Ripple's XRP breaks out of downtrend as RLUSD receives greenlight from New York regulators

- Ripple CEO stated that the RLUSD stablecoin received final approval from the NYDFS.

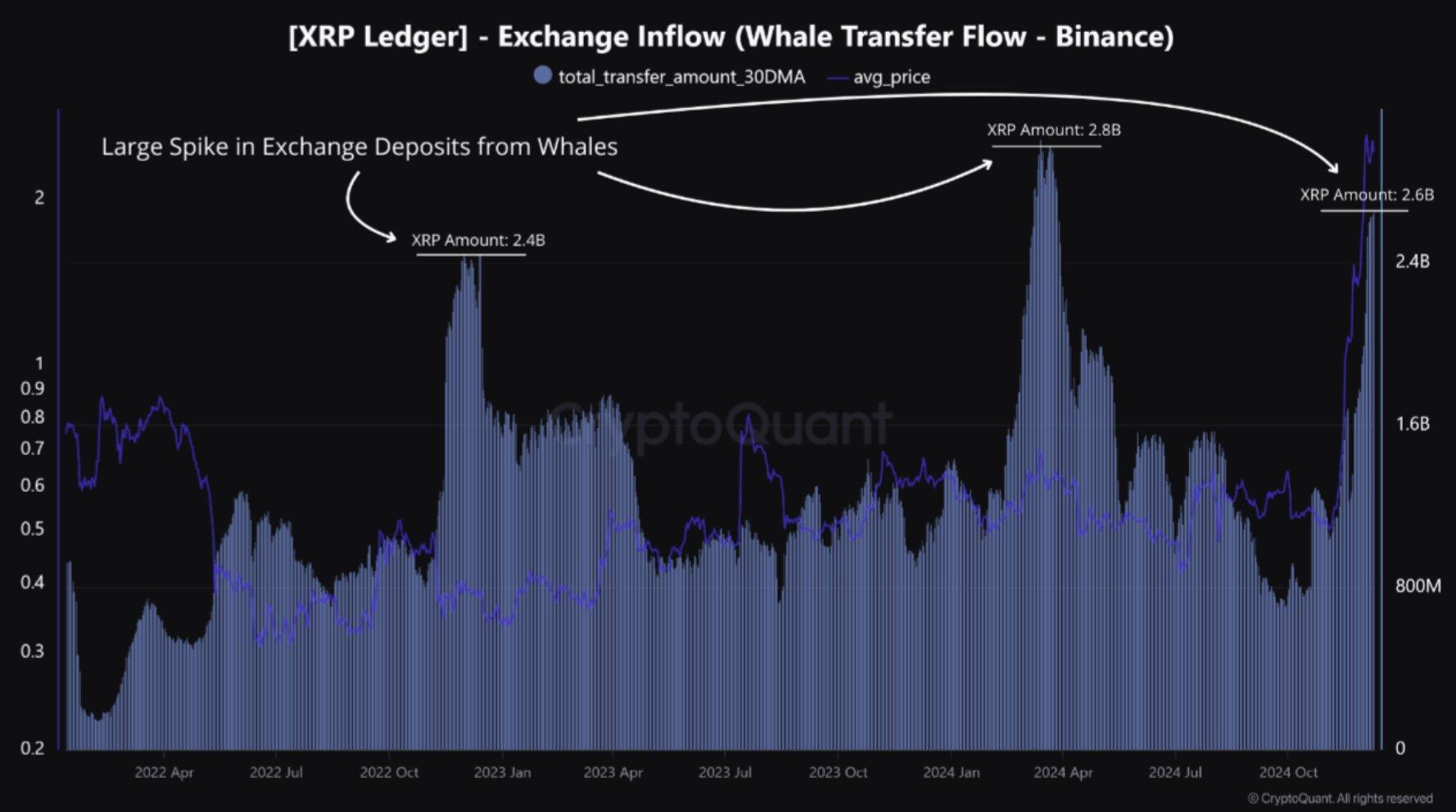

- Whales have transferred over 2.66 billion XRP tokens to Binance in the past month.

- XRP could retest the $3 psychological level after rising nearly 7% following Ripple's announcement.

Ripple's CEO Brad Garlinghouse announced on Tuesday that the company received a green light from the New York Department of Financial Services (NYDFS) on the launch of its stablecoin RLUSD. XRP jumped nearly 7% after the announcement despite on-chain data showing a huge supply pool flooding the Binance exchange.

RLUSD set to go live following approval from New York regulators, whale supply hits Binance

Ripple's RLUSD stablecoin has been approved for listing by the NYDFS, nearly one week after rumors of an official launch, CEO Brad Garlinghouse announced in an X post on Tuesday. The approval confirms that RLUSD can now go live on major exchanges.

RLUSD is a stablecoin designed to maintain a 1:1 price peg to the US Dollar. Similar to popular stablecoins like USDT and USDC, Ripple claims that actual US Dollar deposits, short-term government treasuries and other cash equivalents will back RLUSD.

This just in…we have final approval from @NYDFS for $RLUSD! Exchange and partner listings will be live soon – and reminder: when RLUSD is live, you’ll hear it from @Ripple first.

— Brad Garlinghouse (@bgarlinghouse) December 10, 2024

Ripple first announced RLUSD in April before kicking off beta testing on the XRP Ledger and Ethereum blockchain platforms in August.

In October, Ripple announced its exchange partners for the launch of RLUSD, including Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish.

Additionally, liquidity support will come from market makers B2C2 and Keyrock. This collaboration aims to ensure the stablecoin's availability and efficiency in the market.

Some crypto community members have expressed that RLUSD's launch will create several tailwinds for XRP, especially as it will provide Ripple with a less volatile asset to deepen its remittance and settlement services.

Following RLUSD's approval, XRP jumped over 7% from a low of $1.90. The recent recovery comes after over one week of decline, potentially due to high selling pressure from a few whales.

According to CryptoQuant's data, whales moved over 2.66 billion XRP tokens to the Binance exchange in the past month — the highest since April 2024. This indicates potential selling activity from these large holders.

XRP Whale Transfer Flow (Binance) | CryptoQuant

However, the overall Binance exchange reserve has plunged by 320 million XRP in the same period. This indicates bulls have soaked up the potential selling activity from these whales.

-638694740044361699.png)

XRP Exchange Reserve (Binance) | CryptoQuant

Additionally, popular trader Ash Crypto shared that the huge price movements in XRP — rise or decline — over the past month is majorly because of its thin liquidity despite having a strong market capitalization.

XRP could retest the $3 psychological level after its recent rise

XRP has seen over $50 million in liquidations in the past 24 hours, with liquidated long and short positions accounting for $31.2 million and $18.97 million, respectively, per Coinglass data.

After bouncing off the support level near $1.96, XRP is back above the 23.6% Fibonacci Retracement. If XRP maintains its recent uptrend, it could reclaim the $2.58 level and retest the resistance near the $3 psychological level, where it previously witnessed heavy selling pressure.

XRP/USDT daily chart

XRP needs to maintain an uptrend above the $1.96 level to continue its rally.

The Relative Strength Index (RSI) and Awesome Oscillator momentum indicators are above their neutral levels but trending downwards, indicating weakening bullish momentum.

A daily candlestick close below $1.35 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.