Crypto laundering soars to $1.3 billion in 2024, a 280% surge – PeckShield

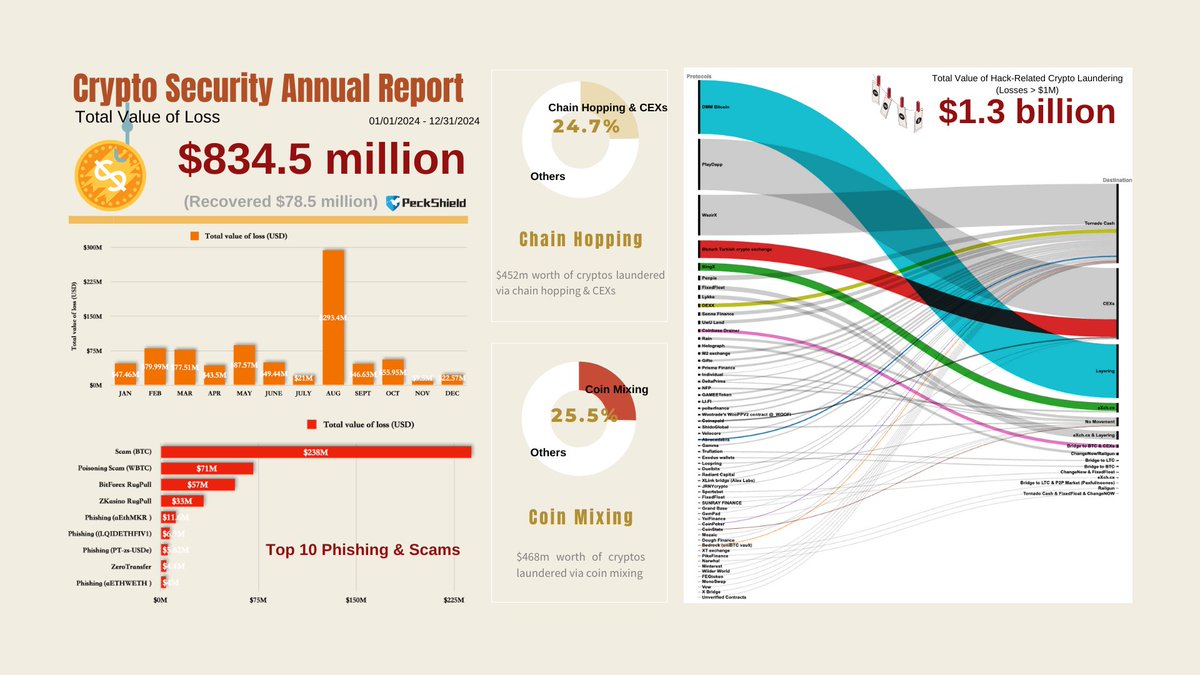

Cryptocurrency laundering reached $1.3 billion in 2024, marking a 280% increase from the $342 million recorded in 2023, according to a new report from blockchain security firm PeckShield.

The surge in laundering activities coincides with the broader upward trend in cryptocurrency prices throughout the year. The total impact of crypto security breaches in 2024 exceeded $3.01 billion, representing a 15% increase from the $2.61 billion stolen in 2023.

The scale of crypto security breaches

Cryptocurrency hacks in 2024 surpassed 300 recorded incidents, with total losses reaching $2.15 billion. This is a 30% increase from the $1.51 billion stolen in 2023. May emerged as the most volatile month, with attackers stealing $574.6 million across 28 separate hacks.

The Ethereum blockchain bore the heaviest losses, accounting for 47.3% of the total value stolen and 34.8% of all incidents. The gaming sector faced particular pressure, with losses totaling $502 million, primarily due to the PlayDapp exploit, which resulted in a $290 million theft.

Source: PeckShield

The data from PeckShield indicates a shift in attack patterns, with hackers increasingly targeting organizational infrastructure rather than protocol vulnerabilities. This trend now represents 46% of all attacks, up from 33% in 2023. Bitcoin-related thefts also increased, correlating with the cryptocurrency’s price appreciation throughout the year.

Recovery efforts managed to secure $488.5 million of the stolen funds, though this represents only 23% of the total losses. The persistence of these attacks, despite enhanced security measures, underscores the ongoing challenges faced by the cryptocurrency industry in protecting digital assets.

Laundering mechanisms by crypto hackers

PeckShield’s analysis reveals two primary methods criminals used to obscure stolen cryptocurrency in 2024. Chain hopping combined with centralized exchange (CEX) transfers accounted for 24.7% of laundering activities, processing approximately $452 million worth of stolen assets. Coin mixing services handled 25.5% of illicit funds, processing $468 million throughout the year.

The rise in crypto prices created additional opportunities for laundering operations, as higher valuations made it easier to process large amounts through multiple smaller transactions. Criminals used increasingly complex routes, often splitting stolen funds across multiple chains and services to avoid detection. The analysis tracked money flows through more than 50 different platforms and services.

On-chain data shows criminals frequently used cross-chain bridges and decentralized exchanges as intermediate steps before reaching their final destinations. The complexity of these operations often delayed fund recovery efforts, with law enforcement and security teams requiring extensive resources to track and freeze compromised assets.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan