it could test resistance levels at $0.0026, with a stronger rally potentially pushing it toward $0.0033.

AI Rig Complex (ARC)

ARC has been hit hard by the ongoing correction in AI coins, with its price plunging 68% in the last 30 days. ARC is developing Rig, an open-source framework that enables developers to create portable, modular, and lightweight AI agents.

However, its price action suggests that market sentiment remains weak, with ARC currently trading at its lowest levels ever.

Even with the sharp decline, 14 smart money wallets have accumulated a net total of $47,275 in ARC over the past seven days, signaling potential accumulation.

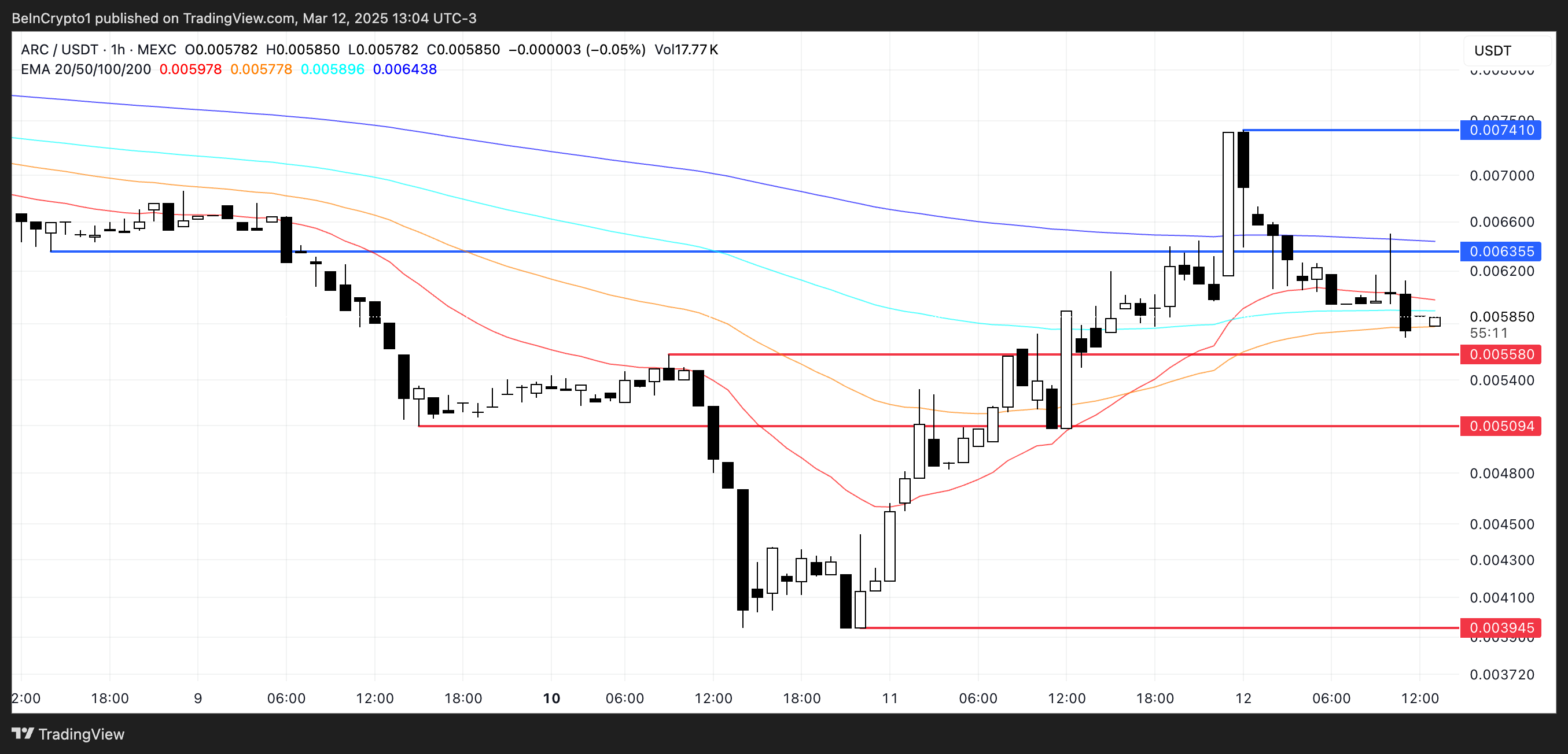

ARC Price Analysis. Source: TradingView.

ARC Price Analysis. Source: TradingView.

If ARC can regain momentum, it could test $0.0063 and $0.0074, which would mark a significant recovery from current levels.

However, if the correction continues, support at $0.0055 and $0.0050 will be critical, and a break below them could send ARC as low as $0.0039.