Dogecoin Whales Desert Market: Number Of $100,000 Transactions Nosedives 70%

The price of Dogecoin has been under significant downward pressure over the past week, and the latest on-chain data suggests that the meme coin might not experience relief any time soon.

Dogecoin Price Overview

As of this writing, the DOGE token is valued at around $0.246, reflecting a mere 0.5 decline in the past 24 hours. While the meme coin seems to have found formidable support around $0.23, there’s not been enough movement to ensure a comeback and wipe out some of the recent loss. CoinGecko data shows that the largest meme coin has shrunk in value by more than 25% in the last seven days.

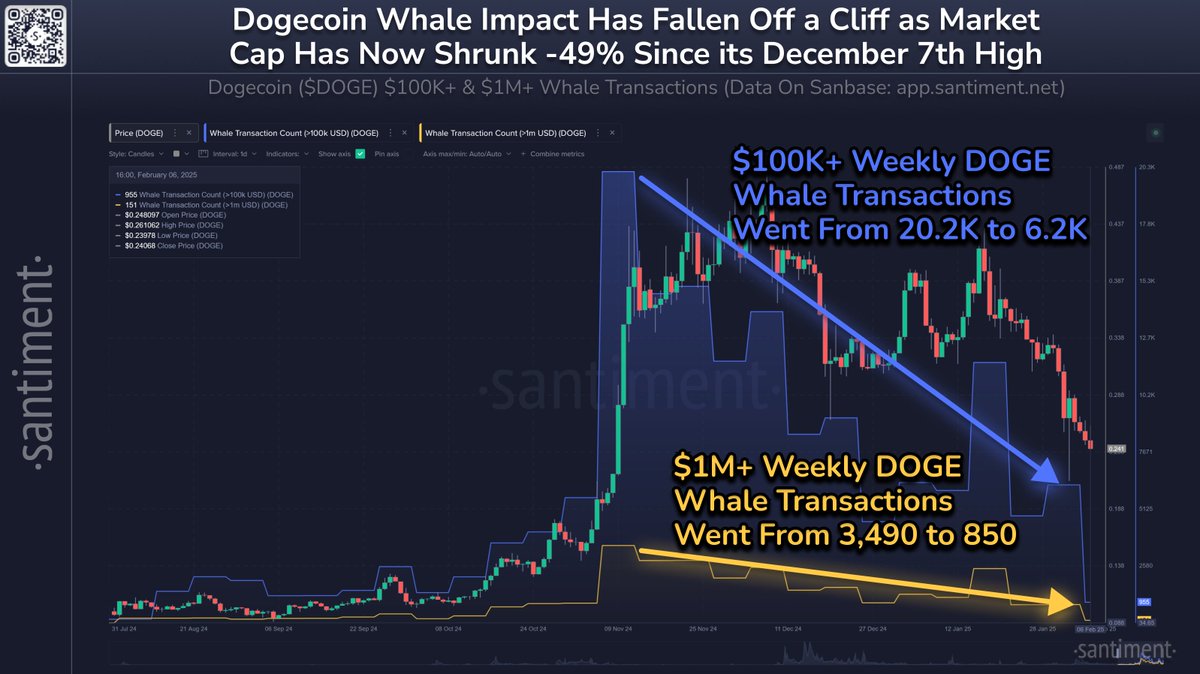

However, price action data shows that Dogecoin’s struggle didn’t begin in the past week, as the meme token has steadily declined since reaching $0.47 in early December. According to data from Santiment, the price of DOGE is down by nearly 50% after notching the local high two months ago.

While the general market condition has not been particularly positive, the meme coin sector appears to be enduring the biggest impact of the climate shift. The latest on-chain data suggests that an important class of large investors might have a role in the price downturn, as they are becoming less active in the Dogecoin market.

DOGE Large Transactions Witness Severe Decline

In a Feb. 8 post on the X platform, the blockchain intelligence firm Santiment revealed that Dogecoin whales have become less active in the market, with their number of transactions dwindling in recent weeks. Specifically, the on-chain analytics firm highlighted the changes in two whale transaction groups: the $100,000 and the $1 million transactions.

According to Santiment, the number of DOGE transactions (worth over $100,0000) has drastically reduced, by more than one-third of the volume during the “Trump pump run-up in early November.” On-chain data shows that the weekly $100,000 transactions have fallen from 20,200 to 6,200 — an almost 70% decline — since November 9, 2024.

Meanwhile, the weekly $1 million DOGE transactions have plunged by over 75%, going from 3,490 to 850 in the last three months. As Santiment highlighted, these whale transaction metrics may need to pick up again if the Dogecoin price is to recover.

In a new post on X, crypto analyst Ali Martinez revealed that whales have accumulated over 100 million DOGE tokens in the past 24 hours. According to the pundit, this latest round of accumulation signals growing interest and confidence amongst large investors.