Crypto Today: Bitcoin breaks past $60,000, Ethereum and XRP gain slightly

- Bitcoin jumps more than 5% and Ethereum gains over 3% on Tuesday due to prospects of greater institutional adoption.

- XRP increases nearly 1% on the day, close to key resistance at $0.60.

- Pro-XRP lawyer John Deaton criticized the US SEC for causing losses to small investors in a recent talk on YouTube.

Bitcoin, Ethereum, XRP updates

- Bitcoin (BTC) trades above $60,000, piling nearly 5% gains on Tuesday. Bitcoin Spot ETFs noted $12.9 million inflows on Monday, according to data from SoSoValue. This marks three consecutive days of inflows.

- Two key market movers are likely behind the recent gains: Apart from the ETF inflows, Singapore's largest bank DBS announced on Monday that the firm has plans to launch Bitcoin and Ethereum options trading soon.

- Ethereum (ETH) trades above $2,300 at the time of writing. Steven Goldfeder, co-founder of Offchain Labs, gave his opinion about the debate between Layer 1 and Layer 2 blockchains in a podcast on Bankless HQ. Goldfeder said that, even as governance challenges on Ethereum gave way to innovation in scaling and reduced transaction costs, there is no competition between Layer 2 chains and Ethereum.

- While it is a common belief among market participants that protocols built on top of the Ethereum are siphoning off revenue from the chain, competing with it, there is no competition with the altcoin, he said. Every Layer 2 chain helps scale the underlying mainnet further, boosting its utility and adoption among users, Goldfeder added.

LIVE NOW -- Refuting L2 FUD & The State of @arbitrum

— Bankless (@BanklessHQ) September 17, 2024

In the world of Ethereum scaling solutions, the debate between L1s and L2 blockchains has been heating up.

Today, Steven Goldfeder (@sgoldfed), co-founder of @OffchainLabs (the team behind Arbitrum), joins us on the podcast… pic.twitter.com/Xd1gaToN6f

- Ripple (XRP) changes hands at $0.5915, just under key resistance at $0.6000.

Chart of the day: SUI

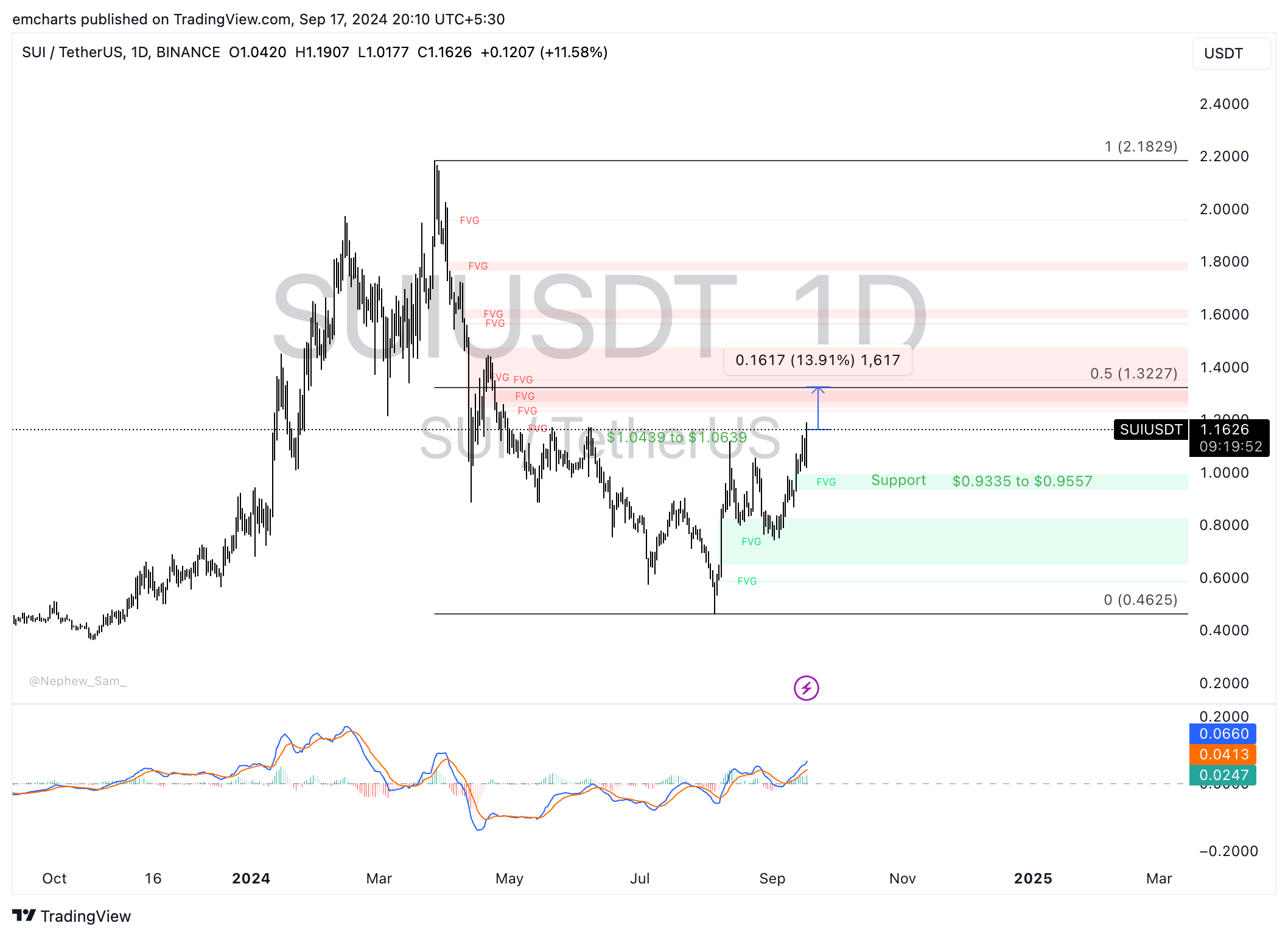

SUI/USDT daily chart

SUI trades at $1.1626, up 11% on the day, making it one of the top trending tokens on CoinGecko on Tuesday. The Moving Average Convergence Divergence (MACD), a momentum indicator flashes green histogram bars, signaling underlying positive momentum in SUI price trend.

If the current uptrend continues, SUI could extend gains by nearly 14% towards $1.3227, which aligns with the 50% Fibonacci retracement of the decline from the March top of $2.1829 to the August low of $0.4625. In the event of a correction, SUI could find support in the Fair Value Gap (FVG) extending between $0.9335 to $0.9557.

Market updates

- Hong Kong’s Financial Services and the Treasury Bureau (FSTB) plans to issue a framework for the ethical use of AI in financial markets, according to a Bloomberg report that cites an anonymous source on the matter.

- Stablecoin issuer Circle’s USD Coin (USDC) is available in Brazil and Mexico. Local real-time payment systems can be used to convert Brazilian Reals (BRL) and Mexican Pesos (MXN) into USDC. This is a key development, since it bypasses the need for first converting the fiat currency into US Dollars (USD).

- Dogecoin (DOGE), the largest meme coin by market capitalization, processed 1.93 million transactions last week. The meme coin has hit its highest weekly transaction count since early July, according to IntoTheBlock data.

- John Deaton, a pro-XRP attorney, recently discussed how the US Securities & Exchange Commission’s (SEC) actions negatively influenced the holdings of small investors and called out the regulator for causing nearly $15 billion in losses through their regulatory actions.

Industry updates

- WalletConnect, an open-source protocol that allows users to connect their crypto wallets to decentralized applications (dApps), gears up to airdrop 185 million WCT tokens, its native cryptocurrency.

Introducing Connect Token (WCT), the native token of the WalletConnect Network.

— WalletConnect (@WalletConnect) September 17, 2024

The WalletConnect Network is the the onchain UX ecosystem enabling apps and wallets to bring better onchain experiences to 23M+ users.

As the network continues to decentralize, WCT will be key in… pic.twitter.com/S6EvvPmKAu

- Circle announces that native USDC is ready for launch on the Sui Network, a Layer-1 blockchain that competes with Ethereum.

1/ We’re excited to announce that native $USDC and Cross-Chain Transfer Protocol (#CCTP) are coming soon to @SuiNetwork!

— Circle (@circle) September 17, 2024

Explore what native USDC and CCTP will mean for Sui.https://t.co/ctP3iAXcgL

- Terra Luna Classic community passed a key proposal primarily focused on correcting the number of validators allowed on the network. This development is likely to fuel positive sentiment among LUNC as it allows for a correction that was awaited by community members.