Litecoin (LTC) Price Rallies 25% Following Grayscale’s Spot ETF Filing

Litecoin’s price surged by 25% this week following news that Grayscale filed for a spot Litecoin ETF, sparking demand from institutional investors.

The move validated the efforts of long-term holders (LTHs), whose support has anchored LTC through market fluctuations. This development has positioned Litecoin as a standout performer in the cryptocurrency market.

Litecoin Has Its Investor’s Support

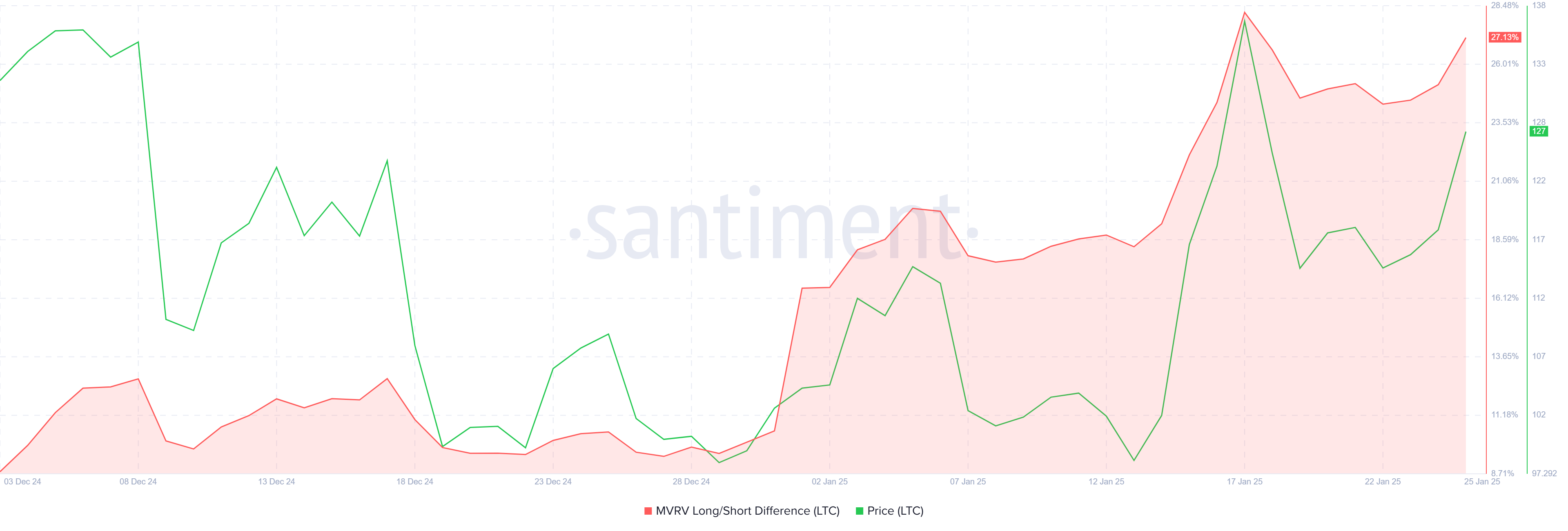

Long-term holders have played a critical role in stabilizing Litecoin. The MVRV Long/Short Difference indicator remains highly positive, signaling that LTHs are in profit. These investors, known for their tendency to HODL rather than sell, provide essential support, reducing the likelihood of sharp corrections.

This behavior has created a strong foundation for Litecoin, enabling it to sustain rallies even during periods of market volatility. By holding onto their assets, LTHs act as the backbone of Litecoin, ensuring that the cryptocurrency maintains momentum and garners investor confidence.

Litecoin MVRV Long/Short Ratio. Source: Santiment

Litecoin MVRV Long/Short Ratio. Source: Santiment

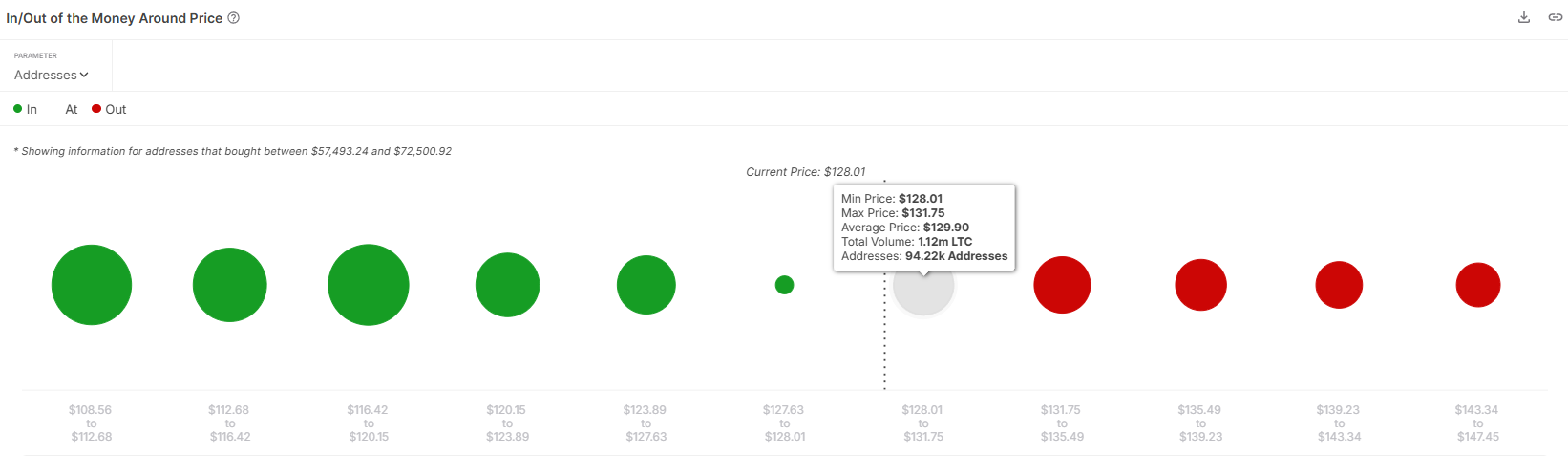

The macro momentum for Litecoin remains bullish, supported by the IOMAP metric. Data reveals that investors bought over 2 million LTC, valued at more than $256 million, within the $128 to $135 range. This supply becomes fully profitable once Litecoin flips $136 into support, reinforcing positive sentiment.

This concentration of profitable investors is likely to keep sentiment optimistic. Anticipation of breaking the $136 resistance level has fueled bullish momentum, as investors remain confident that LTC can sustain its upward trajectory. The substantial backing at these levels further solidifies the asset’s potential for continued growth.

Litecoin IOMAP. Source: IntoTheBlock

Litecoin IOMAP. Source: IntoTheBlock

LTC Price Prediction: Flipping Key Barrier Into Support

Litecoin has risen by 25% in the past 24 hours, currently trading at $128. The altcoin now faces resistance at $136, which will be critical for maintaining its bullish momentum and enabling further gains.

If Litecoin breaches and flips $136 into support, it could unlock the $256 million in profits tied to this level. Such a move would likely propel LTC to $147, marking a significant step in its ongoing rally and validating investor confidence.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, Litecoin price’s failure to break above $136 could result in a decline to $117 or even $105. This would erase a significant portion of recent gains, invalidate the bullish outlook, and delay the realization of anticipated profits.