Dogecoin Active Addresses surge nearly 12% overnight, to DOGE all-time high

- Dogecoin network observed an increase of 1,094% in new addresses in the past week.

- DOGE hit a new all-time high when 247,240 new addresses created on January 29.

- DOGE price recovered slightly, likely to climb to $0.8528 in its uptrend.

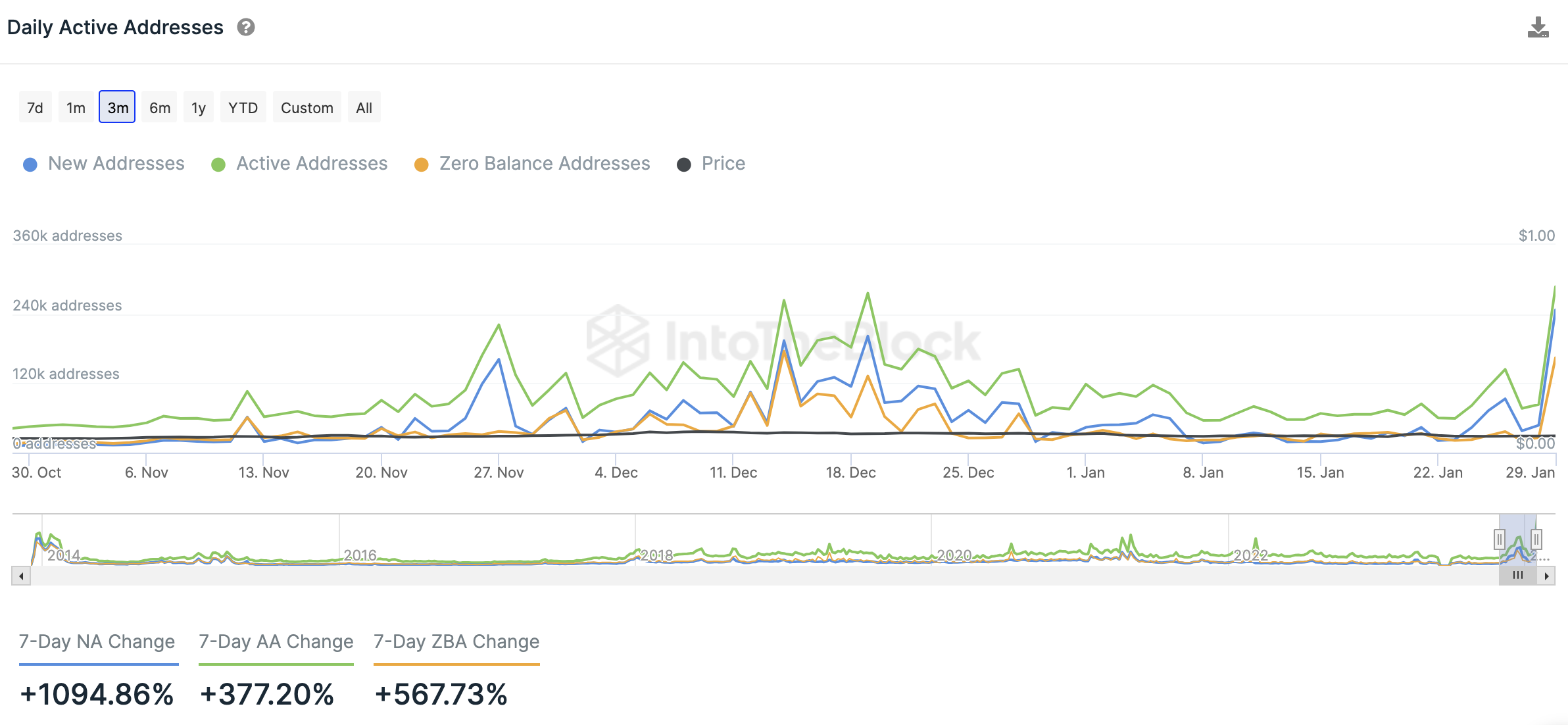

Dogecoin network has observed a surge in Daily Active Addresses and New Addresses. On January 29, new DOGE addresses hit an all-time high of 247,240, according to data from IntoTheBlock.

DOGE price climbed to $0.8215 on Tuesday.

Also read: Bitcoin price could rally as buying power increases with rise in exchange stablecoin reserves

Dogecoin witnesses spike in new DOGE addresses

According to data from on-chain intelligence tracker, IntoTheBlock, DOGE network saw a 1,094% increase in New Addresses in the past week. 247,240 new DOGE addresses were created on January 29, and this marked a new all-time high.

Dogecoin is likely to witness a sustained network expansion. This could catalyze price gains in the meme coin.

DOGE Daily Active Addresses. Source: IntoTheBlock

Santiment charts reveal a 12% surge in Active Addresses overnight, DOGE Active Address count hit 393,060 on January 30, at the time of writing. This increase implies DOGE is relevant among market participants and there is a surge in demand for the asset among traders. Higher address activity supports a bullish thesis for DOGE price.

%20[16.27.20,%2030%20Jan,%202024]-638422110491888340.png)

DOGE Active Addresses. Source: Santiment

At the time of writing, DOGE price is $0.0821, the meme coin’s price remained unchanged on the weekly timeframe.