Trump’s election odds hit record 30.1% against Harris on Polymarket

Donald Trump’s odds of winning the presidential election just spiked to a record 30.1% against Kamala Harris.

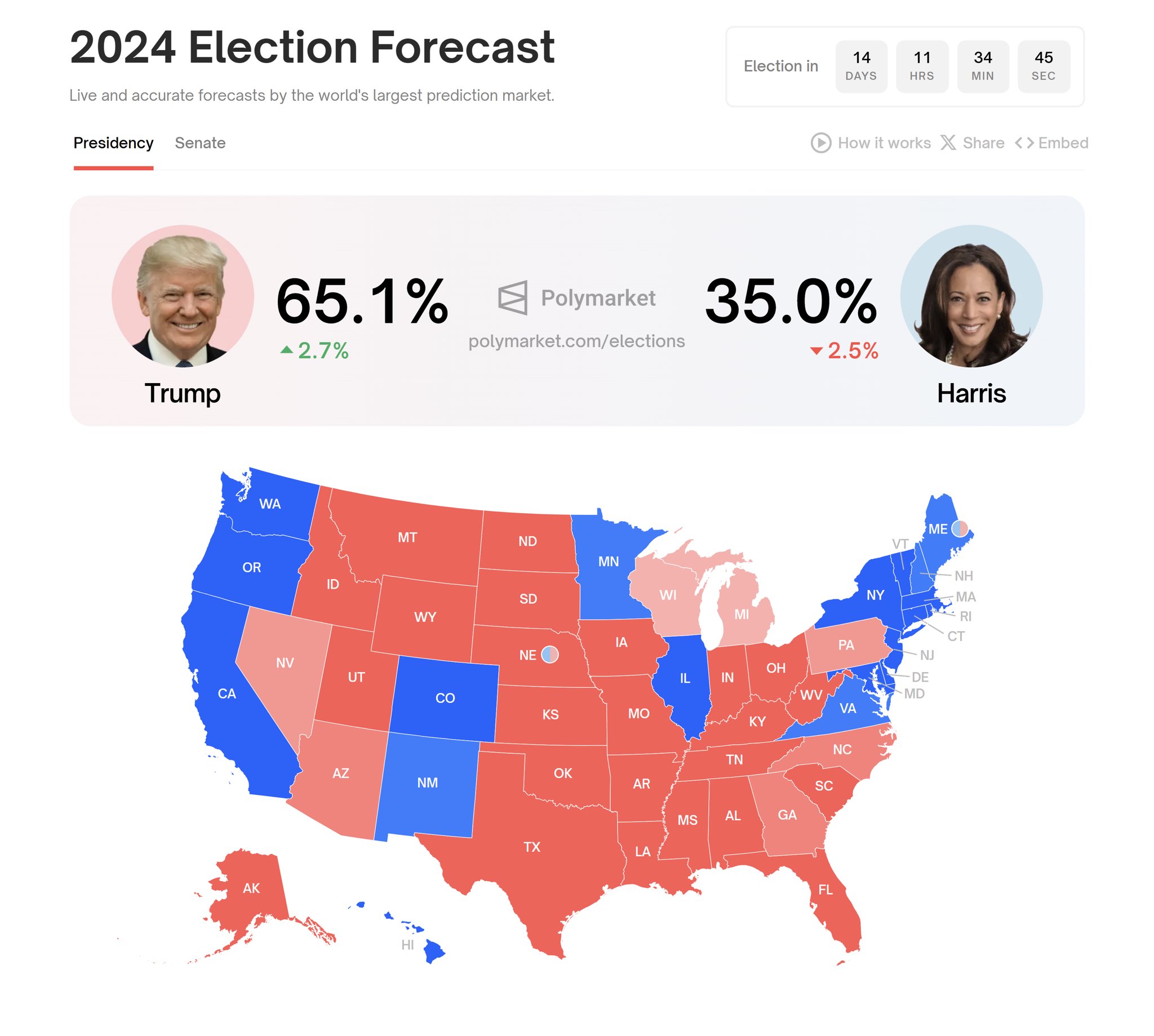

According to Polymarket, a crypto-powered prediction platform, Trump holds 65.1%, while Harris is at 35%. This platform is becoming a go-to spot for crypto enthusiasts and election watchers who are eager to bet on real-time changes.

Forget traditional polls—this market reacts much faster, but it’s still far from the liquidity of major financial markets. “It might feel like a cultural phenomenon,” said founder Shayne Coplan, “but as a financial market, it’s still tiny.”

Polymarket is only four years old. After the 2016 election, where pollsters got it embarrassingly wrong, prediction markets gained a lot of traction.

Unlike traditional polls, people risk their money here, and according to Elon Musk, that makes them “more accurate.” The platform famously nailed it by predicting Biden’s dropout before anyone else saw it coming.

Betting on Trump surges

Trump is favored heavily by crypto voters. His chances of winning key swing states sit around 64% on average. Harris, on the other hand, holds 35%.

His odds take a slight hit in places like Wisconsin and Michigan, where he drops below 60%, but he’s still the frontrunner for now.

The surge in Trump’s chances isn’t a fluke. Several high-stakes bettors have placed massive wagers on his victory.

Four individuals, in particular, have collectively dropped $25 million, driving up Trump’s odds significantly. Meanwhile, platforms like PredictIt cap individual bets at $850 to avoid this kind of influence.

Whales and liquidity

Polymarket’s growth has been explosive. It started the year with $9.5 million in stablecoins locked on its platform. By August, that number had skyrocketed to $220 million.

Total lifetime trading volume on the platform has already surpassed $1 billion, with nearly $430 million of that tied to the U.S. presidential election.

Yet, despite its growth, Polymarket remains relatively illiquid, leaving it open to manipulation by a few big players. The anonymity of traders only adds to the concerns.

There are whispers about potential wash trading, where traders artificially manipulate prices by trading with themselves.

The platform has seen scrutiny ramp up in recent weeks as big spenders have bet heavily on Trump’s win. One user, known as Fredi9999, has wagered more than $18 million on Republican outcomes so far. This includes $13 million on Trump alone, making Fredi9999 the top bettor on the platform.

On-chain analysts believe that Fredi9999 isn’t acting alone. According to Arkham Intelligence and sleuths on X (formerly Twitter), Fredi9999 and three other accounts may be controlled by the same person.

Together, these accounts have dropped over $43 million on Republican outcomes. All of these accounts are verified as being based outside of the U.S., as Polymarket doesn’t allow residents there to trade on its platform.

Polymarket is taking steps to double-check the compliance of its users, particularly those making massive wagers, to make sure that none of them are breaking the rules.

The surge in Trump bets has caught the attention of regulatory authorities too. The Commodity Futures Trading Commission (CFTC) fined Polymarket in early 2022 for offering illegal trading services.

As part of that settlement, the platform agreed to wind down its services in the U.S. and focus on international markets.

Yesterday, CFTC Chairman Rostin Behnam shared his concern about election-related betting, warning that it could put democracy itself at risk. “It puts us in a very difficult place,” he said.

Behnam urged Congress to weigh in on whether betting on elections should be permissible, explaining that the stakes are higher than ever.

Polymarket’s shares are priced based on the probability of an outcome. If Trump’s chances of winning are priced at 60 cents, for example, that translates to a 60% probability of his victory.

If Trump wins, the buyer gets $1 per share. If he loses, the shares become worthless. The betting market is extremely volatile, and the odds change rapidly.

With over $1.1 billion wagered on the U.S. presidential race, Polymarket is breaking records. But whether these bets translate into real-world results remains to be seen.