Will XRP Hit $27? Historical Data Suggests Another 718% Price Surge

The XRP market has experienced some significant bullish action in the past week with prices rising by 7.05%. Amidst this surge, popular market analyst Egrag Crypto has provided an interesting bullish prediction highlighting two potential price targets for the altcoin.

XRP Price Outlook: Analysts Eye $9.7 And $27 Breakout Targets

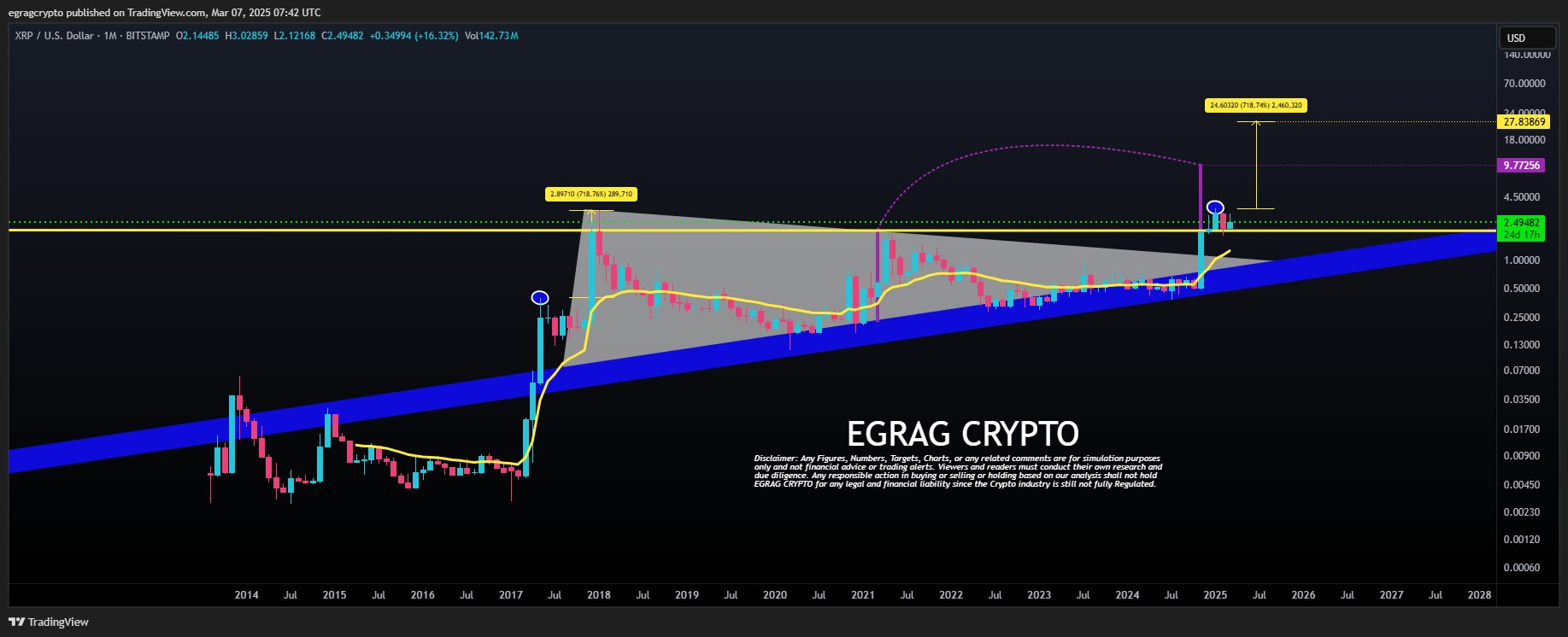

In an X post on March 7, Egrag Crypto shared an audacious technical analysis of the XRP price action suggesting the altcoin may be gearing up for a major price upswing following recent gains. Egrag Crypto’s positive prediction is based on XRP’s potential ability to repeat a price surge from its 2017-2018 bull cycle.

While past performance does not guarantee future results, the repeating nature of market cycles has led certain analysts to believe that XRP could experience another parabolic move. Notably, in early 2018, XRP moved from a breakout range of $0.35-$0.39 to a local market peak of around $2.89.

However, for XRP to show any potential in validating a repeat of this price surge, market bulls must reclaim the $3.4 price level, which represents the local peak of the current bull cycle. Using this price level as a reference point, Egrag Crypto identifies $9.7 as the first major price target for XRP, mirroring the midpoint of its 2017–2018 breakout.

The analyst explains that for investors looking to take profit, it would be ideal to sell at or around this price level i.e. $8, $9, $10, rather than waiting for an exact market peak. The second, more intriguing target would happen if XRP produces an exact 718% price surge, suggesting a potential price target of approximately $27.

XRP Price Overview

At the time of writing, XRP trades at $2.34 reflecting a 5.34% decline in the past 24 hours. However, its daily trading volume has increased by 8.56% and is now valued at $8.63 billion. In realizing Egrag Crypto’s bullish prediction, the altcoin must push past immediate resistance levels at $2.62 and $3.0 before a fated encounter at the $3.4 price barrier.

Furthermore, there must be a significant increase in buying volume and market participation. Other potential bullish factors include a clear regulatory stance around XRP. While its addition to the US digital assets stockpile is a much-welcome development, a termination of the SEC’s appeal case against Ripple would erase all regulatory and legal concerns around XRP.

Finally, a widescale bull run across the crypto market is another potential bullish driver. Notably, XRP was one of the best-performing crypto assets in the late Q4 2024 crypto rally, rising by over 460% in three weeks following the US elections.