Blum Users Surpass Hamster Kombat Ahead of Token Generation Event

Gamified Telegram-based decentralized exchange (DEX) Blum has outperformed Hamster Kombat’s monthly active users before its forthcoming token generation event (TGE).

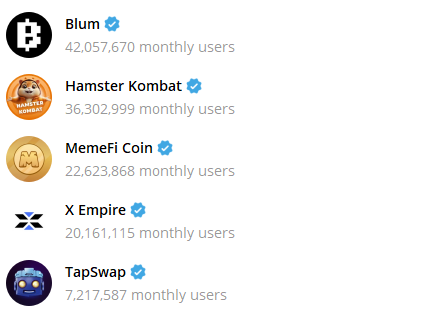

While Blum enjoyed a user base of 42 million in November, Hamster Kombat’s continuing decline has placed it at just 36 million users, following a continuous plummet.

Pre-Launch Success: Blum Outperforms Hamster Kombat Users

Blum is a DEX that combines the features of centralized and decentralized platforms. Specifically, it is a Telegram mini-app that offers a simplified trading experience that is accessible directly within the messaging app.

Blum’s journey began on April 19, 2024, and it accumulated an impressive 100,000 users within the first 24 hours of its announcement. Now, the DEX enjoys a user base of 42 million ahead of its anticipated airdrop. Eight days into November, the “Blum: All Crypto—One App” channel had already added one million new subscribers.

Top 5 Mini Apps by Active Users November 2024. Source: Telegram.

Top 5 Mini Apps by Active Users November 2024. Source: Telegram.

At the time of writing, Blum’s pre-market price is in the $0.003 to $0.004 range. At the beginning of November, the DEX announced an investment from The Open Platform (TOP), a venture builder in Telegram’s TON ecosystem. This investment included technical support in addition to funding, which was an undisclosed amount.

In September, Binance Labs, the venture capital and incubation arm of crypto exchange Binance, announced an undisclosed investment in Blum and added the mini app to its BNB Chain’s MVB (Most Valuable Builder) Program. The program has a small acceptance rate of just 2%.

Tap-to-Earn Games’ Short Lifespan

Many have questioned the long-term viability and credibility of the tap-to-earn gaming concept. Hamster Kombat, once a beloved tap-to-earn game boasting approximately 300 million users, has seen its fanbase plummet post-airdrop due to unfair allocation.

It was not the only model to suffer an underwhelming fate. The tap-to-earn game Catizen had a similar storyline after functionalities left its players unsatisfied.

Meanwhile, DeFiLlama says the total assets locked in the TON Blockchain have fallen to $354 million, landing it at spot 21, despite being in the top ten ranks just a few months ago. This suggests a trend where users accumulate tokens, sell them and then stop engaging with the platform.

Total Value Locked All Chains, November 8, 2024. Source: DeFiLlama.

Total Value Locked All Chains, November 8, 2024. Source: DeFiLlama.

However, despite the performance of Hamster Kombat and Catizen, players are still demonstrating a strong interest in upcoming airdrop projects like BLUM, Tapswap, MemeFi, and X Empire. The question remains whether the demand for these dApps will remain after their TGE and for long enough to scale.