21Shares Is Launching Four New Crypto ETPs Focusing on AI Tokens

Swiss wealth manager 21Shares has introduced four new crypto exchange-traded products in Europe, broadening its range of digital asset investment options.

The latest additions focus on AI and decentralized computing projects Pyth Network, Ondo, Render, and NEAR Protocol.

A Broader Focus on AI-Related Cryptocurrencies

The asset manager is seeing an increased demand from institutional investors for next-gen decentralized technologies. The four tokens represent the firm’s extended entry into four distinct sectors: price oracles, asset tokenization, decentralized computing, and AI.

According to the announcement, investors in the NEAR ETP will be able to reinvest staking rewards directly into the product. NEAR’s proof-of-stake blockchain model supports network security through token staking, which generates yields for participants.

The new ETPs will be available for trading on exchanges in cities like Amsterdam and Paris. The firm has been constantly improving its crypto ETP offerings throughout Europe.

Earlier this week, 21Shares upgraded its Ethereum Core ETP to include staking capabilities. The product now operates under the name Ethereum Core Staking ETP and trades with the ticker ETHC.

“The 21Shares NEAR Protocol Staking ETP offers investors a regulated and transparent way to gain exposure to one of the most scalable smart-contract platforms, designed to simplify the complexity of crypto infrastructure while pushing the boundaries of decentralized AI integration,” the firm wrote on its press release.

This enhanced version offers investors the opportunity to earn staking rewards while maintaining exposure to Ethereum. It is listed on leading European exchanges, including the SIX Swiss Exchange, Deutsche Börse Xetra, and Euronext Amsterdam.

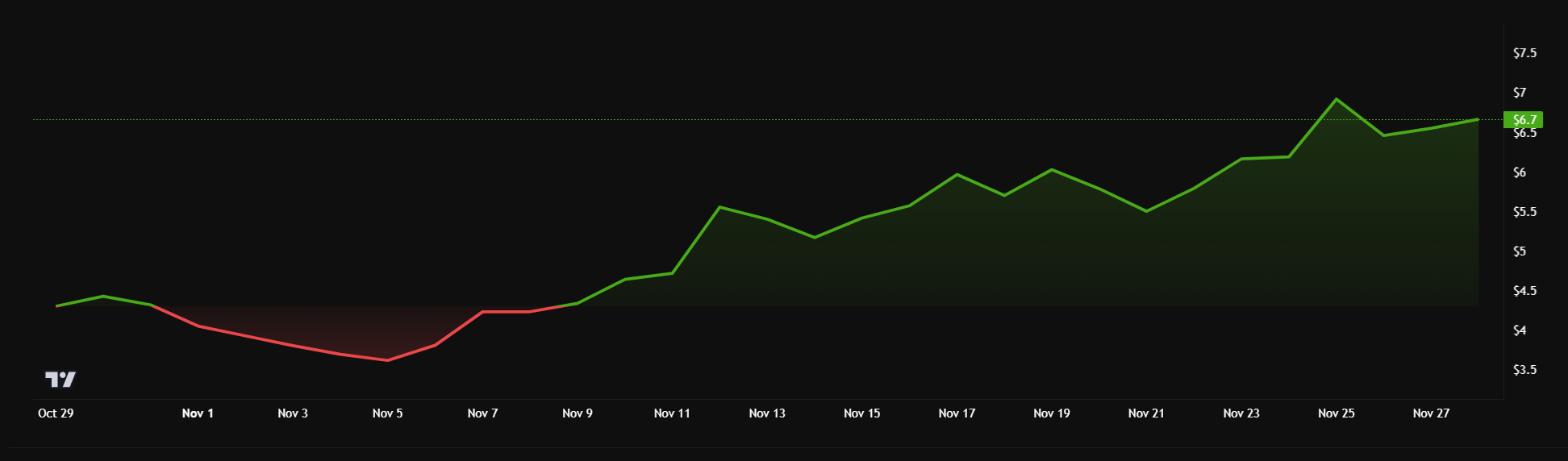

NEAR Protocol Price Performance throughout November. Source: BeInCrypto

NEAR Protocol Price Performance throughout November. Source: BeInCrypto

Increasing Activity in the Crypto ETP Market

21ShareThe crypto ETP market is experiencing a surge in activity. Bitwise recently rebranded its XRP ETP to “Bitwise Physical XRP ETP (GXRP)” following Ripple’s strategic investment. This product provides secure, physically backed XRP exposure for European investors.

Also, Bitwise launched its Aptos Staking ETP on the SIX Swiss Exchange, offering regulated access to Aptos staking in Europe.

Meanwhile, WisdomTree introduced an XRP-backed ETP across Germany, Switzerland, France, and the Netherlands. This product aims to attract investors with low-cost exposure to XRP’s spot price.

WisdomTree also filed for an XRP ETF in the US earlier this week. Trump’s re-election and the resignation of SEC chain Gary Gensler have renewed optimism about Ripple’s cryptocurrency.