Jordan Approves Blockchain Policy to Modernize Government Operations

The Jordanian Council of Ministers approved a major Blockchain Technology Policy for 2025. This legislation seeks to enhance public trust in government performance by promoting economic modernization, increased data security, and wider transparency.

The government wants to amplify blockchain adoption in the country to improve its operational efficiency while safeguarding citizens’ privacy.

A Strong Focus on Transparency and Security

According to the latest announcement, the government wants to implement blockchain in managing public administration operations. The aim is to increase public confidence in government performance and reduce time and cost in governmental transactions.

The new policy will also support blockchain start-ups, build capabilities, and develop specialized skills in the industry. It’s part of Jordan’s wider digital transformation initiative for 2025. The policy prioritizes the security and privacy of citizen data as the global need for solid digital protections grows.

By leveraging blockchain’s capabilities for real-time transaction automation and verification, the government aims to streamline administrative procedures. This would reduce operating costs and improve the efficiency of public services, benefiting both businesses and residents.

This initiative aligns with Jordan’s broader economic modernization plan. Improved public service efficiency will contribute to a more competitive economy and have positive ripple effects across various sectors.

Also, the new blockchain policy is expected to improve the country’s public services and infrastructure and attract foreign investment, contributing to Jordan’s economic diversification and establishing the country as a competitive player in the global digital economy.

Furthermore, this isn’t the first time that the country has turned to blockchain to address its national challenges. Back in 2022, citizens of the country increased crypto trading and investment to tackle the critical unemployment crisis.

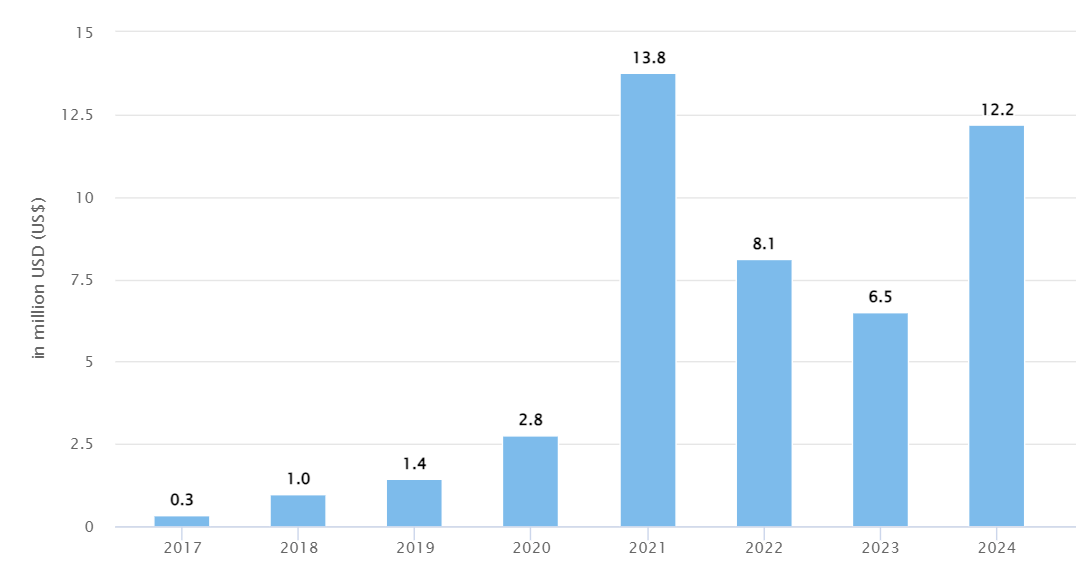

Crypto Revenue in Jordan from 2017 to 2024. Source: Statista

Crypto Revenue in Jordan from 2017 to 2024. Source: Statista

A Broader Trend in the Middle East

Jordan’s implementation of blockchain technology in government procedures reflects a broader ripple effect in the Middle East.

Earlier today, Syria’s transitional government announced that it is considering a proposal to legalize Bitcoin and digitize the Syrian pound. This move is a potential strategy to stabilize the country’s economy—which is significantly impacted by ongoing conflict—and attract international investment.

“The central bank will oversee this process, ensuring a secure and accountable framework,” the Syrian Center for Economic Research (SCER) said.

In October, the Dubai Financial Services Authority (DFSA) granted Ripple in-principle approval to expand its operations within the Dubai International Financial Centre (DIFC). The approval allows Ripple to offer a full suite of end-to-end payment services within the United Arab Emirates.

Following suit, the TON Foundation registered with the Abu Dhabi Global Market (ADGM) in December, leveraging its regulatory framework for decentralized ledger technology (DLT) foundations to establish a structured legal footing for its operations and governance.