Ethereum staked hits all-time high, dwindling exchange supply could push ETH price higher

- Ethereum staked in the deposit contract climbed to 29.37 million, hitting a new all-time high on January 28.

- Ethereum in circulation is on a decline with dwindling exchange supply and rising volume of staked Ether.

- ETH price observed an 8% decline in the past week.

Ethereum’s supply in circulation is on a decline as ETH staked in the deposit contract rises and on exchanges drops. Traders are likely holding on to their Ether, contributing to likely decrease in selling pressure.

ETH price could recover from its slump after 8% weekly losses for holders.

Also read: Bitcoin bull run is likely sustainable, BTC balance on exchanges declines by over 1 million since 2020

A quarter of Ethereum’s supply is staked

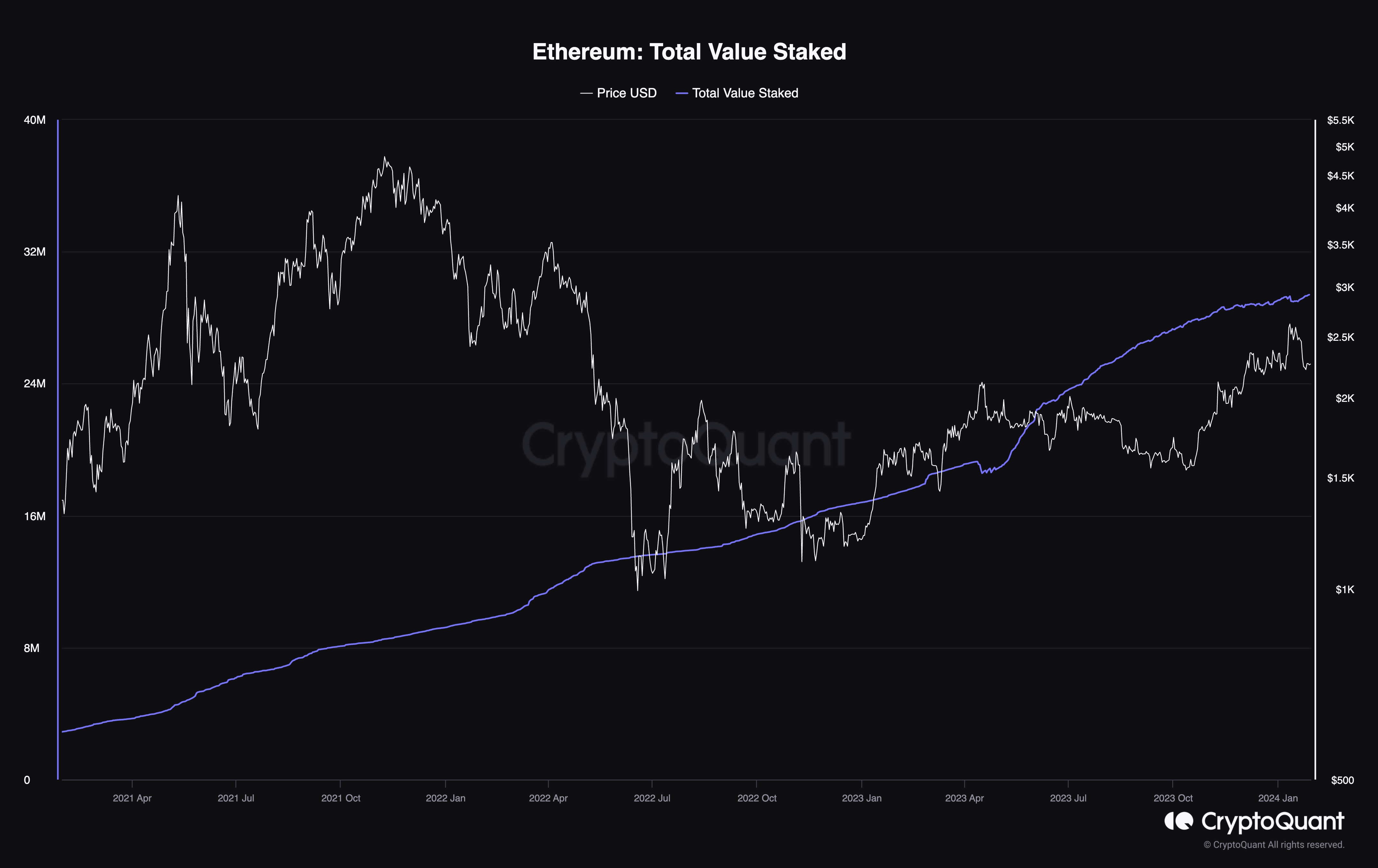

According to CryptoQuant data, staked Ethereum supply climbed to 29.37 million on January 28. This marks a new all-time high in terms of staked Ether supply since the launch of the deposit contract.

Ethereum: Total Value Staked. Source: CryptoQuant

Leon Waidmann, editor and analyst at BTCEcho, notes that a quarter of Ethereum’s supply is staked. The analyst comments on how this metric supports the bullish potential of ETH. The analyst identified that Ethereum’s dwindling supply, strong base of holders and increasing trust could fuel the altcoin’s gains in the ongoing cycle.

According to Santiment data, the supply on exchanges has nosedived to 10.32 million, close to its six-month low. Typically, a decrease in exchange supply is equated with reduced selling pressure on the asset and room for price gains.

%20[18.04.03,%2029%20Jan,%202024]-638421315190199931.png)

Ethereum supply on exchanges. Sources: Santiment

Network growth, another on-chain metric, shows bullish divergence. While ETH price dropped between January 16 and 29, network growth has increased, as seen in the chart below. The bullish divergence supports a bullish thesis for Ethereum price.

%20[18.05.15,%2029%20Jan,%202024]-638421315616177555.png)

Ethereum network growth. Source: Santiment

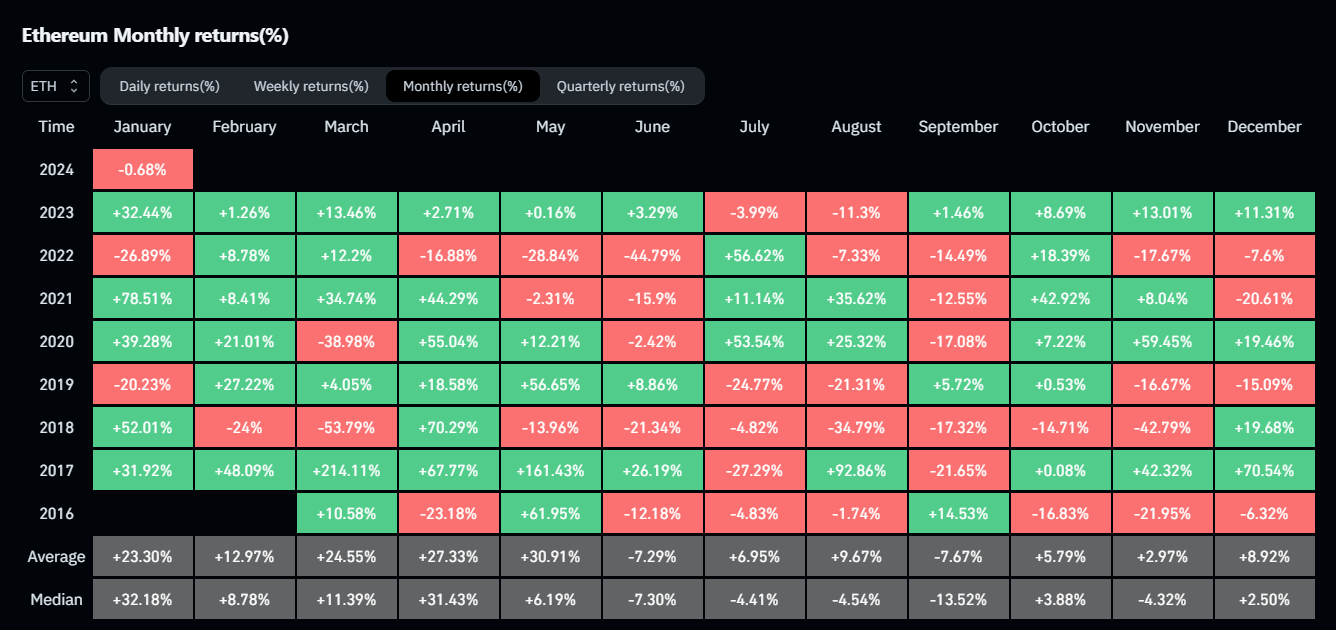

Historically, January to May have been the best months for Ethereum in terms of returns. The altcoin has observed double-digit gains in these months, on average. If history repeats itself, combined with bullish on-chain metrics, Ethereum price could recover from its recent slump.

Ethereum monthly returns. Source: DaanCryptoTrader’s tweet on X

At the time of writing, ETH price is $2,255 on Binance.