Uniswap token fully unlocked but only 25% of the supply is in circulation, what’s next for UNI

- Uniswap’s governance token UNI has an actual circulation of only 25% even after full unlock.

- On-chain data provider EmberCN says the community treasury received 430 million UNI, and only 7% entered circulation.

- Top six holders of Uniswap have not shed their UNI tokens yet.

- UNI erases over 3% value on Wednesday, trades at $6.528.

Uniswap’s governance token for the protocol, UNI, was launched in 2020. In the last four years, even as the entire supply of UNI has been fully unlocked, only 25% has entered into circulation as of Wednesday.

The majority of the tokens are held by the six largest holders. Data from on-chain tracker EmberCN shows that the top six addresses, including a16z and Union Square Ventures, have not sold their UNI.

Whale wallet activity has an impact on price depending on whether it is accumulation or large-scale distribution of the asset.

At the time of writing, UNI trades at $6.528, down over 3% on the day.

Uniswap token could rally or crash depending on these factors

According to on-chain data, the largest wallet holders of Uniswap have not sold their UNI holdings, even as the entire supply of the governance token has been unlocked. The last unlock event kicked off on September 18, 2023, unlocking 227,040 UNI a day for 365 days.

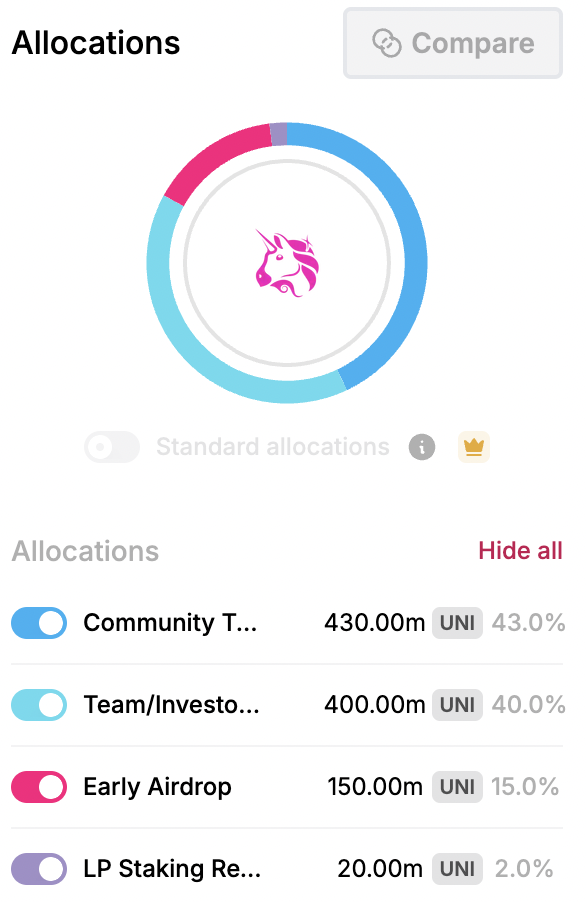

Data from Tokenunlocks app shows that Uniswap’s entire supply (maximum supply) of 1 billion tokens has been unlocked. The unlocked tokens have been allocated in the following manner:

Uniswap token allocation

Of the 430 million UNI allocated to the community treasury, the address currently holds 399,789,850 UNI tokens, per Etherscan data. This means that the difference, 30.21 million, has flown into the market.

Uniswap top holders

The rest of the tokens remain untracked, within cold wallets or exchange wallets of entities. A mere 7% of the tokens distributed to the community treasury entered circulation, contributing to low selling pressure on Uniswap across exchange platforms.

Uniswap wallets with large UNI token holdings, a16z, USV, ParaFi Capital

Coingecko data shows that UNI circulating supply is 753,766,667, however, EmberCN’s analysis of newly unlocked tokens between 2023 and 2024 shows that only about 25.83% UNI tokens are currently in circulation.

已进入全流通状态的 $UNI 链上筹码分析

— 余烬 (@EmberCN) September 17, 2024

2020 年 9 月, $UNI 发行上市。团队/投资人/顾问以及社区财库获得了共计 83% 的 UNI (8.3 亿枚) 分配,这些 UNI 有四年的解锁周期。

现如今 4 年时间已经过去,这些 UNI 已经完成解锁,UNI 成为全流通代币。我们从链上来看看这 83%… pic.twitter.com/AM3WHmg2Ub

While this appears bullish for the asset, a deeper look reveals how the stronghold of the six large entities holding UNI tokens and their actions (mass sell-off, profit taking or holding) could influence the asset’s price.

One interesting insight is that the New York State Attorney General Letitia James sent subpoenas to some venture capital firms that have invested in Uniswap. The list includes Andreessen Horowitz (widely known as a16z) and Union Square Ventures, among others. An Axios report shows that the US Securities & Exchange Commission (SEC) also had questions for Venture Capitalists earlier this year.

As regulators scrutinize entities holding a large share of the UNI token, their next steps could make or break the asset’s price trend. If the entities sold their holdings on a large scale, it could increase the selling pressure on Uniswap, pushing price down. If the venture capitalists continue to hold, and demand is sustained at current levels or rises, UNI price could either hold steady or rise in the short term.