Crypto investment products witness $1.2 billion inflow as monetary policy expectations linger

- Digital asset products recorded inflows totaling $1.2 billion last week, marking a third consecutive week of positive flows.

- Bitcoin ETFs witnessed the highest inflows, totaling $1 billion, as BTC supply in profit remained above 80%.

- Ethereum ETFs recorded inflows of $87 million despite varying sentiment among altcoins last week.

CoinShares' weekly report on Monday indicates that digital asset investment products recorded inflows totaling $1.2 billion last week after the Securities & Exchange Commission (SEC) approved options trading for Bitcoin ETFs. Additionally, Ethereum ETFs posted inflows for the first time in five weeks, in this case totaling $87 million as the altcoin market witnessed mixed sentiment.

Crypto products see inflows as monetary policy expectations linger

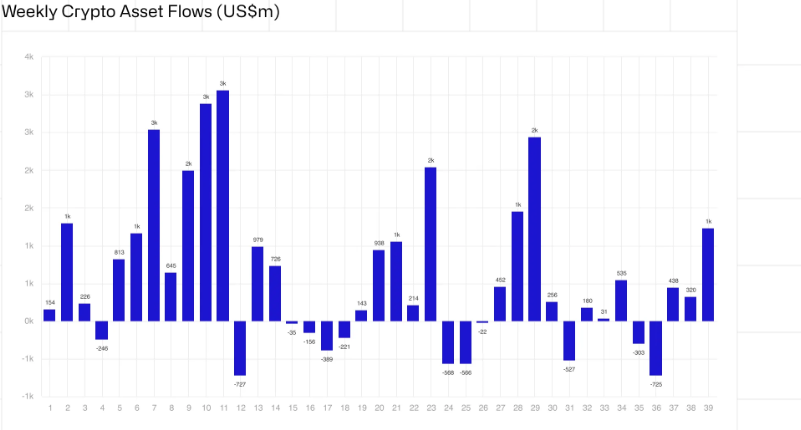

Crypto investment products recorded inflows of $1.2 billion last week, marking a third consecutive week of inflows, according to CoinShares' weekly report on Monday.

Last week's inflows were the highest recorded since July, stirred by growing expectations of "dovish monetary policy in the US" and the SEC’s approval of options trading for BlackRock's iShares Bitcoin Trust (IBIT). However, trading volumes among crypto ETFs declined week-on-week by 3.1% despite a 6.2% rise in assets under management (AuM).

Weekly Crypto Asset Flows

Regionally, the US saw the most volumes, recording inflows of $1.2 billion. Switzerland also witnessed $84 million in inflows, its highest since mid-2022. Conversely, Germany and Brazil saw outflows of $21 million and $3 million, respectively.

Asset-wise, Bitcoin ETFs remained the highest gainers, recording inflows of $1 billion. The inflows may have received a boost following the SEC's approval of options trading for BlackRock's IBIT.

Bitcoin’s price has shown remarkable strength in the past three weeks, rising over 14% from $55,000 to $64,000. BTC has declined by 3.1% in the past 24 hours and trades at $63,691 at publishing time.

CryptoQuant analyst Axel Adler points to a decline in Bitcoin's Exchange Flow Multiple, suggesting that long-term BTC investors are retaining their holdings, which is an initial sign of a bull run.

Additionally, CryptoQuant CEO Ki Young Ju opines that Bitcoin is still in the middle of a bull cycle as its market capitalization has continued to outpace its realized cap. He further adds that the growth may be due to bulls leveraging exchanges for trades trading as opposed to on-chain, over-the-counter (OTC) trading among bears.

Furthermore, Bitcoin's supply in profit remains above 80%, which historically signals a bull cycle, per SignalQuant via CryptoQuant.

BTC Supply in Profit (%)

Altcoins experienced varying sentiment last week, with global Ethereum products recording inflows of $87 million after five weeks of net outflows that date back to August.

In contrast, Solana ETFs saw outflows totaling $4.8 million. Other altcoins that recorded negative flows include Binance and Stacks, which posted $1.2 million and $0.9 million in outflows, respectively.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.