SUI Breaks $2 Barrier, Sets Sights on a New Record

SUI, the native token of the Layer-1 Move-programmed blockchain, has surged over the past 24 hours. Currently trading at $2.20, the token has jumped 18% during this period and is approaching its all-time high of $2.36, last reached on October 12.

BeInCrypto’s readings from the token’s technical setup suggest it appears positioned to extend these double-digit gains further. Here is how.

SUI Is Everyone’s Favorite

A corresponding spike in trading volume has accompanied SUI’s double-digit price hike. Totaling $2 billion at press time, the token’s trading volume has skyrocketed by 184% over the past 24 hours.

When a surge in trading volume backs a price rally, it signifies strong market participation and investor confidence. It indicates that a few huge trades do not drive upward price movement but widespread market demand. In such cases, the buying pressure is stronger, and the price movement is less likely to be a temporary fluctuation.

Read More: A Guide to the 10 Best Sui (SUI) Wallets in 2024

SUI Price/Trading Volume. Source: Santiment

SUI Price/Trading Volume. Source: Santiment

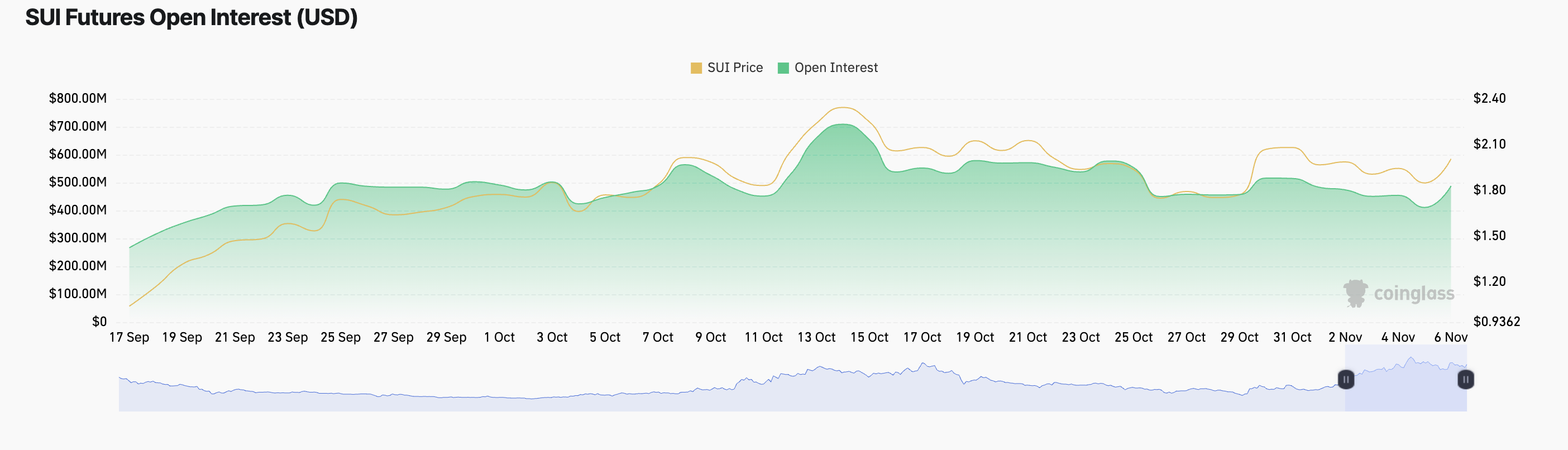

Moreover, the SUI token’s rising open interest confirms the uptick in market activity over the past 24 hours. According to Coinglass’ data, SUI’s open interest has increased by 27% during that period and currently stands at $556 million.

Open interest refers to the total number of outstanding contracts — such as futures or options — that have not been settled or closed. A rise in open interest suggests that traders are adding to their positions.

When combined with a rising price, it indicates that the market is not simply driven by a few large traders but by increasing participation from buyers and sellers. This scenario suggests that the SUI price rally has solid backing, which further strengthens the bullish sentiment and can lead to a continuation of the trend.

SUI Open Interest. Source: Coinglass

SUI Open Interest. Source: Coinglass

SUI Price Prediction: Will Coin Surpass Resistance?

SUI’s Relative Strength Index (RSI) on the SUI/USD one-day chart supports a continued bullish outlook. Currently, the RSI sits at 60.77, signaling increased buying pressure over selling, as the metric reflects an asset’s overbought or oversold status.

At press time, SUI trades at $2.20, just 7% below its all-time high of $2.36. If current momentum holds, SUI’s rally may push it to surpass this peak.

Read More: Everything You Need to Know About the Sui Blockchain

SUI Price Analysis. Source: TradingView

SUI Price Analysis. Source: TradingView

However, if traders begin selling to lock in gains, the upward trend may stall, potentially leading to a downtrend. In such a scenario, SUI could decline toward the $1.64 markZ