Shiba Inu and PEPE hold recent gains as Bitcoin hovers around $61,000

- Bitcoin halts decline after erasing recent gains, hovers around $61,000 on Thursday.

- Shiba Inu and PEPE climb on Thursday, while Dogecoin lags behind in the 7-day timeframe.

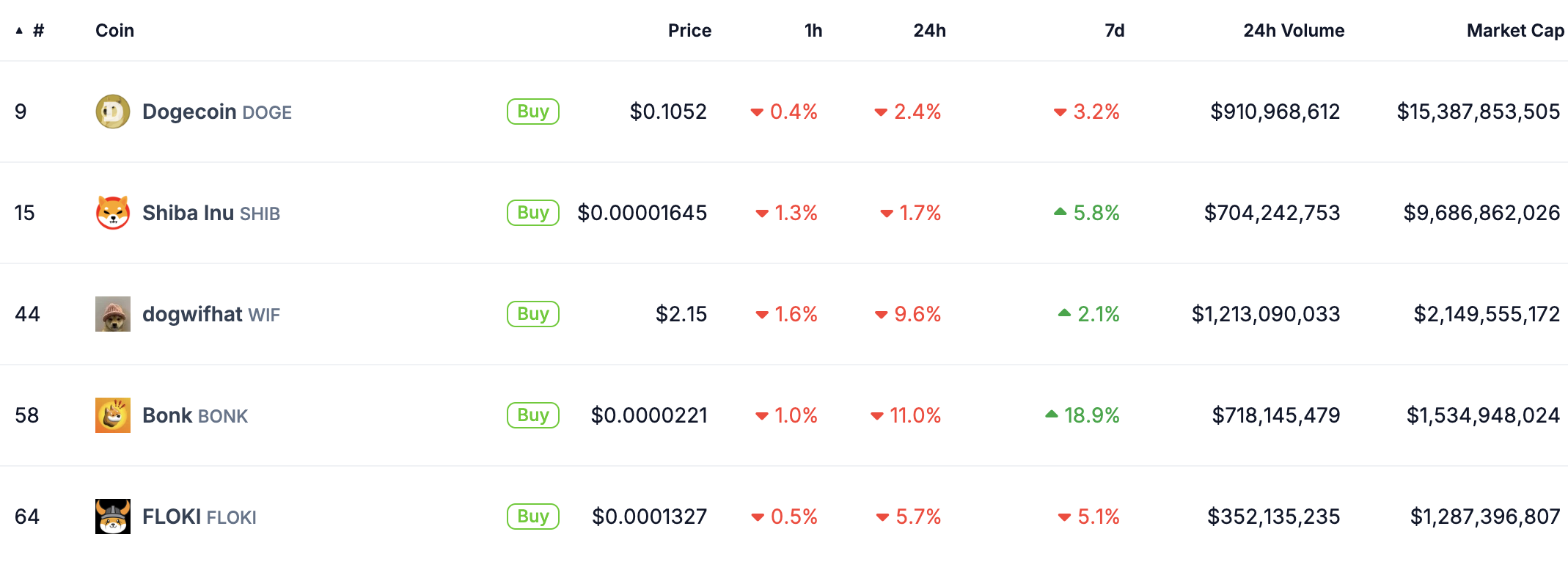

- Shiba Inu, Dogwifhat, and Bonk lead in gains in the 7-day timeframe among dog-themed meme coins.

Bitcoin’s (BTC) price halts the decline and hovers around $61,000 at the time of writing on Thursday, after erasing recent gains and losing around 4.5% in the last seven days time frame. Over the same period, Shiba Inu (SHIB) and Pepe (PEPE) have held onto their gains, while Dogecoin (DOGE), the top meme coin by market capitalization, has lost around 3.2%.

SHIB and PEPE held on to their gains from the last seven days

Coinglass’ Crypto Fear & Greed Index reads “fear” on Thursday. Bitcoin slipped from Monday’s high above $65,000 to around $61,000 at the time of writing. Dog-themed meme coins, Shiba Inu, Dogwifhat (WIF), and Bonk (BONK), are holding on to their gains from the last seven days, according to CoinGecko data.

Dog-themed meme coins

Shiba Inu and PEPE have held onto their gains from the last seven days even as Bitcoin risks a drop to the psychologically important $60,000 level.

On-chain data from IntoTheBlock shows that 49% of SHIB holders are currently sitting on unrealized losses. In the case of Dogecoin, 73% of holders are currently profitable, while in PEPE, 68% of token holders are profitable.

The selling pressure on Dogecoin and PEPE will likely increase if holders take profits at the current price level.

IntoTheBlock data shows that the sentiment among market participants is mostly neutral in the case of Dogecoin and PEPE, but it is bullish in the case of Shiba Inu.

DOGE, SHIB, and PEPE trade at $0.1032, $0.00001597, and $0.00000886, respectively, erasing between 2% and 4% of their value on the day.