Crypto Today: Bitcoin at $77k, Solana Memes’ in demand, CZ cuts ties with Binance

- Bitcoin price entered its second consecutive day of price discovery on Thursday, November 7, reaching new peaks above $76,800.

- Demand for Solana memecoins is on the rise with the sector’s trading volume crossing the $3.5 billion mark within the last 24-hours.

Solana memecoins and XRP market updates

- Solana price gained 5.45% to reach the $195 mark for the first time in 220 days, dating back to April 2.

- XRP price is facing stiff resistance at the $0.55 level, as highly-leveraged short-traders dominate Ripple-back coin’s derivatives futures contracts.

- Solana memecoins are flashing strong demand signals, with the sector’s 24-hour trading volumes exceeding $3.5 billion on November 7.

Chart of the day: Solana memecoins flashing market maturity signals

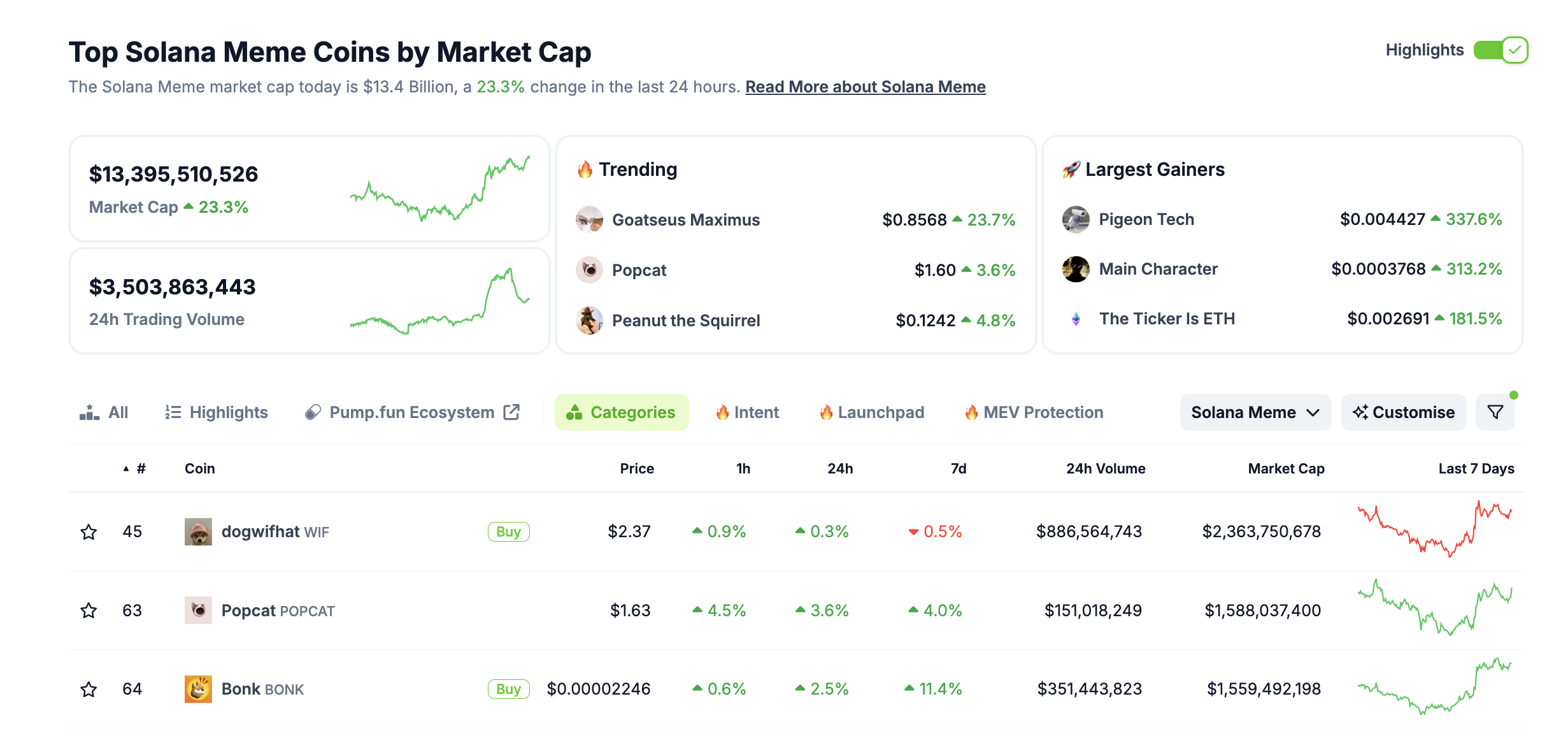

According to Coingecko data, the tokens listed within the Solana meme sub-sector attracted $3.5 billion aggregate trading volume on November 7. A closer look at the chart also shows that the sector's total market capitalization is around $13.4 billion.

Solana memecoin sector performance, November 7, 2024 | Coingecko

Solana memecoin sector performance, November 7, 2024 | Coingecko

Trading Volume-to-Market Capitalization (TV-MC) ratio is a metric used in crypto analytics to gauge the activity level and liquidity of a given asset or sector.

For Solana’s meme token sub-sector, recent data shows that meme tokens on the Solana network recorded a trading volume of $3.5 billion on November 7, while the sector’s market capitalization stands at approximately $13.4 billion, reflecting a TV-MC ratio of 0.26.

Typically, TV-MC values between 0 .2 to 05 is symptomatic of a maturing market, without extreme speculation. Assets with values within this range are likely experiencing steady liquidity and consistent market engagement relative to their current market valuation.

The Solana memecoin sector’s rising TV-MC ratio underlines steady growth and rising confidence within the global Solana memecoin community. The liquidity surge could potentially see top-ranked tokens like Dogewifhat (WIF), BONK and Book of Meme (BOME) avoid volatile price downswings when market retreats.

Market updates

- Bank of England slashed interest rates by 25 basis points on Thursday as UK inflation fell below the 2% target.

- In a Bloomberg report, Binance co-founder Changpeng Zhao has confirmed that he is no longer involved in running the exchange, ending weeks of speculation that the convicted founder could return following his recent release from prison.

“I’ve been leading the company for seven years. I enjoyed it. It’s a lot of work. But I think that chapter is that chapter. I don’t think I want to go back. I’m just a regular shareholder at this point”

Binance Co-Founder Changpeng Zhao

On-chain updates

- Solana node validators have staked approximately 5 million SOL within the last seven days.

- US Bitcoin ETFs maintain positive showing despite Blackrock’s record-breaking outflows.

- Bleeding 996 BTC on November 6, Blackrock’s IBIT set a new record for its largest single-day outflow since the inception of the Bitcoin ETFs asset class in January 2024.

Remarkably, despite Blackrock’s record-breaking outflows, the overall US Bitcoin ETFs markets still recorded aggregate inflows of 8,970 BTC valued at $660 million on November 6.

Bitcoin ETF Flows, November 2024 | Coinglass

Bitcoin ETF Flows, November 2024 | Coinglass

This signals that the ongoing BTC rally is being driven by market-wide demand, rather than a handful of investors linked to Blackrock.