5 Token Unlocks to Watch Next Week

Token unlock involves releasing tokens that were previously blocked under fundraising terms. Projects carefully schedule these releases to avoid market pressure and prevent a drop in token prices.

However, factors like lack of liquidity or early investor profit-taking can significantly impact an asset’s dynamics. Here are five major unlocks to watch next week.

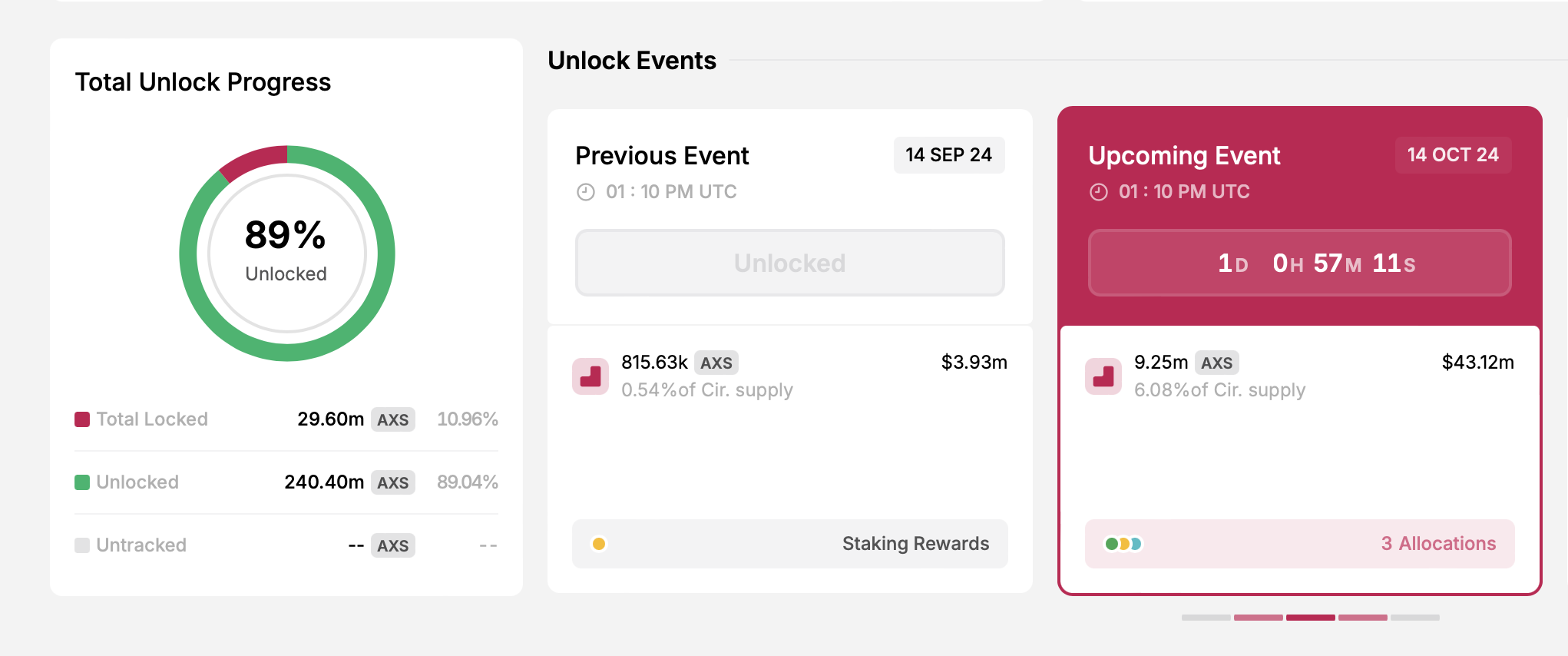

Axie Infinity (AXS)

- Unlock date: October 14

- Number of tokens unlocked: 9.25 million AXS

- Current circulating supply: 152.23 million AXS

Axie Infinity, created by Sky Mavis, is a leading Play-to-Earn blockchain game where players collect, breed, and battle creatures called “axies.” The game has garnered significant popularity, partly due to its engaging gameplay and the potential for earning rewards. Players can crossbreed axies to create new characters and earn rewards by winning battles and selling axies in the marketplace.

The game utilizes its native AXS token for various purposes, including platform development and governance. On October 14, 9.25 million AXS will be unlocked and distributed between stakers and the project’s team.

Read more: Axie Infinity (AXS) Price Prediction 2024/2025/2030

AXS Unlock. Source: token.unlocks

AXS Unlock. Source: token.unlocks

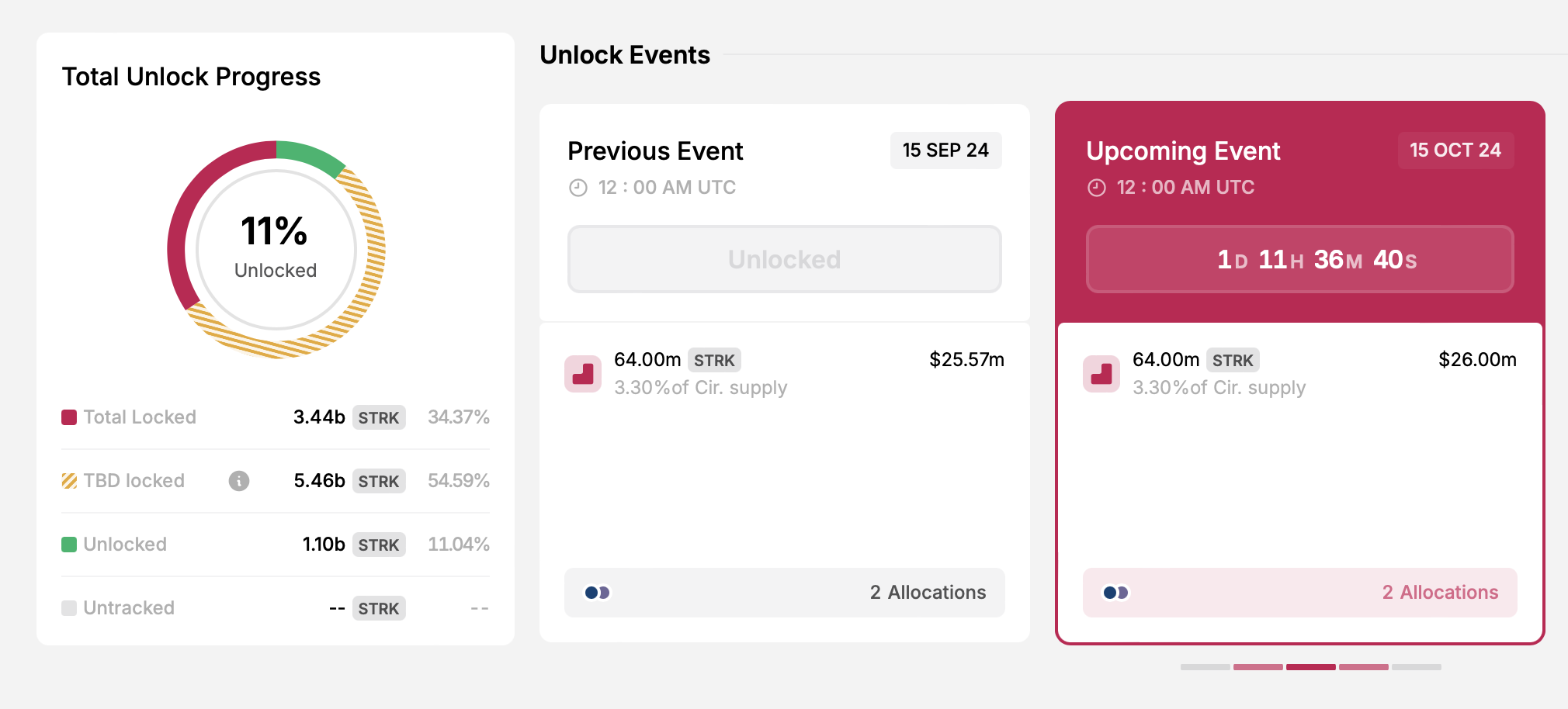

Starknet (STRK)

- Unlock date: October 15

- Number of tokens unlocked: 64 million STRK

- Current circulating supply: 1.94 billion STRK

Starknet is developing a ZK-Rollup Layer-2 solution to scale decentralized applications on Ethereum. Following a successful investment round, the team introduced the STRK token, essential for decentralizing the network.

On October 15, the project will unlock 64 million STRK tokens, distributed to investors and early contributors.

Read more: A Deep Dive Into Starkware, StarkNet, and StarkEx

STRK Unlock. Source: token.unlocks

STRK Unlock. Source: token.unlocks

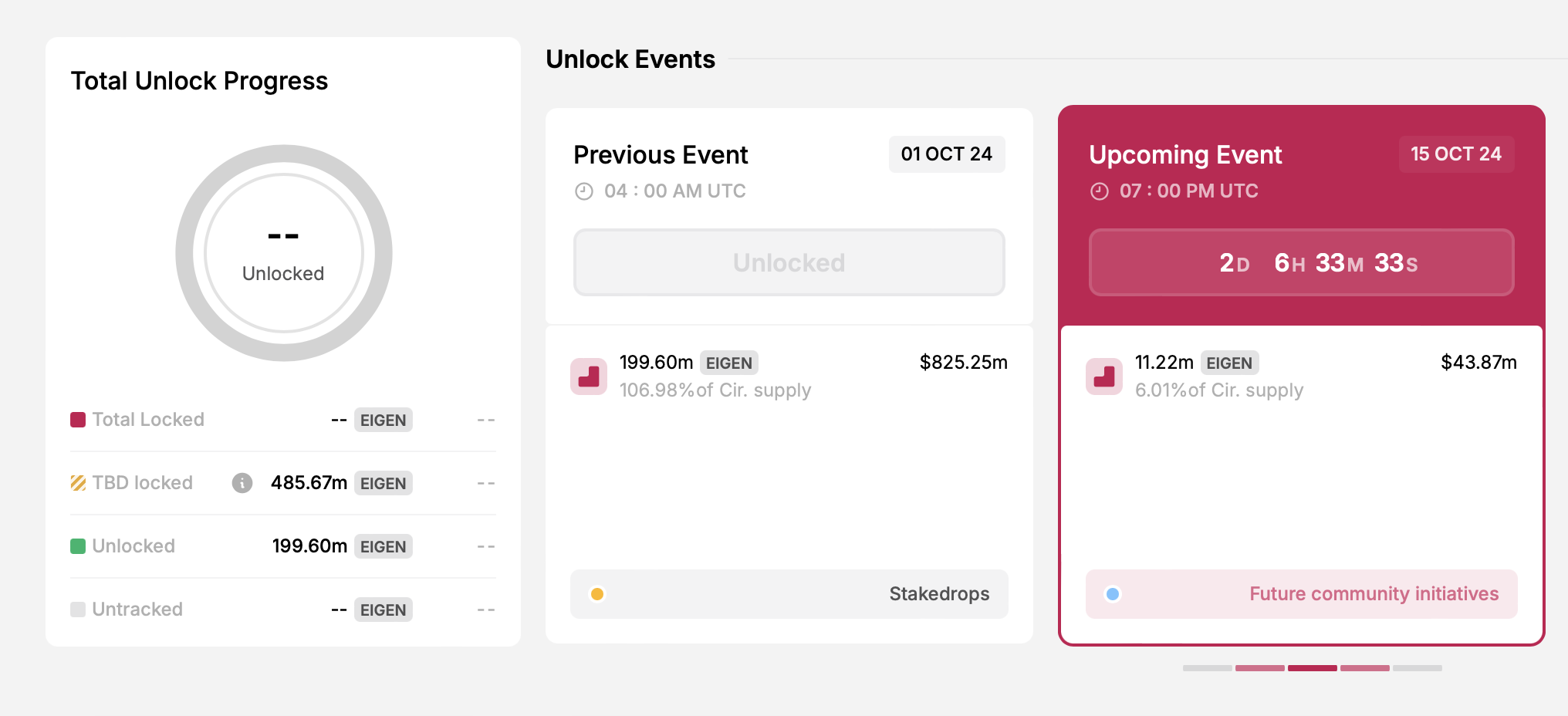

EigenLayer (EIGEN)

- Unlock date: October 15

- Number of tokens unlocked: 11.22 million EIGEN

- Current circulating supply: 186.58 million EIGEN

Ethereum-based restaking protocol EigenLayer started October by listing its EIGEN token on major exchanges. On October 15, the project will unlock over 11 million EIGEN, valued at $43.87 million as of this writing. These tokens are earmarked for future community initiatives, making it unlikely that the unlock will significantly impact the token’s price.

Read more: Ethereum Restaking: What Is it and How Does it Work?

EIGEN Unlock. Source: token.unlocks

EIGEN Unlock. Source: token.unlocks

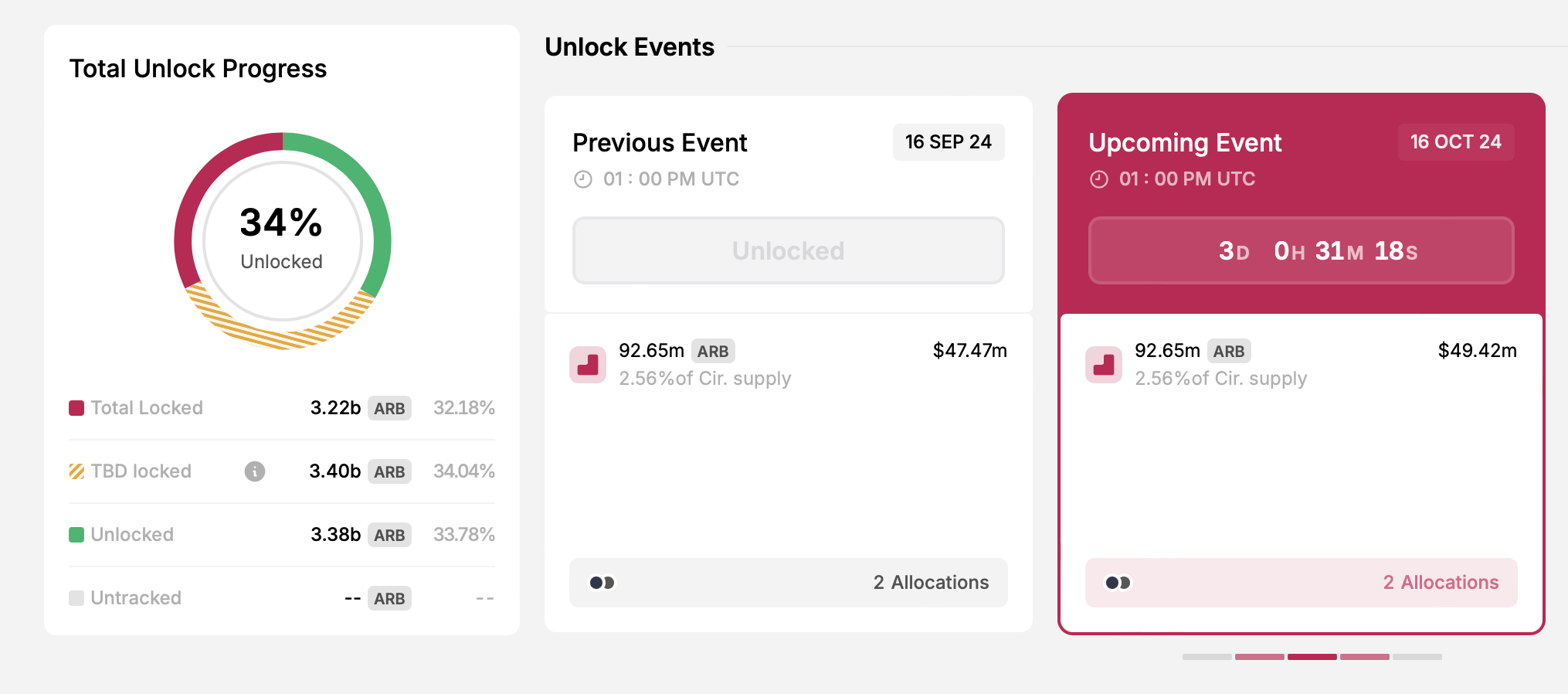

Arbitrum (ARB)

- Unlock date: October 16

- Number of tokens unlocked: 92.65 million ARB

- Current circulating supply: 3.6 billion ARB

Arbitrum, developed by Offchain Labs, is one of the most popular Layer-2 solutions for Ethereum. The mainnet launched in August 2021, with funding from Lightspeed Venture Partners, Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Alameda Research, entrepreneur Mark Cuban, and cryptocurrency exchange Coinbase.

Next week, Arbitrum will unlock 92.65 million ARB, currently valued at approximately $49.42 million. The team, advisors, and investors will receive these tokens.

Read more: How to Buy Arbitrum (ARB) and Everything You Need to Know

ARB Unlock. Source: token.unlocks

ARB Unlock. Source: token.unlocks

ApeCoin (APE)

- Unlock date: October 17

- Number of tokens unlocked: 15.6 million APE

- Current circulating supply: 674.64 million APE

ApeCoin is the native token of Yuga Labs’ Ape ecosystem, which includes the renowned Bored Ape Yacht Club (BAYC) NFT collection. On October 17, the project will unlock over 15 million tokens, distributing them among the treasury, founders, team, and contributors.

Historically, APE has seen a price drop following large unlocks. Investors and traders should closely monitor this event, as it could heavily influence the token’s price dynamics.

Read more: Bored Ape Yacht Club Explained: What Is BAYC?

APE Unlock. Source: token.unlocks

APE Unlock. Source: token.unlocks

Other next-week cliff unlocks include Render (RNDR), CYBER, Ethena (ENA), Cardano (ADA), Ethena (ENA), and Echelon Prime (PRIME), with a total value exceeding $219 million. While many see token unlocks as bearish, a well-structured schedule can actually support a project’s long-term success. Tied to key milestones and development, unlocks can motivate the team, engage the community, and drive ecosystem growth.