Crypto Today: Bitcoin, Ethereum rally, XRP recovers even as institutional demand for BTC, ETH ETFs slows

- Bitcoin rises towards $65,000 on Monday, gaining nearly 4% on the day.

- Ethereum adds over 3% to trade above $2,500.

- XRP edges up above $0.53 but trades within its recent range.

Bitcoin, Ethereum and XRP updates

- Bitcoin (BTC) Spot Exchange Traded Funds (ETFs) recorded merely two days of positive flows out of five last week. Bitcoin ranges close to $65,000 at the time of writing, even as institutional demand slows.

- Ethereum (ETH) climbs above $2,500 on Monday, even as Spot Ether ETFs struggle to gain relevance among institutional investors. Spot ETH ETFs recorded three days of flows last week, after days of inactivity, according to data from Farside Investors.

- XRP holds recent gains, trading above $0.5300 on Monday as traders await updates in the Securities & Exchange Commission (SEC) lawsuit.

Chart of the day: Ethena (ENA)

Ethena (ENA) broke out of its downward trend during the weekend. The token ranks among the assets that yielded high gains for traders in the last 24 hours on the Binance spot market, with 21.72% gains in that timeframe. ENA added nearly 14% to its value on Monday.

The Moving Average Convergence Divergence (MACD) indicator shifted to green histogram bars above the neutral line in the daily chart. This implies that there is positive underlying momentum in ENA’s price trend.

ENA could break past resistance at $0.4800 and rally towards the June 29 high at $0.5290. This marks over 30% gains from the current level, around $0.4000. The Relative Strength Index (RSI) reads 66.78, still below the overbought level of 70.

ENA/USDT daily chart

A daily candlestick close below the 50-day Exponential Moving Average (EMA) at $0.3799 could invalidate the bullish thesis. In that case, ENA could sweep liquidity at the support of the 10-day EMA at $0.3053, as seen on the daily chart.

Market updates

- A September 2024 stablecoin report from CCData states that the total market capitalization of stable assets rose 1.50% in September, at $172 billion. This marked the twelfth consecutive increase in the end-of-month market capitalization for stablecoins.

- Donald Trump-backed DeFi project World Liberty Financial confirms token sale on Tuesday, October 15.

.@WorldLibertyFi Token Sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday:…

— Donald J. Trump (@realDonaldTrump) October 12, 2024

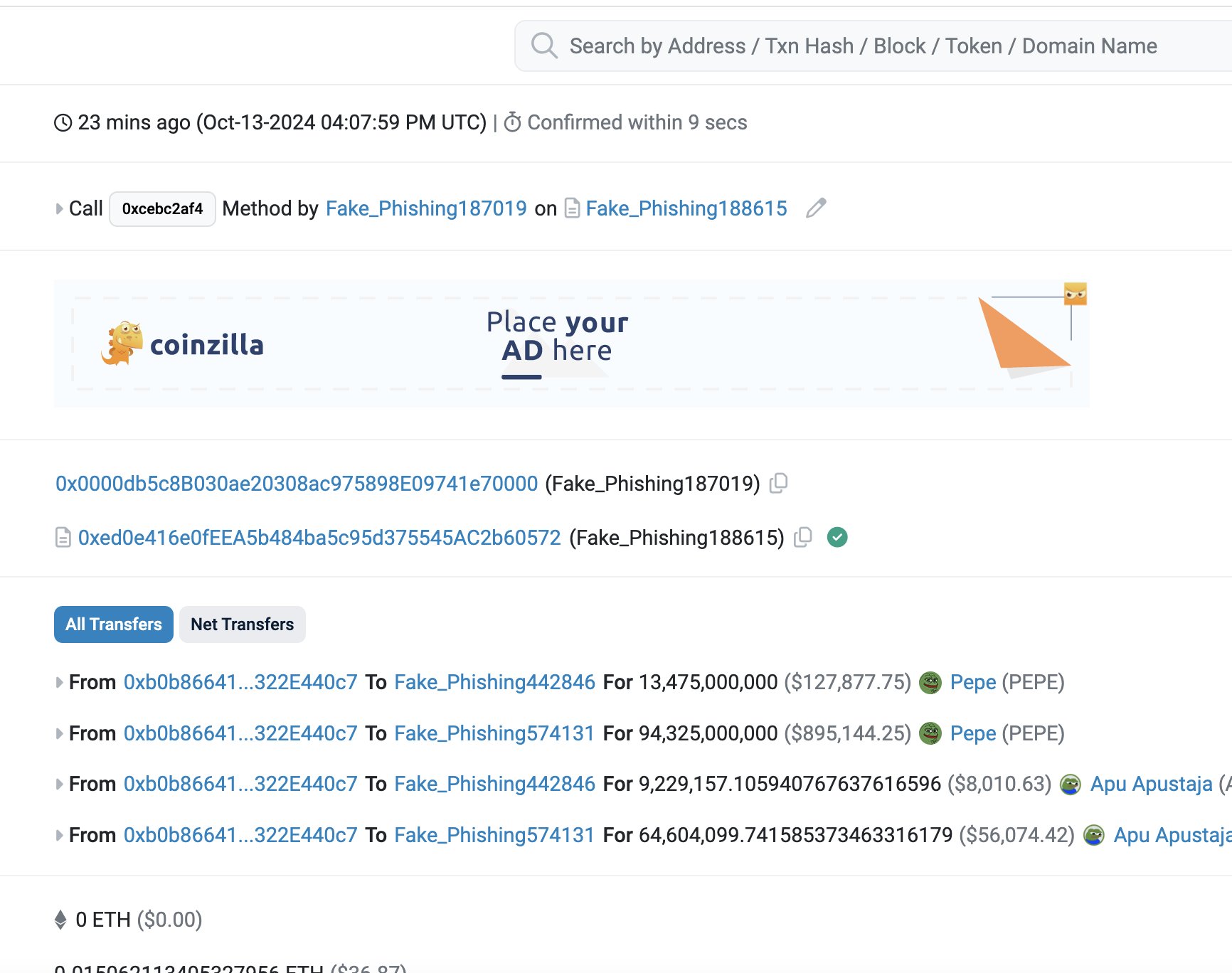

- On-chain data shows a PEPE coin holder lost $1.39 million worth of the meme coin in a phishing attack on Sunday. The user was a victim of Signature phishing, where attackers obtain an off-chain signature from the individual and use it later to access their assets on-chain.

PEPE holder loses holdings to phishing scam

Industry updates

- A local Korean news outlet reported that the Korean Virtual Asset Committee, a 15-member policy and institutional advisory body chaired by the vice chairman of the Financial Services Commission (FSC), will hold a meeting to discuss the approval of virtual asset spot ETFs and corporate virtual asset investments, as early as October.

- Lookonchain data shows that a wallet associated with Longling Capital (the crypto fund of China’s Meitu company founder) purchased 5,000 Ether on Sunday.

A wallet related to #LonglingCapital bought another 5,000 $ETH($12.34M) 20 mins ago.

— Lookonchain (@lookonchain) October 13, 2024

This wallet holds 68,064 $ETH($168M) and borrowed 44M $USDT from #Aave.#LonglingCapital was liquidated for 93,793 $ETH($114M) when the market crashed in 2022!https://t.co/40efdPkl2A pic.twitter.com/V2sHArcjt1

- Bitcoin staking platform Solv Protocol raised $11 million at a $200 million valuation from Nomura subsidiary Laser Digital, Blockchain Capital, and OKX Ventures. The product has over 20,000 BTC staked as of Monday, removing the tokens from circulation.