$782 Million Crypto Investment in October 2024: Blockstream, Azra Games, and More

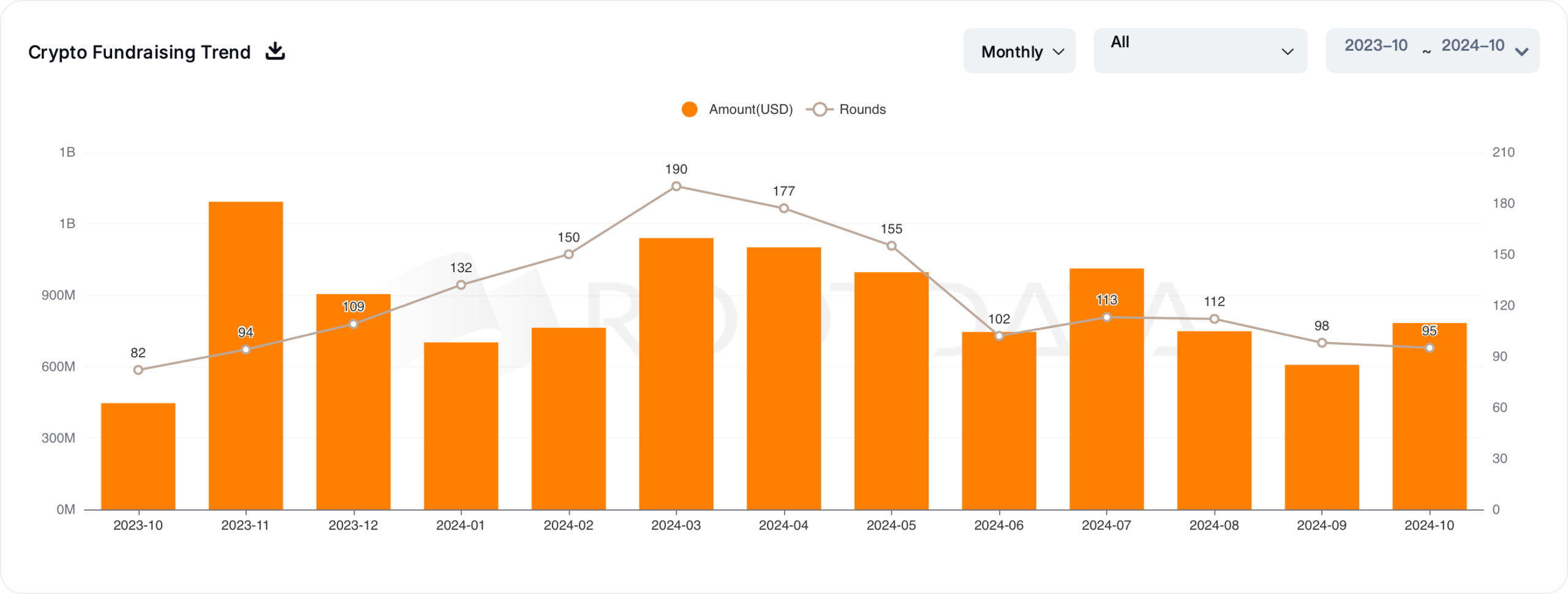

According to RootData statistics, 95 publicly disclosed crypto VC investments occurred in October, representing a 3.06%decrease from September’s 98 rounds.

October’s total fundraising amount reached $782 million, a 28.84% increase compared to the $607 million raised in September.

Notable Increase in Crypto VC Investments

Venture capital activity acts as a crucial barometer of major investors’ interest and confidence in the crypto market. Although October saw the lowest number of publicly disclosed crypto VC rounds in 2024, with only 95 deals, investor commitment remained strong.

Despite fewer rounds, the total funds raised surged, reaching $782 million — a significant increase from the $607 million raised in September. The rise in funding volume highlights an optimistic outlook among investors, even amid economic and political shifts.

Read more: Best Investment Apps in 2024

Crypto Fundraising Trends. Source: RootData

Crypto Fundraising Trends. Source: RootData

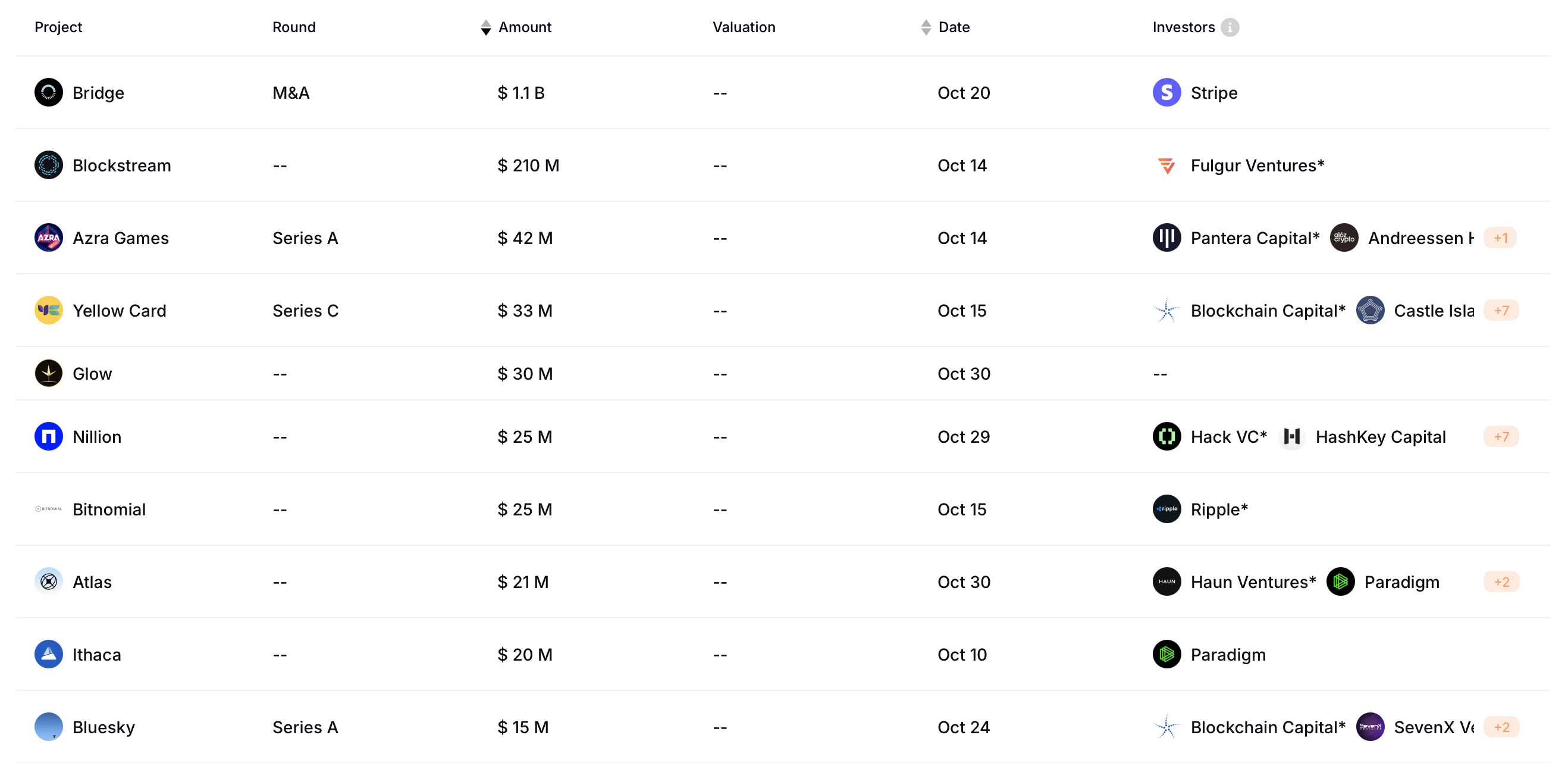

Interestingly, the allocation of funds across sectors has shifted significantly. In September, infrastructure and DeFi projects captured over half of the total investment value.

In October, the infrastructure sector led with $249 million raised, while gaming, DeFi, and CeFi followed with $92.5 million, $88.8 million, and $70.18 million, respectively.

Blockstream’s $210 Million Round Steals the Spotlight

October’s largest funding event was Blockstream’s $210 million round, led by investment firm Fulgur Ventures. The funds will support the adoption and development of Blockstream’s Layer-2 technologies and expansion of its mining operations.

Azra Games raised $42 million from Pantera Capital, with contributions from A16z Crypto, A16z Games, and NFX, to accelerate the development of its mobile role-playing game, Project Legends.

Read more: Top Blockchain Companies in 2024

Most Funded Crypto Projects of Octover 2024. Source: RootData

Most Funded Crypto Projects of Octover 2024. Source: RootData

Yellow Card, a South African centralized exchange and the largest licensed stablecoin on/off-ramp in Africa, secured $33 million in a Series C round led by Blockchain Capital. This latest funding brings Yellow Card’s total equity financing to $85 million, supporting its expansion in digital financial services across the continent.

“This fundraise not only demonstrates our resilience, but also highlights the vital role of digital assets for businesses across Africa. We are excited about the opportunities, partnerships, and journey ahead; and I’m proud to work with an incredible cohort of investors that share our vision for the industry and the continent,” said Chris Maurice, CEO and co-founder of Yellow Card.

Glow and Nillion rounded out the top five largest investment rounds of October. Glow, a decentralized physical infrastructure network (DePIN) of solar farms across the US and India, secured $30 million from Framework and Union Square Ventures. The platform incentivizes solar farms to outperform traditional energy grids through an economy based on subsidies and token rewards.

Meanwhile, privacy-focused blockchain project Nillion raised $25 million in a round led by Hack VC, bringing its total funding to over $50 million. Nillion operates at the intersection of blockchain and artificial intelligence, focusing on secure data sharing and storage. Key partners in its ecosystem include NEAR, Aptos, Arbitrum, ZKPASS, and Ritual.