Crypto Today: XRP dips, Bitcoin dives under $64,000, Ethereum hovers around $2,600

- Bitcoin loses recent gains and trades at $63,823 on Monday.

- Ethereum erases 1%, down to $2,631.

- XRP falls by more than 2% on the day, slipping under the psychologically important $0.65 level.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $63,823 at the time of writing. Bitcoin Spot ETFs recorded inflows consistently for seven days, according to data from Farside Investors. Inflows to Spot ETFs typically represent demand among institutional investors. BTC lost over 3% value on the day, correcting over 4% from September’s monthly peak of $66,498.

- Ethereum exchanges hands at $2,601, down 2% on the day. Ethereum Spot ETFs recorded a net positive flow of $58.7 million on Friday. The altcoin erased 4.5% of its value compared to the monthly high of $2,728.60.

- XRP slips under $0.6500, a key psychological support level for holders. The altcoin declined on Monday as XRP holders speculated the likelihood of Securities & Exchange Commission’s (SEC) appeal in the Ripple lawsuit.

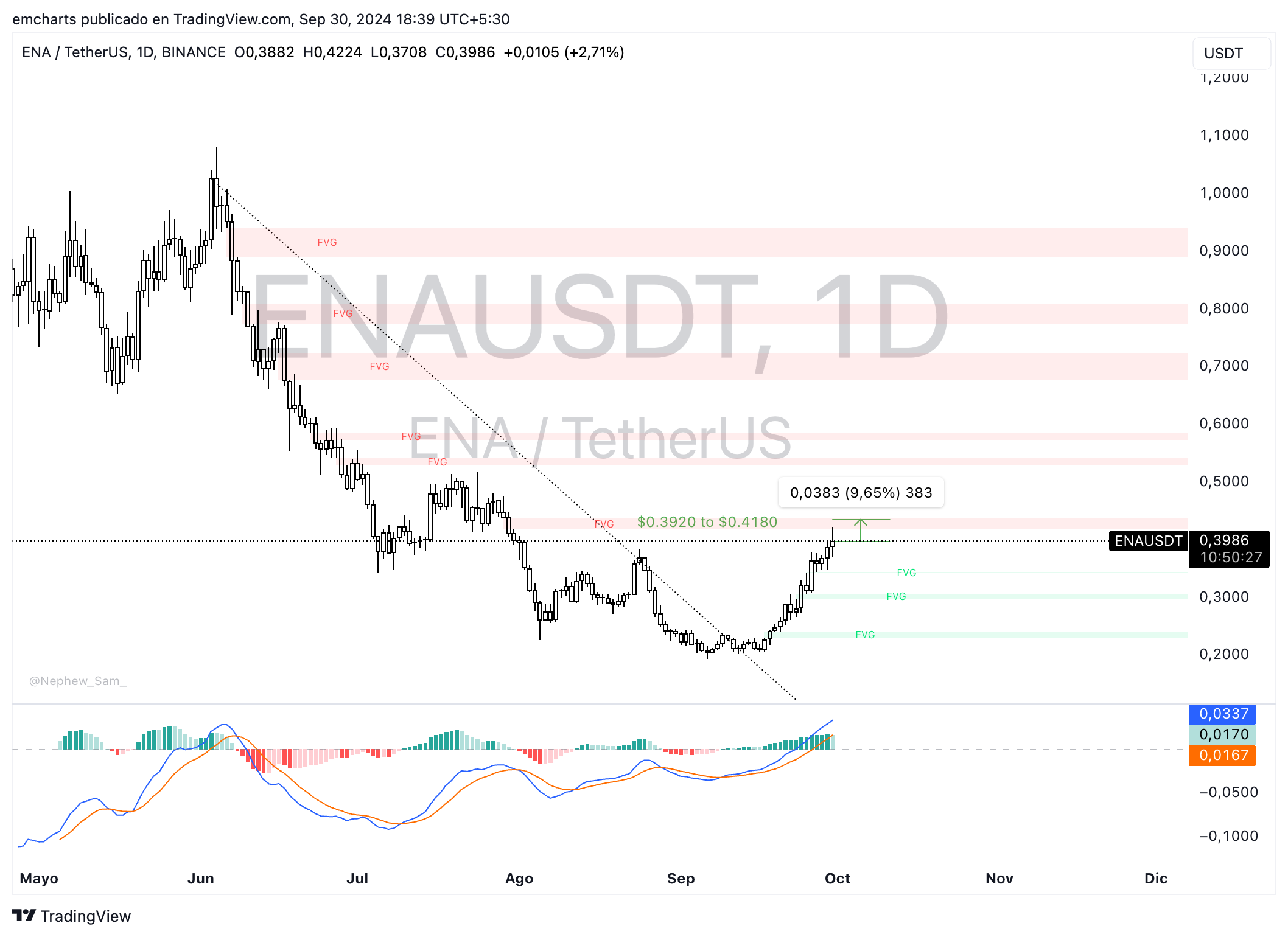

Chart of the day : Ethena (ENA)

Ethena (ENA), the utility token of the Ethena protocol, is one of the top trending tokens on Binance in the spot market. The token ranks in the top 10 cryptocurrencies that yielded the highest gains in the last 24 hours. ENA, which ended its multi-month downward trend on September 14, gains 2.63% on the day.

ENA is likely to extend its gains by 9.65% and rally towards the upper boundary of the Fair Value Gap (FVG) between $0.3920 and $0.4180.

The green histogram bars above the neutral line on the Moving Average Convergence Divergence (MACD) indicator show there is underlying positive momentum in ENA price trend.

ENA/USDT daily chart

In case of a correction, ENA could find support in the imbalance zone between $0.3792 and $0.3064.

Market updates

- Vitalik Buterin shared a vision to align Layer 2 and Layer 3 chains with the Ethereum blockchain in a recent blog post. This is an important development for ETH holders and users holding tokens of Layer 2 projects that are currently taking steps towards aligning the project and the chain’s utility with the Ethereum blockchain.

- PEPE, a leading meme coin, is listed on Noones Spot Exchange, according to an official announcement on X.

You can now trade @PEPE on the #NoOnes Spot Exchange! With 3 new coins added every week, we’re the ONLY #Crypto #Exchange with a 7-bullet privacy policy , letting you trade with just your name and email — the simplest #KYP ever! Why trade anywhere else? ♂️

— Noones App (@noonesapp) September 30, 2024

Check out our… pic.twitter.com/iGUo4aySuh

- Tron (TRX) successfully completed a security assessment of its Java-Tron client by ChainSecurity, a blockchain security firm. The assessment focused on key components of the blockchain to identify and resolve any vulnerabilities that could potentially affect the blockchain’s performance, including transaction execution, block generation, and consensus operations.

Industry updates

- Chainlink (LINK) further committedto Real World Asset tokenization (RWA) through an official partnership with ANZ, an Australian bank. The DeFi project will secure the cross-chain exchange of tokenized assets for the bank.

.@ChainlinkLabs is officially partnering with ANZ—a leading Australian bank with over A$1 trillion in AUM—in the Monetary Authority of Singapore's Project Guardian.#Chainlink CCIP will help enable the secure cross-chain exchange of tokenized RWAs. https://t.co/nlXJPJKjDv

— Chainlink (@chainlink) September 30, 2024

- World Liberty Financial, a project supported by former US President Donald Trump’s family office, opens Know Your Customer (KYC) verifications, according to an announcement on the official website. The website is under maintenance at the time of writing.

- On-chain data from Spot On Chain shows that the Ethereum Foundation’s wallet address sold 100 Ether on Monday through CoWSwap exchange. Former ETH sales by the organization have been criticized as they contribute to increasing the selling pressure on the token, likely negatively influencing its price.

The Ethereum Foundation sold another 100 $ETH for 262,474 $DAI about 10 minutes ago!

— Spot On Chain (@spotonchain) September 30, 2024

So far in 2024, the Ethereum Foundation has directly sold 3,766 $ETH for 10.46M $DAI via #CoWSwap at an average price of $2,777. Notably, 1,250 $ETH ($3.06M) has been sold in September alone.… https://t.co/OFQiC42V4t pic.twitter.com/PBgaBxZtjr