Moo Deng Price Crashes 60% in a Week Due to This Reason

Moo Deng (MOODENG) price witnessed an impressive rally throughout September, becoming a must-watch token in the crypto space. However, towards the end of the month, the altcoin’s fortunes turned, and it began a steep decline.

As of this week, Moo Deng has become one of the biggest losers, with its price crashing by nearly 60%. Investors are now left wondering what led to this drastic drop.

Moo Deng Investors’ Mood Has Been Ruined

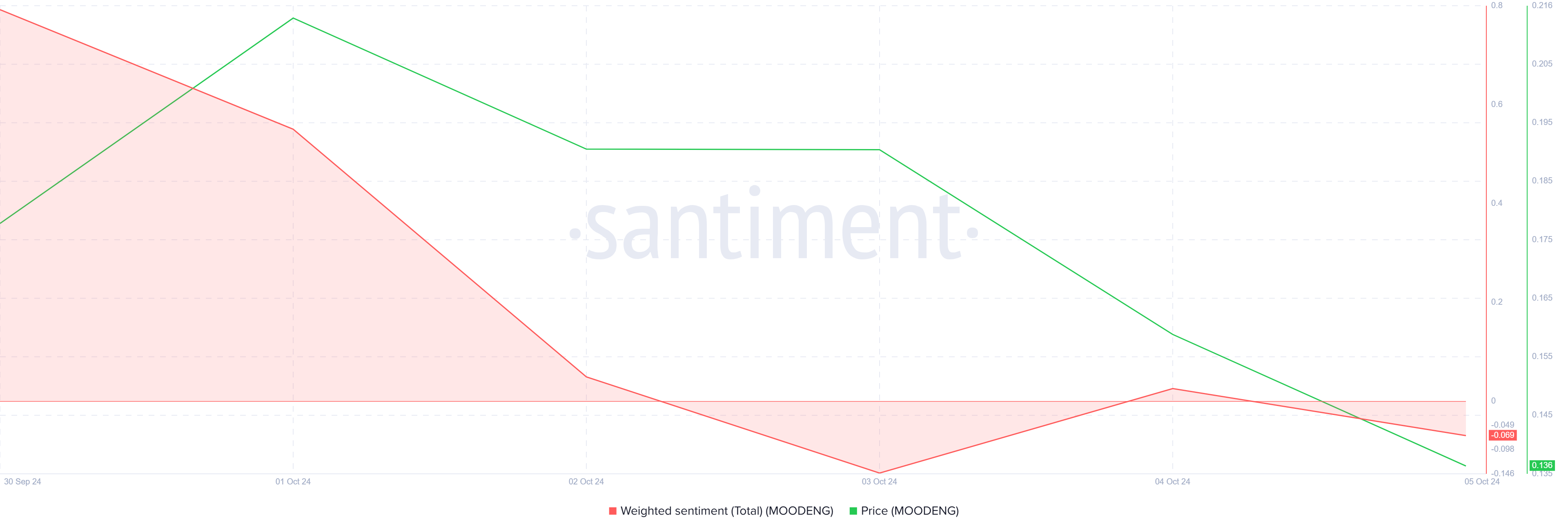

The market sentiment for Moo Deng has shifted sharply. After reaching an all-time high of $0.355, investor optimism quickly faded. The weighted sentiment, which gauges overall investor mood, has turned negative, signaling reduced confidence in the token’s recovery.

As sentiment declines, so does the chance of a swift rebound. The decreasing enthusiasm has led to lower trading volumes, worsening the price drop. Without renewed buyer interest, the coin’s recovery appears uncertain, raising further concerns among its backers.

Read more: What Are Meme Coins?

Moo Deng Weighted Sentiment. Source: Santiment

Moo Deng Weighted Sentiment. Source: Santiment

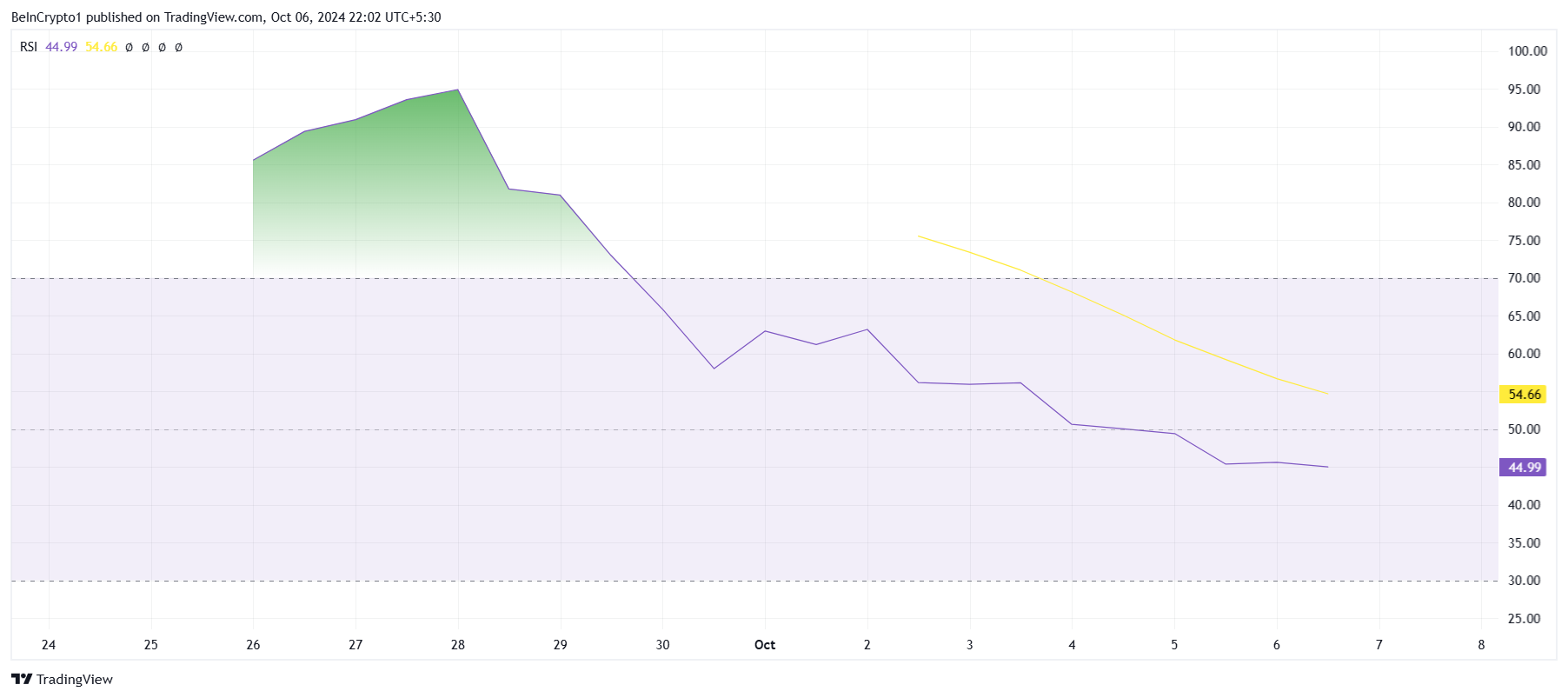

On the technical front, Moo Deng’s momentum has also turned decisively to the bearish side. The Relative Strength Index (RSI) has fallen below the critical neutral line of 50.0, a sign that the buying pressure is weak and that bearish momentum has taken over.

The drop in RSI from bullish to bearish reflects the broader market trend for Moo Deng. With the momentum favoring sellers, the coin is likely to experience more downward pressure in the near term. This could potentially drive the price even lower if the bearish conditions persist.

Moo Deng RSI. Source: TradingView

Moo Deng RSI. Source: TradingView

MOODENG Price Prediction: The Hippo Is in Danger

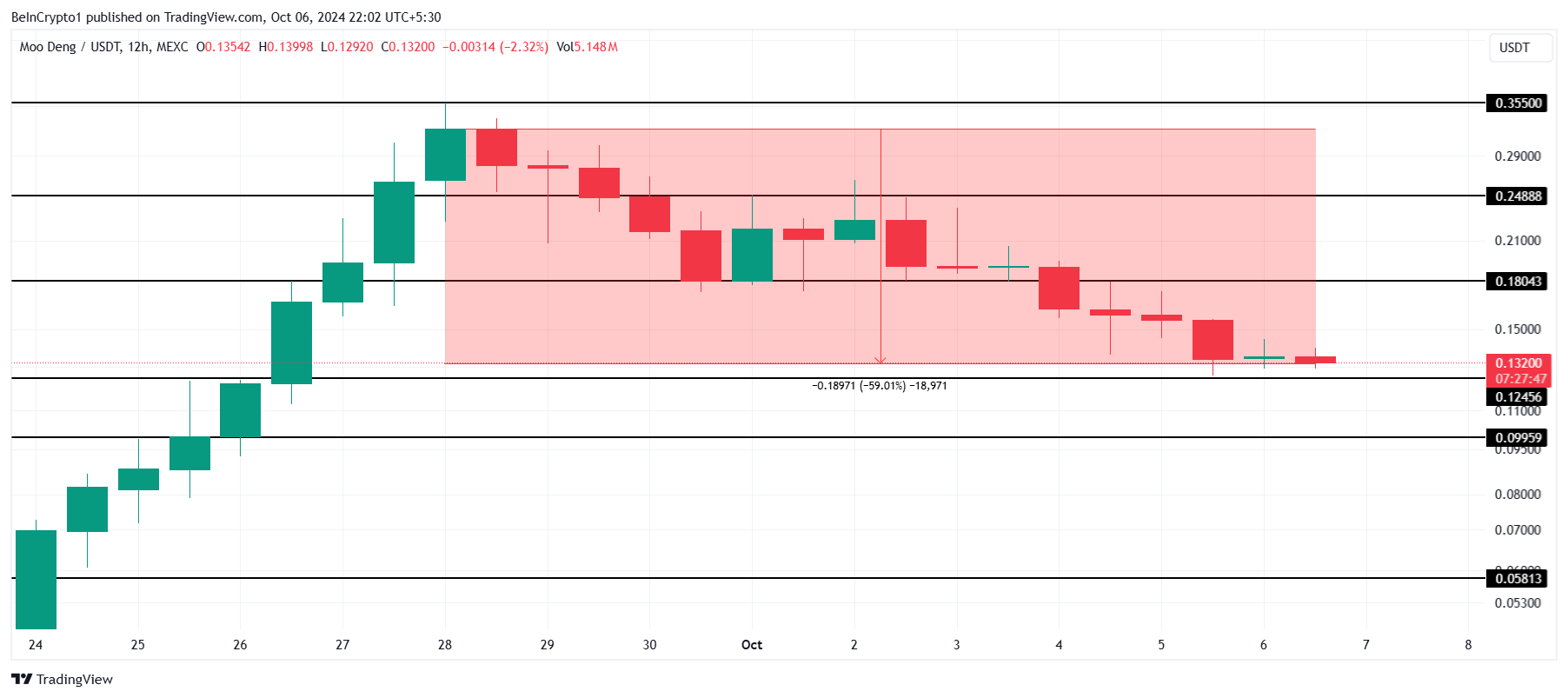

Moo Deng’s price has plummeted by nearly 60% over the last seven days, currently trading at $0.132. For now, the meme coin is managing to hold above the crucial support level of $0.124, but this stability may not last long.

Given the negative market sentiment and bearish technical indicators, Moo Deng’s price could potentially drop below $0.124. If this support fails to hold, the meme coin will slide further, testing the next critical support at $0.099.

Read more: 11 Top Solana Meme Coins to Watch in October 2024

Moo Deng Price Analysis. Source: TradingView

Moo Deng Price Analysis. Source: TradingView

However, there is still a possibility of recovery. If Moo Deng price manages to bounce off the $0.124 support, it could initiate a rise towards $0.180. Breaching this level would invalidate the bearish outlook and push the coin closer to $0.200, recovering some of its recent losses.