Crypto Today: Bitcoin, XRP and Ethereum dip slightly amidst fear of market-wide correction

- Bitcoin holds steady above $72,000 on Thursday, notes a slight decline on the day.

- Ethereum loses less than 1% of its value, trades above $2,600.

- XRP trades above $0.51, down less than 1% on the day.

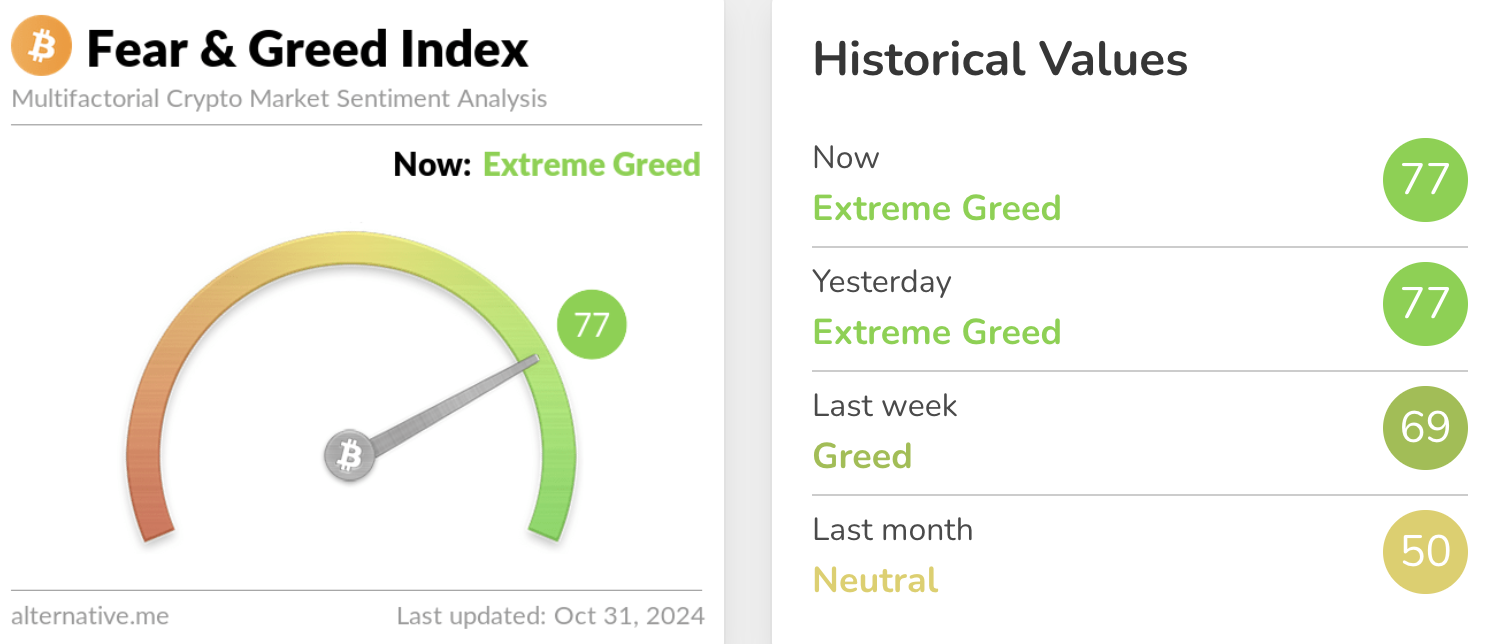

The Crypto Fear & Greed Index indicates “extreme greed” for the second consecutive day, increasing the chances of a market-wide correction.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades above the $72,000 level as traders watch the largest cryptocurrency for signs of a return to the previous all-time high. The Crypto Fear & Greed Index, an indicator used to gauge the sentiment among traders, reads “extreme greed” for the second day in a row.

- This reading is typically associated with an impending correction in the crypto market, according to the indicator’s interpretation on the official site.

Crypto Fear & Greed Index Source: Alternative.me

- Ethereum loses nearly 1% on the day, trades at $2,638.

- XRP trades at $0.5184, less than a 1% decline on Thursday. The native token of the XRP Ledger is likely gearing up for further decline.

Chart of the day: ApeCoin (APE)

ApeCoin (APE), the token of the Bored Apes Yacht Club NFT collection, ranks among the cryptocurrencies that yielded losses in the last 24 hours. APE could extend its decline further and slip to $0.902, its 10-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) reads 52. Though it remains above the neutral level of 50, thedownward slope hints at a negative trend in APE’s price.

The Moving Average Convergence Divergence (MACD) indicator shows red histogram bars under the neutral line, indicating an underlying negative momentum in APE’s price trend.

APE/USDT daily price chart

If ApeCoin gains, it will face resistance at the lower boundary of the FVG at $1.204.

Market updates

- Changpeng Zhao (CZ), former CEO of Binance, made an appearance at Binance Blockchain Week and gave a speech. The executive had previously informed in a tweet on X that he would attend the event in a personal capacity.

I will be attending the Binance Blockchain Week in Dubai on Oct 30-31, in my personal capacity. It’s one of the biggest web3 events of the year. See you there. ✊

— CZ BNB (@cz_binance) October 10, 2024

- MicroStrategy (MSTR) announced a plan to raise $42 billion in capital over the next 3 years for Bitcoin purchases, including a $21 billion equity offering and $21 billion raised in fixed-income securities, founder Michael Saylor said on X.

MicroStrategy announces $42 billion capital plan including $21 billion ATM equity offering and a target of raising $21 billion in fixed-income securities. Join us at 5pm ET as we discuss our quarterly results and #Bitcoin Treasury Company plans. $MSTR https://t.co/eXYELbN1Dm

— Michael Saylor⚡️ (@saylor) October 30, 2024

- Crypto data intelligence platform Lookonchain says that Youtuber MrBeast, an influencer with 31.2 million followers, engaged in insider trading, mislead investors and used his influence to pump tokens before dumping them.

MrBeast (@MrBeast), an influencer with 31.2M followers, has engaged in insider trading, misleading investors, and using his influence to pump tokens, only to dump them later.

— Lookonchain (@lookonchain) October 30, 2024

He has made over $23M in profits from various crypto projects:

$11.45M from $SUPER

$4.65M from $ERN… pic.twitter.com/gMtXVemCDE

Industry updates

- Bitwise data shows that even as Bitcoin is close to its previous all-time high, Google searches for the cryptocurrency remain low.

NEW: The #Bitcoin price is near its ATH, yet Google searches for “Bitcoin” remain low.

— Bitcoin Magazine (@BitcoinMagazine) October 31, 2024

We are just getting started pic.twitter.com/YDjopgk5oK

- Archax, UK’s first regulated Real World Asset (RWA) exchange, agreed to acquire Spanish broker King and Shaxson Capital Markets to expand its operations in Europe.

Archax to acquire Spanish broker KSCM, extending its current UK regulations into #EU in preparation for #MiCAR and adding #crypto #derivatives permissions.https://t.co/cdhEInHXTc pic.twitter.com/ooV3gVAZAS

— Archax (@ArchaxEx) October 31, 2024

- Reddit sold a large share of its crypto portfolio in Q3, offloading its Bitcoin and Ethereum previously held for treasury purposes, according to a SEC filing.