Worldcoin Price Stalls at 3-Month Barrier Amid Profit-Taking Pressure

Worldcoin (WLD) experienced a remarkable rally last week, surging by 50% and attracting significant attention from investors.

However, after reaching a key resistance level that has held it back for three months, the altcoin’s momentum stalled, leading to an 11% price drop within the past 24 hours. This resistance has proven challenging, triggering what appears to be a market top for WLD.

Worldcoin Is Facing Challenges

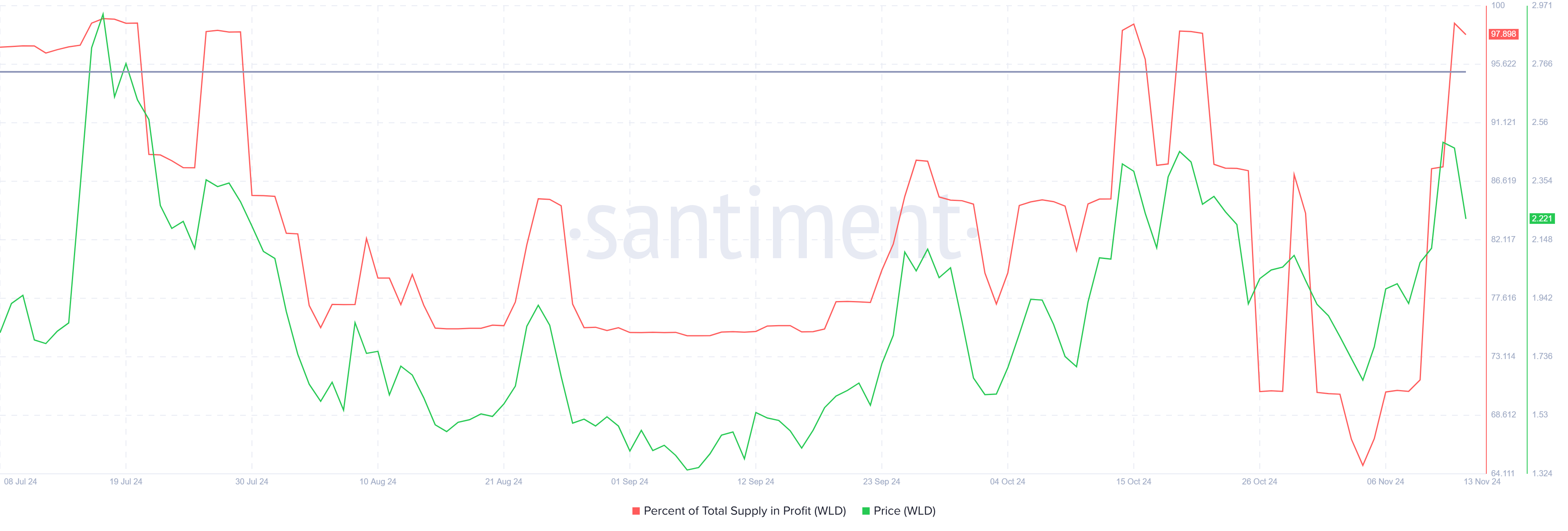

Currently, 97% of the total Worldcoin supply is profitable, which typically indicates a market top. When more than 95% of a cryptocurrency’s supply becomes profitable, historical trends show that growth often halts, increasing the potential for a price reversal. This scenario reflects a common pattern where profit-taking behavior rises, leading to potential corrections. For Worldcoin, this high profitability level suggests a potential price pullback as holders look to secure gains.

Historically, reaching such a high profitability threshold often precedes a correction phase, as investors become more likely to sell their positions. In the case of WLD, the current level of profitable supply aligns with market top patterns seen in previous altcoin cycles. With Worldcoin facing heightened selling pressure, the likelihood of further declines in the short term is growing.

Worldcoin Supply in Profit. Source: Santiment

Worldcoin Supply in Profit. Source: Santiment

Analyzing Worldcoin’s macro momentum, the distribution of active addresses by profitability supports the notion of a market top. Notably, over 25% of active addresses holding WLD are in profit, which is a concern. When the percentage of profitable addresses surpasses 25%, investors often move to sell, which has historically led to downward pressure on the asset’s price.

This high concentration of profitable addresses adds to the bearish outlook for WLD, as the altcoin is already experiencing increased selling activity. The combination of widespread profitability and a high percentage of participating addresses in profit may continue to challenge Worldcoin’s recent upward trend, making further price growth difficult without a consolidation phase.

Worldcoin Active Addresses by Profitability. Source: IntoTheBlock

Worldcoin Active Addresses by Profitability. Source: IntoTheBlock

WLD Price Prediction: Breaching Barriers

Over the last day, Worldcoin’s price dropped by 11%, failing to breach the $2.48 resistance level for the third time in three months. Currently trading at $2.21, WLD appears to be struggling to maintain its recent gains amid selling pressure and resistance at higher levels.

If this decline persists, Worldcoin may find support at $2.11, offering a chance for reversal. However, should the downward trend continue, the next support levels at $2.00 and $1.74 may come into play, marking a potential deeper correction for the altcoin.

Worldcoin Price Analysis. Source: TradingView

Worldcoin Price Analysis. Source: TradingView

Alternatively, a bounce from $2.11 would invalidate the bearish outlook, allowing Worldcoin to attempt another push past the $2.48 resistance. Breaking through this level successfully would signal a renewed bullish trend, potentially setting WLD up for further gains.