Kamala Harris Promises Pro-Crypto Regulation in Outreach to Black Men

Vice President Kamala Harris published a new “Opportunity Agenda for Black Men,” aiming to bolster failing support among this demographic. Her campaign promises a crypto-friendly regulatory framework, among other measures.

African Americans have disproportionately higher rates of crypto asset adoption than other US demographics, but this may not guarantee Harris new votes.

Harris’ Crypto Outreach

Kamala Harris, US Vice President, and Democratic Party nominee is apparently tying her support for cryptocurrency to an effort to win over African-American voters. In the Opportunity Agenda for Black Men published today on her website, Harris’ campaign cast regulatory friendliness as a move that would disproportionately help this community.

“More than 20% of Black Americans own or have owned cryptocurrency assets. Vice President Harris… will make sure owners of and investors in digital assets benefit from a regulatory framework so that Black men and others who participate in this market are protected,” the agenda stated.

Read More: Crypto Regulation: What Are the Benefits and Drawbacks?

The claim that African Americans hold a relatively high amount of crypto compared to other demographics has held out in recent years. However, casting new crypto regulations as a gift to the Black community seems like an odd choice.

After all, polling suggests that voters increasingly support crypto across the board. Why is Harris calling this a racial issue?

A key concern for the Harris campaign is her flagging support among Black men. The New York Times claims Harris is underperforming substantially with this particular demographic. Joe Biden enjoyed 15% more support with it in 2020 than Harris does today.

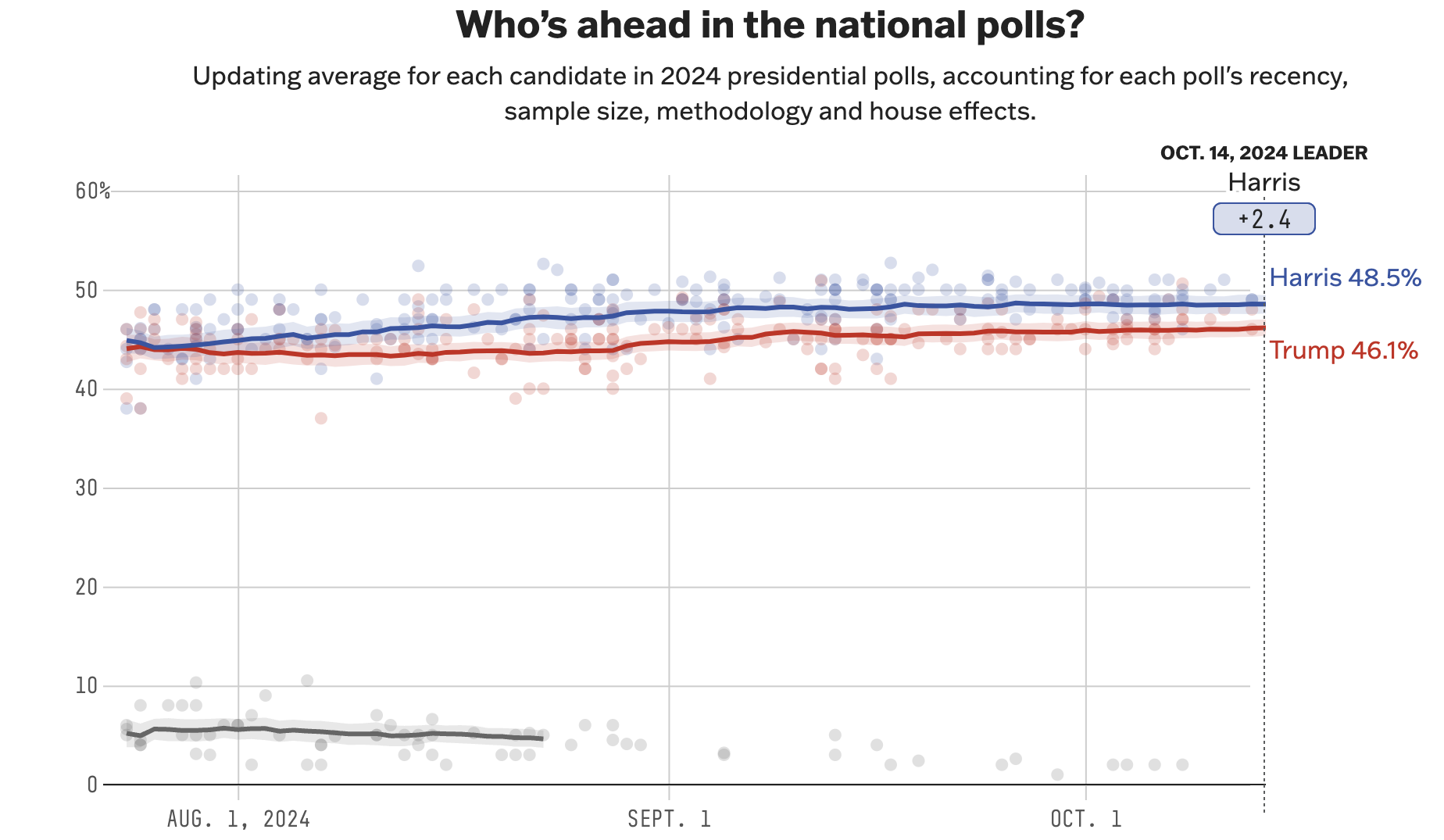

As polls remain remarkably close, the Harris campaign intends to win back some votes on this front.

2024 Election Polls. Source: FiveThirtyEight

2024 Election Polls. Source: FiveThirtyEight

Her opponent, Donald Trump, has made support for Bitcoin a cornerstone of his 2024 campaign. Harris has also supported the industry to the extent that VanEck considers either candidate’s victory a success for crypto. Still, Harris’s support is generally seen as vaguer than Trump’s, and she has fewer concrete promises for the industry.

Ultimately, campaign statements have cast pro-crypto regulation as one of several “tools to achieve financial freedom” that Harris is offering to Black men. These tools include debt forgiveness, new loans, job programs, and several other economic incentives.

Read More: How Can Blockchain Be Used for Voting in 2024?

It’s presently unclear whether this particular economic message will translate to new support. Arthur Hayes, BitMEX co-founder and industry thought leader, expressed ambivalence to either candidate’s crypto policies in an interview.

“Both the Trump administration or Harris administration will print the money. They do it in different ways. But the money will be printed. And so your crypto is going to go up — the path could be very wonky, but at the end of the day, we know where it’s going,” said Hayes.