POPCAT Price Hits New ATH as Solana Meme Coin Rallies 120%

POPCAT, a Solana meme coin, has reached a new all-time high (ATH) following a significant rally. The coin surged by 109% over the past month, crossing the crucial $1.00 resistance barrier and reaching $1.29.

This marked a pivotal moment for POPCAT, driven by strong market sentiment and unique factors that set it apart from other altcoins.

POPCAT Is a Unique Case

One of the key factors behind POPCAT’s recent rally is its lack of correlation with Bitcoin (BTC). Unlike many other altcoins that tend to move in sync with BTC’s price fluctuations, POPCAT has historically performed better when its correlation with Bitcoin drops. Currently, the correlation between POPCAT and BTC has fallen to 0.33, indicating a weaker relationship.

This lower correlation has proven beneficial for POPCAT, as the broader cryptocurrency market has been facing challenges. The meme coin’s ability to move independently of Bitcoin has allowed it to capitalize on favorable market conditions, leading to the recent price surge.

Read More: How to Buy Solana Meme Coins: A Step-By-Step Guide

POPCAT Correlation with Bitcoin. Source: TradingView

POPCAT Correlation with Bitcoin. Source: TradingView

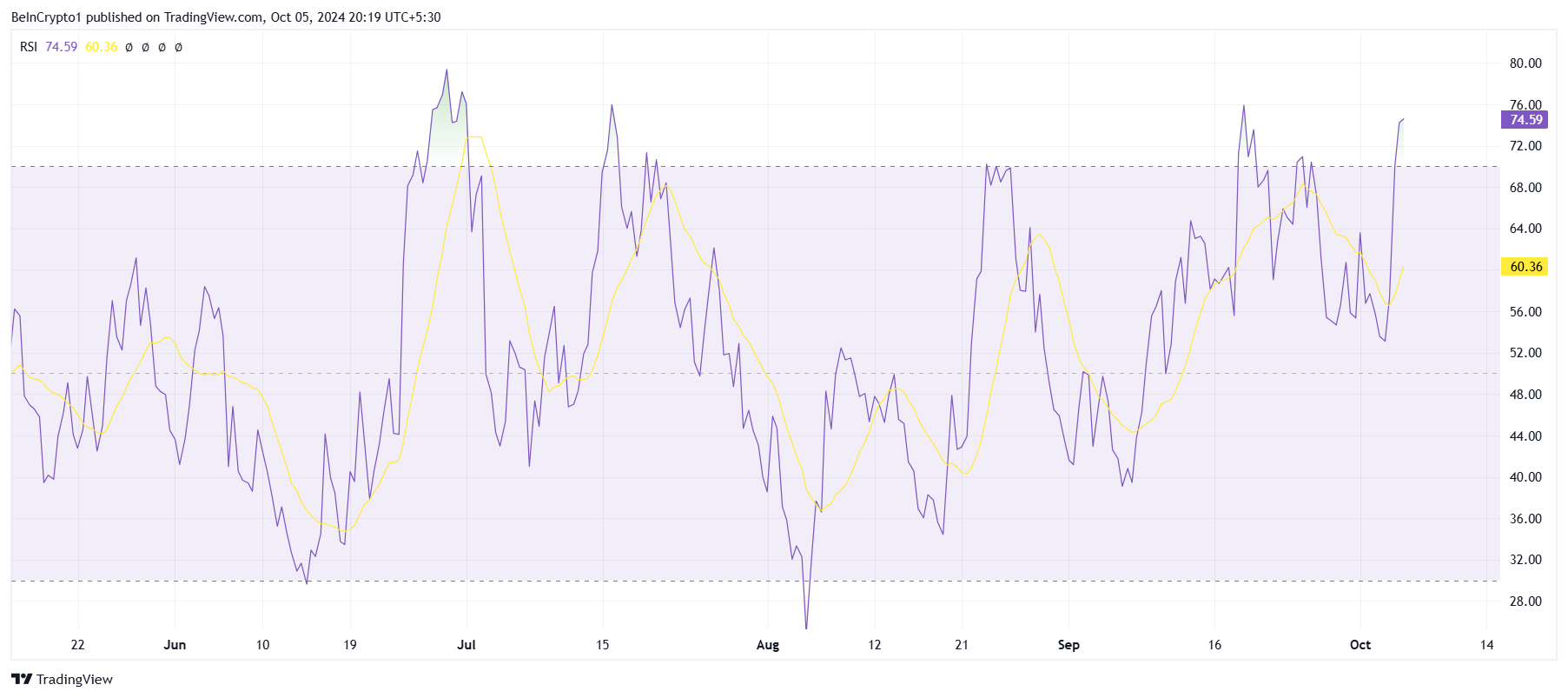

From a technical perspective, POPCAT’s macro momentum remains strong. The Relative Strength Index (RSI), a key indicator for assessing overbought or oversold conditions, is currently in the former zone. Despite this, the RSI is still rising, signaling that buying pressure remains strong for POPCAT.

However, it’s worth noting that meme coins like POPCAT often experience sudden price corrections, especially when investors decide to take profits. Although POPCAT holders have not yet shown signs of selling, the risk of a potential pullback looms, given the RSI’s position in the overbought zone.

POPCAT RSI. Source: TradingView

POPCAT RSI. Source: TradingView

POPCAT Price Prediction: Beating the Odds

POPCAT’s price saw a 31% rise over the past 24 hours, propelling the Solana-based meme coin to $1.29, its new ATH. This impressive increase is part of a larger 109% rally over the past month, driven by strong market sentiment and favorable technical indicators.

Breaking through the $1.00 barrier was a significant milestone for POPCAT, as this level had previously served as a tough resistance. The broader market conditions supported this breach, enabling the meme coin to soar to new heights.

Read More: 11 Top Solana Meme Coins to Watch in October 2024

POPCAT Price Analysis. Source: TradingView

POPCAT Price Analysis. Source: TradingView

However, a sharp price correction could occur if investors move to take profits. A drop to the $1.00 support level is possible, and losing this key level could push POPCAT down to $0.75, invalidating the potential for further upward momentum. Investors should remain cautious as the coin continues to navigate its volatile price action.