Filecoin bulls eye for double-digit gains

- Filecoin’s price extends its gain by 5% on Monday after surging more than 19% the previous week.

- The rally was fueled by the announcement that Bithumb, the second largest exchange in South Korea, will add a new Filecoin trading pair on Monday.

- On-chain data further support the rally as FIL’s open interest and TVL are rising.

Filecoin (FIL), a decentralized storage network, extends its gain by 5% and trades around $6.20 on Monday after surging more than 19% the previous week. The main reason behind the rally is the announcement that Bithumb, the second largest exchange in South Korea, will add a new Filecoin trading pair on Monday. Moreover, on-chain data further support the rally as FIL’s Open Interest (OI) and Total Value Locked (TVL) rise, hinting at further gains ahead.

Why is Filecoin going up today?

Filecoin price extends its gain by 5% on Monday after surging more than 19% in the previous week. The main reason for the recent price surge is stated below:

According to Wu Blockchain's Twitter post, Bithumb, the second largest exchange in South Korea, will add a new Filecoin Korean won trading pair on Monday. This announcement allows investors to gain exposure to the native token of Filecoin in South Korean markets, which is a positive sign for the token’s accessibility and liquidity. This renewed interest will likely attract investors and traders to the FIL token.

Bithumb, the second largest exchange in South Korea, will add a new Filecoin (FIL) Korean won trading pair. Trading is expected to open at 04:00 pm local time on Monday, January 6, 2025.https://t.co/eMp0PjMLGE

— Wu Blockchain (@WuBlockchain) January 6, 2025

Moreover, Messari’s “The Crypto Theses 2025” report highlights Filecoin’s growing momentum in 2025.

“From nearly 30% storage utilization growth to advancements like FWS and Fast Finality (F3), Filecoin is shaping the future of decentralized storage”, says the report.

As the new year begins, the findings from @MessariCrypto's Theses for 2025 remain a testament to Filecoin's growing momentum. From nearly 30% storage utilization growth to advancements like FWS and Fast Finality (F3), Filecoin is shaping the future of decentralized storage. pic.twitter.com/zQZBb1zdii

— Filecoin (@Filecoin) January 5, 2025

Technical Outlook: FIL bulls aim for $8.4 mark

Filecoin price found support around the weekly level of $4.85 in mid-December and rallied 22% until the end of the month. At the time of writing on Monday, FIL continues to trade higher at around $6.20.

If FIL continues its upward trend, it could extend the rally by 35% to retest the 61.8% Fibonacci retracement level, drawn from the March 2024 high of $11.85 to the August 2024 low of $2.87, at $8.42.

The Relative Strength Index (RSI) on the weekly chart reads at 56 after bouncing off from its neutral level of 50 on December 23, indicating a rise in bullish momentum.

FIL/USDT weekly chart

Other optimism for FIL bullish rally

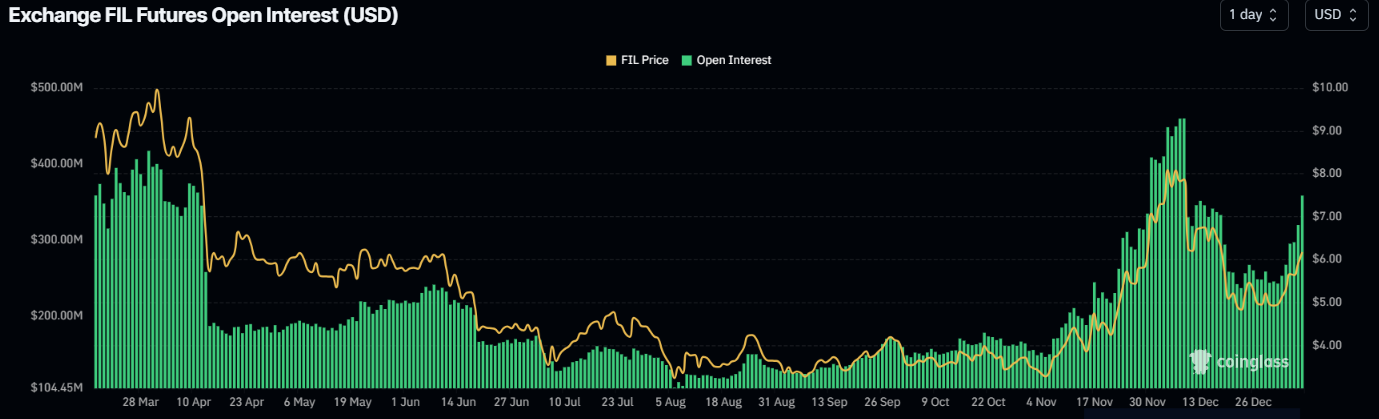

Coinglass’s data shows that the futures’ Open Interest (OI) in FIL at exchanges rose from $242.34 million on Wednesday to $358.30 million on Monday, reaching the highest level since December 9. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Filecoin price.

Filecoin Open Interest chart. Source: Coinglass

Additionally, data from crypto intelligence tracker DefiLlama shows that FIL’s TVL increased from $67.69 million on Tuesday to $93.12 million on Monday, constantly rising since the end of December.

This increase in TVL indicates growing activity and interest within the Filecoin ecosystem. It suggests that more users deposit or utilize assets within FIL-based protocols, adding credence to the bullish outlook.

FIL TVL chart. Source: DefiLlama