Tether Explores Lending Opportunities With International Commodities Traders

The stablecoin Tether (USDT) is considering lending to international commodities traders, especially in developing markets. Tether’s high profits and existing connections may create lucrative opportunities.

Tether could profit handsomely from credit-starved business ventures, especially as it faces competition in the stablecoin market.

Tether’s Global Connections

According to a Bloomberg report, Tether (USDT) is considering entering the commodity business. The stablecoin has enjoyed rampant success in its ten years of operation and has found particular success in developing economies. A partnership with commodities traders could play to Tether’s advantages, especially when competitors are looking to muscle in.

Read More: 9 Best Crypto Wallets to Store Tether (USDT)

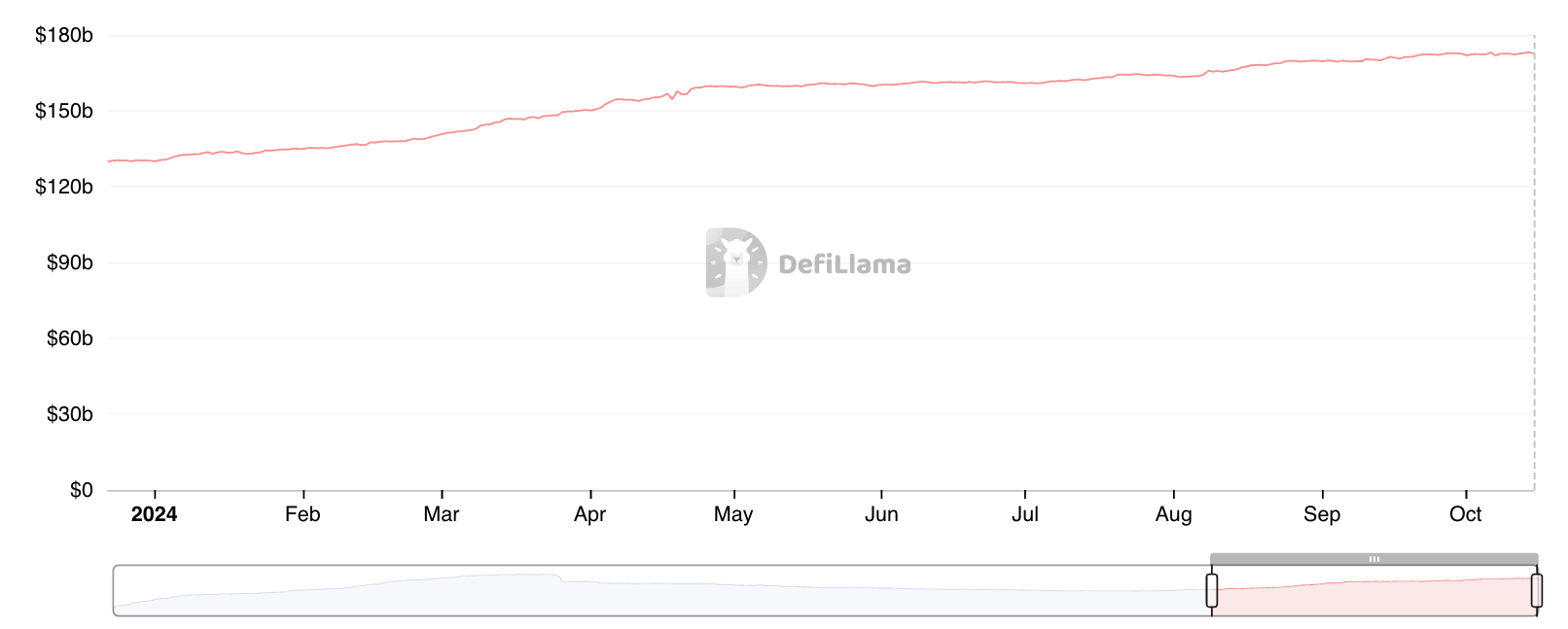

Stablecoin Total Market Capitalization. Source: DefiLlama

Stablecoin Total Market Capitalization. Source: DefiLlama

Several key factors could make Tether well-suited to global commodities traders. First, businesses like this are very reliant on credit, which generally involves traditional financial institutions. This can prove particularly tricky with US sanctions on the rise; Russian metal producers already use USDT to help facilitate smooth international transactions.

Essentially, commodities producers from many countries cannot conduct trade on their own terms due to intensive credit requirements, regardless of their products’ quality. Tether has very deep pockets and is independently popular in many such countries, so it may have the opportunity to function as a line of credit itself.

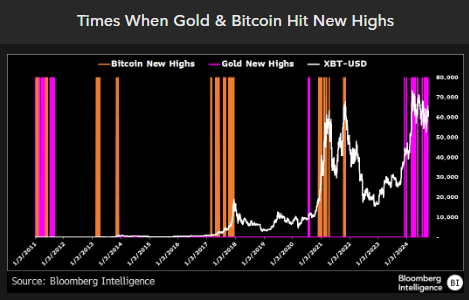

If Tether’s plan is successful, it could benefit tremendously from this opportunity. Commodities markets are very lucrative, and Eric Balchunas has observed an increasing correlation between gold and crypto ETF markets in the last year. Tether already launched a real-world asset (RWA) based on gold and could always expand to other commodities.

“Interesting, since the launch of the bitcoin ETFs, Bitcoin has hit records highs 5 times but gold has hit record highs 30 times. Albeit [gold] has only taken in $1.4 billion in net inflows vs $19 billion for bitcoin ETFs,” said Balchunas.

Read More: Real World Asset (RWA) Backed Tokens Explained

Gold and Bitcoin Price Highs. Source: Bloomberg

Gold and Bitcoin Price Highs. Source: Bloomberg

Moreover, Tether has already experimented with commodity trading in Russian metals and Venezuelan oil, and some commodities are already tangled with crypto.

However, there are many potential drawbacks. This is because commodities trading is prone to fraud and failures, and Tether may demand juicier profit margins than traditional creditors. Higher profit margins will lead to higher risks.

For now, Tether is playing the specifics of this plan quite close to the chest, with CEO Paolo Ardoino claiming it’s in the “early stages.”

“We likely are not going to disclose how much we intend to invest in commodity trading. We are still defining the strategy. We are interested in exploring different commodity trading possibilities,” Adroino said, adding that he believed opportunities here would be “massive in the future.”