Binance Research Shows 47 Crypto ETF Filings and Record Token Launches

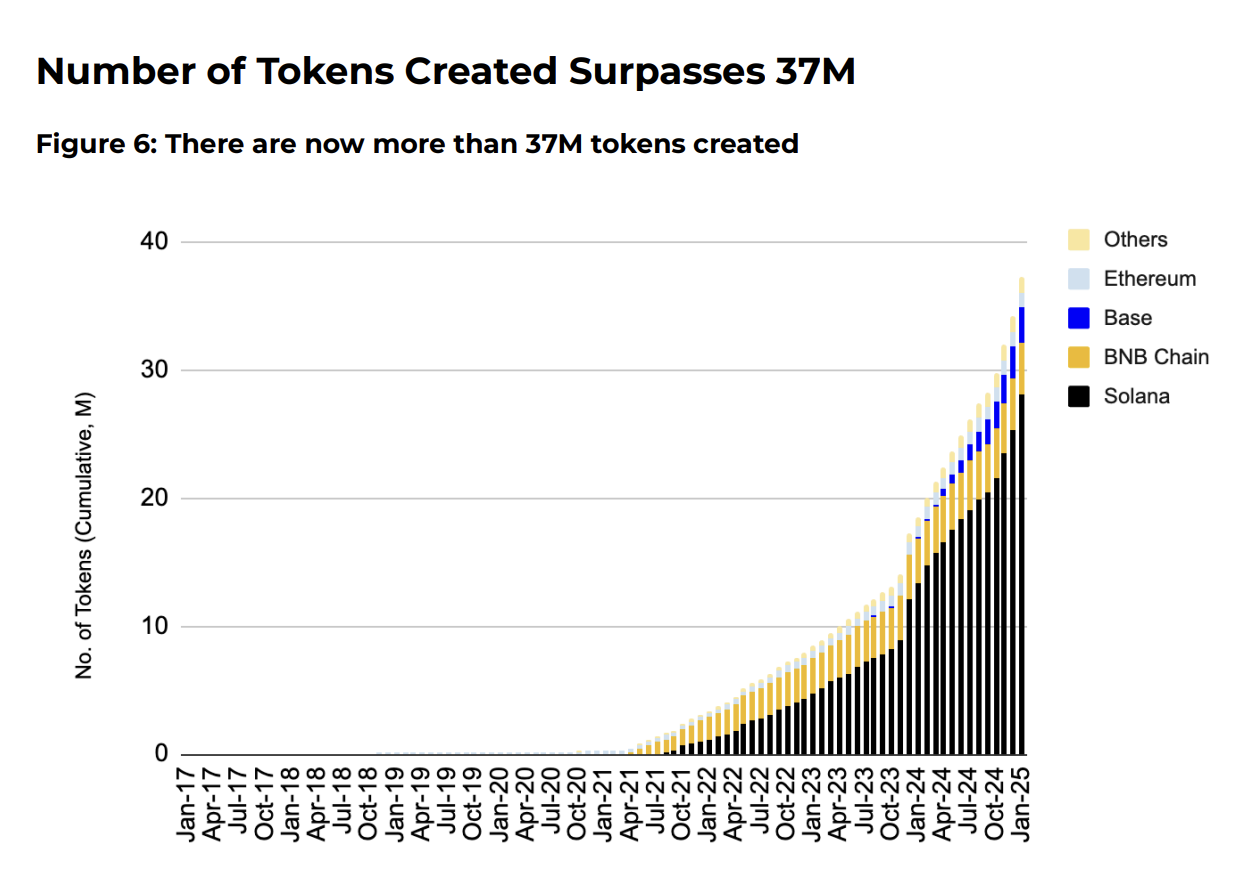

Binance released its latest monthly market insights report, detailing growth in meme coins and ETF filings. The total number of tokens in circulation has reached over 37 million, the majority launching on Solana. Also, there are 47 active ETF filings in the US.

January 2025 was a positive month for the crypto industry, with a peaking market and gains in several key areas. The biggest loser was in AI-related crypto projects, which took a hard beating from DeepSeek.

Binance Research: Meme Coins, ETFs, AI Tokens

Binance Research, a subsidiary of the largest crypto exchange, just released its newest Monthly Market Insights report. In it, Binance painted a positive picture, with the crypto market peaking at $3.76 trillion in January and growth areas like meme coins having a dramatic impact.

“The advent of token launchpads and the meme coin mania has led to the creation of over 37 million tokens, with projections exceeding 100 million by year-end. This growth has fragmented capital, making it harder for tokens to sustain prices and achieve high valuations,” the report claimed.

Binance Research has been studying the meme coin craze for several months, so it makes sense that it has a wealth of data on the subject.

Although meme coins are a growth area in the industry, the report raised a few concerns. Specifically, it concurred with the research suggesting that this tidal wave of projects is sapping energy from traditional altcoins.

The Growth of Token Launches Over the Years. Source: Binance Research

The Growth of Token Launches Over the Years. Source: Binance Research

Binance claimed that this meme coin influx “fuels speculation, reduces attention spans and discourages long-term holding,” asserting that most tokens have a negligible market cap.

Still, it did have positive downstream impacts, like rapid growth in Solana DEX volumes. Meme coins and AI agents helped the Solana-to-Ethereum DEX volume ratio surpass 300% in January.

Additionally, Binance’s report discussed political changes after Trump’s Inauguration. Since Gary Gensler resigned as SEC Chairman, the Commission immediately saw a rush of ETF applications.

Binance Research claimed that there are currently 47 active ETF applications in the US, covering 16 asset categories, including meme coins.

All in all, Binance reported that January was a positive month for the broader crypto industry. The only significant loser was in AI, as DeepSeek severely punished this niche market.

Regardless, the DeFAI sector did recover somewhat, ending the month with only a -10% return. Compared to initial losses, it could have been a lot worse.