Crypto products post heavy outflows amid August decline in US unemployment rate

- Digital asset products record highest outflows since March, totaling $725.7 million.

- US Bitcoin ETFs saw the highest outflows following the release of lower-than-expected macroeconomic data.

- Ethereum ETFs saw further outflows of $98 million, while Solana ETFs recorded minor inflows.

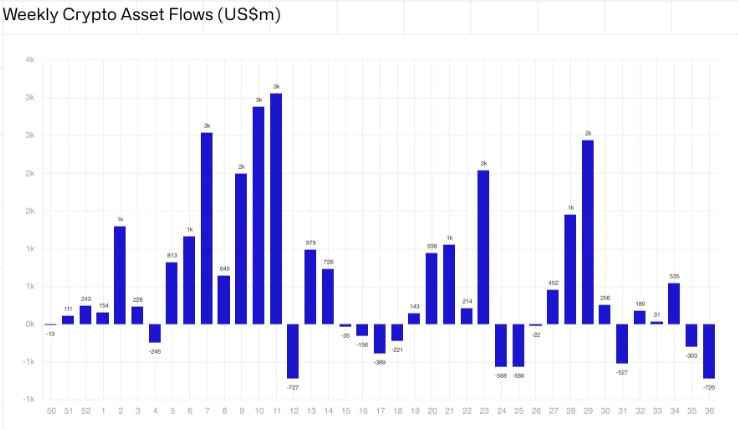

CoinShares' digital assets weekly report on Monday revealed that crypto ETFs saw their highest outflows since March, totaling $725.7 million. This is suggested to have resulted from last week's lower-than-expected Nonfarm Payroll (NFP) report.

Crypto ETF investors reduced holdings amid lower-than-expected NFP

Crypto investment products recorded a second week of outflows last week, with $725.7 million in net outflows, per CoinShares data. The report indicates that the huge outflows may have resulted from the overly high anticipation for a 25 basis point interest rate cut by the US Federal Reserve in September.

The US and Canada spearheaded net outflows of $721 million and $28 million, respectively. On the other hand, Europe noted inflows, with Germany and Switzerland recording positive flows of $16.3 million and $3.2 million, respectively.

Among digital asset classes, Bitcoin ETFs were the most affected, recording outflows totaling $643 million. BTC also witnessed a significant dip in its price, diving below $54K before seeing a slight correction on Monday. The decline follows August's NFP report, which noted an in-line unemployment rate of 4.2% but lower-than-expected jobs growth.

Weekly Crypto Asset Flows

Investors have now turned their focus toward the US Consumer Price Index (CPI) data report slated for Wednesday. CoinShares notes that a 50 basis point rate cut will be possible if the CPI data comes in below expectations.

The US presidential debate on Tuesday may also prove decisive, as Donald Trump has reiterated his support for Bitcoin and the entire digital asset market.

Short-bitcoin ETFs, on the other hand, witnessed inflows of $3.9 million after Bitcoin's heavy outflows. Among altcoins, Solana products saw inflows totaling $6.2 million, while Ethereum witnessed further outflows of $98.1 million.