LIBRA Meme Coin Insiders are Linked to MELANIA and Other Rug Pull Projects

Blockchain analysts have uncovered links between the LIBRA meme coin and other questionable crypto projects, including the official token of Melania Trump.

These findings have raised further concerns on LIBRA particularly after its brief endorsement by Argentina’s President Javier Milei.

Suspicious Connections Between LIBRA And MELANIA

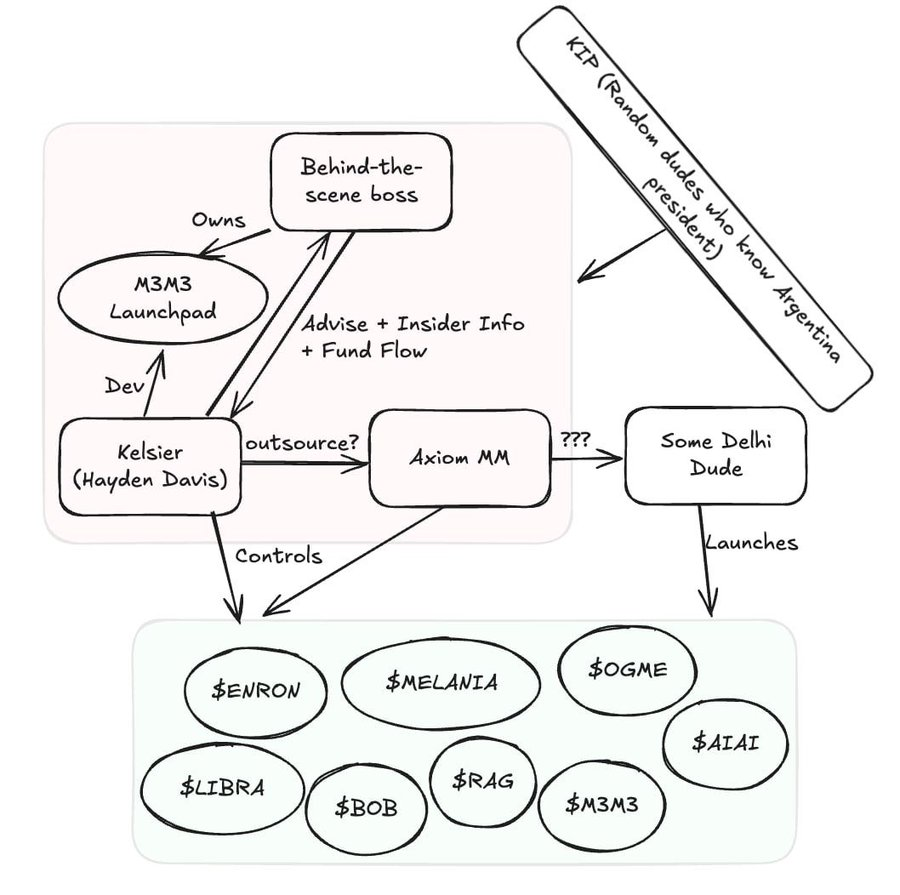

On February 16, Chaofan Shou, co-founder of Fuzzland, alleged that LIBRA’s market maker operates from Delhi and was also involved in the MELANIA meme coin.

Shou shared wallet data suggesting that the same entity controlled both projects, fueling suspicions of coordinated insider activity. He further linked the LIBRA team to tokens like Enron and OGME, which followed a similar pattern of price manipulation.

LIBRA Connection to Other Crypto Projects. Source: X/Chaofan Shou

LIBRA Connection to Other Crypto Projects. Source: X/Chaofan Shou

These projects experienced rapid price increases driven by insider trading and automated bots, followed by sudden sell-offs that left retail investors with losses. This pattern resembles pump-and-dump schemes designed to exploit traders.

The MELANIA token, launched just before Donald Trump’s second-term inauguration, briefly surged to a $2 billion market cap before crashing below $200 million.

LIBRA followed a similar trajectory. After receiving public support from President Milei, the token saw a surge in investments. However, insiders reportedly withdrew $107 million soon after, leading to its collapse.

Following the fallout, Milei distanced himself from the project, triggering accusations of market manipulation. Some critics have even called for his impeachment, citing the incident as a financial and political scandal.

LIBRA Insiders Reject Fraud Accusations

Despite the controversy, KIP Protocol, an entity linked to LIBRA, has denied any wrongdoing.

Julian Peh, KIP’s CEO, stated that all funds remain on-chain and accounted for. He also clarified that KIP had no role in the token’s launch, attributing responsibility to Kelsier, the project’s market maker.

“KIP has taken on alot of FUD today, including with threats to me and my staff, but we were not involved in the launch, we did not handle any tokens or SOL. KIP publicly acknowledged its role in the project (though not in the token issuance) because we were already listed on the website and believed in the initiative’s potential,” KIP said.

Meanwhile, Hayden Davis of Kelsier blamed President Milei and his team for investors’ losses. He argued that meme coin investments rely heavily on trust and endorsements.

When Milei’s team deleted their promotional posts, panic selling ensued, leading to a sharp market decline.

Nevertheless, he stated that his team still believes in the project and plans to reinvest $100 million in it. So, instead of transferring the assets to President Milei’s associates or KIP, Kelsier plans to reinvest the funds into LIBRA and burn all acquired tokens.

“I am proposing to reinvest 100% of the funds under my control, as much as $100 million, back into the Libra Token and burn all bought supply. Unless a more viable alternative is presented, I intend to begin the process of executing on this plan within the next 48 hours,” Davis stated.

The LIBRA controversy highlights the risks associated with speculative meme coins, especially those tied to high-profile figures. While supporters insist the project remains viable, investigators continue to examine its connections to potential market manipulations.