XRP price faces risk of decline with XRPLedger AMM amendment proposal in jeopardy

- XRPLedger Automated Market Maker amendment is facing criticism in the community and the consensus is 65.71%.

- Major XRPL validators Vet and Daniel Keller have rescinded their support for the amendment citing a minor but significant bug.

- XRP price is nearly unchanged in the past 24 hours, the altcoin is trading at $0.5133 on Wednesday.

XRP price is $0.5133, yielding nearly 2% weekly gains for holders. The native token of the XRPLedger is holding steady despite the status of the Automated Market Maker (AMM) amendment proposal.

Validators are critical of the amendment and some notable ones have pulled support citing concerns regarding a significant bug.

Also read: Ethereum price poised for gains as Dencun upgrade goes live on the testnet

Daily Digest Market Movers: XRPLedger amendment for AMM in jeopardy

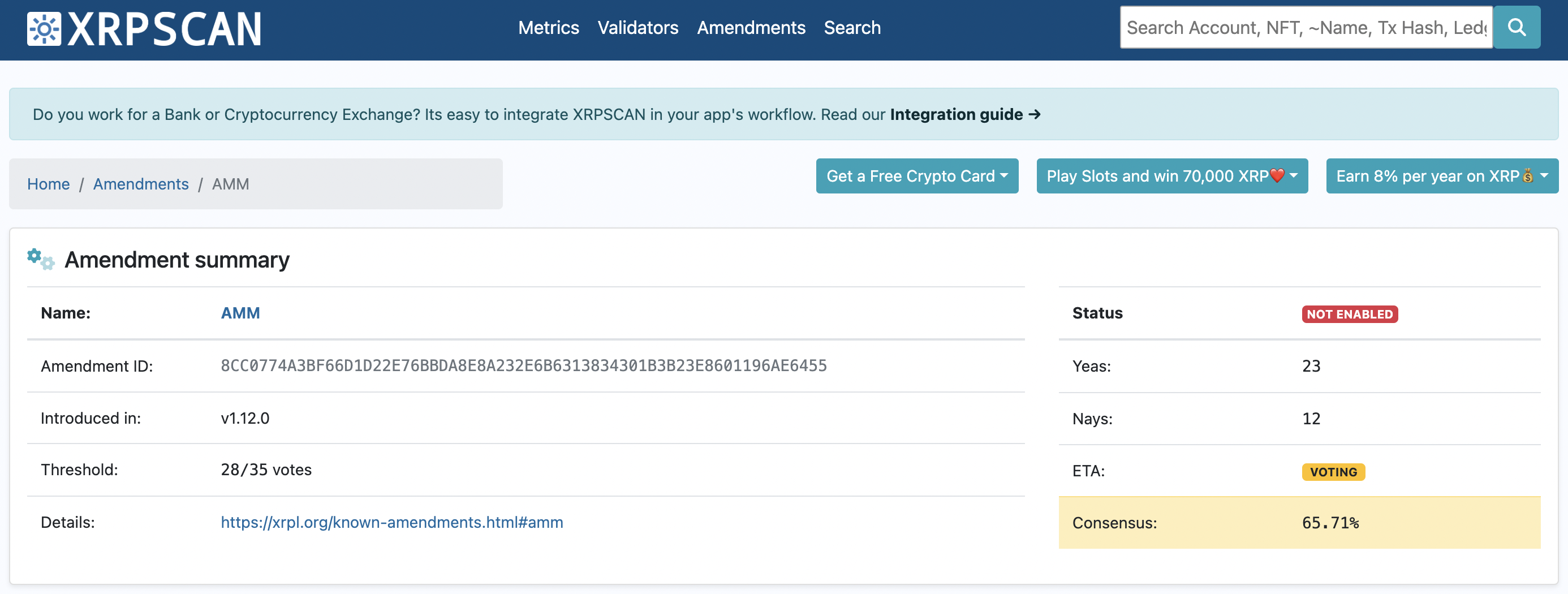

- The XRPLedger (XRPL) is currently faced with a major hurdle as the proposal for Automated Market Maker amendment has dropped below the required 80% consensus threshold.

- On Thursday, the consensus is 65.71%, notable validators have pulled support for the amendment citing their concerns.

- This is a setback for XRPLedger as the amendment previously secured an 85.7% approval rate and was well on its way to be finalized.

XRPL AMM Amendment consensus on Thursday. Source: XRPScan

- Validator Vet stated that allowing the AMM proposal to go through would damage the XRP community’s image and XRPL’s reputation. There is room for improvement in the Ledger before rollout of a key feature like AMMs, according to the validator.

- The developments in the SEC v. Ripple lawsuit continue to influence the community of XRP holders.

- Ripple’s lawyers have asked for a deadline extension for the remedies-related discovery phase stating that SEC’s request for information includes large volumes of data to be compiled by the cross-border payment remittance firm.

Technical Analysis: XRP price likely to decline further

XRP price is in a downtrend since the beginning of 2024. The altcoin’s price sustained above the $0.50 psychological level, however further correction is likely due to signals from two key indicators. The Moving Average Convergence Divergence (MACD) indicator is flashing green, however the momentum is likely not enough to push XRP price into recovery.

The Relative Strength Index (RSI), a momentum oscillator reads 40.50, down from 41.29 on Wednesday. As RSI dips and moves away from the neutral level, there is room for a correction in XRP price.

XRP price is likely to sweep support at $0.4968, just below the psychologically important level of $0.50 before rebound to R1 at $0.5272. In the event that XRP price sees a daily candlestick close above this level, price could rally towards R2, at $0.5625, that coincides with the 50% Fibonacci Retracement of the decline between January 3 and January 31.

XRP/USDT 1-day chart

A daily candlestick close below support at $0.4968 could invalidate the recovery thesis and the January 31 low of $0.4850 is likely to come into play for XRP price.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.