PIN AI secures $10M from a16z CSX, Hack VC, and All-Star angels to launch open platform for personal AI

San Francisco, United States, September 9th, 2024, Chainwire

Innovative startup from Ethereum Core research, Google Brain, Stanford, MIT, and CMU aims to democratize on-device intelligence, empowering users with control over their personal AI, and receiving investment from a16z CSX, Hack VC, and investors from projects like Solana, Polygon, Near, Worldcoin, etc.

PIN AI, a pioneering AI infrastructure company, announces $10 million in pre-seed funding to develop the world’s first open-source Personal Intelligence Network (PIN). A16z CSX, Hack VC, and notable investors, including Blockchain Builders Fund (Stanford Blockchain Accelerator), Illia Polosukhin (Transformer paper author; Founder, NEAR Protocol), Anagram/Lily Liu (President, SOL Foundation), Symbolic Capital (Co-Founder, Polygon), Evan Cheng (CEO, Mysten Labs/SUI), dcbuilder (Worldcoin Foundation), Foresight Ventures (parent company of the Block), Nomad Capital, Tim Shi (Co-Founder, Cresta), Ben Fisch (CEO, Espresso), Scott Moore (Co-Founder, Gitcoin), Alumni Ventures, and Dispersion Capital, have backed the project.

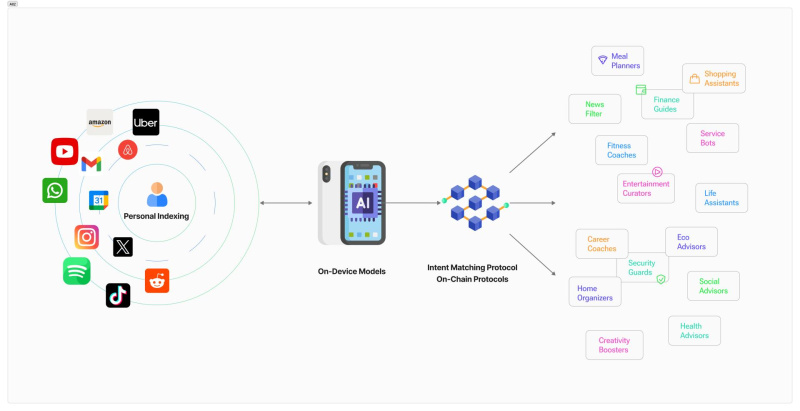

Offering an open-source, web3-enabled alternative to Apple Intelligence, PIN AI’s platform turns smartphones into privacy-focused AI personal assistants. By redirecting profits from users’ data and attention, it empowers users to regain control and monetize their data. The platform leverages personal, contextual data and cryptography, deploying cutting-edge AI models on-device to handle tasks across apps—like shopping, ordering food, wealth management, and interacting with centralized exchanges, DeFi, and prediction markets.

This AI-driven assistant ensures robust privacy and user-controlled data management, disrupting ultra-profitable models of web2 giants, including Apple’s 30% app revenue cut (over $100 billion) and Google’s mobile ads and Android store revenue cuts.

Davide Crapis, Co-Founder leading Protocol Research, said, “We’re building a movement towards an open-source future where personal AI assistants can work on PIN AI’s platform like smart contracts on Ethereum.” He added, “PIN AI will take back the $100b+ profit from tech giants and return it to users, allowing them to control and monetize their data. Our platform offers access to a wider range of AI agents, developed by the open-source community, capable of handling tasks across popular apps.”

PIN AI’s mission is to foster innovation for personal AI agents by offering access to personal, contextual data that reflects individual users’ needs and preferences. Unlike closed ecosystems like Apple, PIN AI’s open platform connects privacy-protected user data via a Layer-2 blockchain. This enables more flexibility in AI application development without the constraints of traditional, closed systems.

Bill Sun, Co-Founder and Chief Scientist, said, “On-device multi-modality models will revolutionize daily life. We are building a personal index for each user to create an on-device model that evolves via distributed training on the user’s phone. Soon, users won’t need to open multiple apps to complete tasks. The personal AI assistant will understand preferences and manage tasks efficiently.” PIN AI’s assistant will connect users with apps and services bidding on its blockchain protocol to fulfill tasks like shopping or crypto activities.

PIN AI shifts data monetization from big tech to users, allowing secure monetization of personal data. Users receive token incentives through data onboarding and intent fulfillment, only providing necessary data with matched Personal AI Agents, while maintaining control of their information.

At launch, PIN AI partners with Worldcoin and is developing a front-end product similar to Siri, expanding its reach and enhancing user experience.

Leading the team are co-founders Davide Crapis and Ben Wu. Crapis, formerly of Ethereum Core Research, leads Protocol Research. Ben Wu, heading Strategy, is an MIT graduate, Y Combinator alum, and serial entrepreneur. The technical leadership includes Bill Sun, a Stanford AI/Math PhD and early Google Brain researcher, as Chief AI Scientist, and Regan Peng, a CMU graduate and former lead at Didi Fintech and Yahoo Data Infra, as Founding Head of Engineering.

PIN AI collaborates with a16z crypto research, Flashbots, Espresso Systems, and academics from Stanford, Columbia, and NYU. Ben Wu emphasized the importance of an open platform, saying, “The open internet has made large language models possible. We need to build an open platform for users on their trusted device, allowing access to their various data, making their Personal AI possible.” Unlike Apple Intelligence, PIN AI’s system can run on low-spec smartphones by dynamically shifting between edge AI (on-device) and server AI to optimize performance, ensuring wide accessibility.

The funding will expand research, grow the team of AI and blockchain experts, and accelerate the deployment of PIN AI’s technology. The company will join the a16z CSX Fall 2024 cohort in New York City.

About PIN AI

PIN AI is developing an open-source personal AI operating system that leverages smartphone and app data to empower users with control and privacy. The company’s approach aims to connect AI developers with users, promoting data sovereignty and developer empowerment. PIN AI collaborates with Ethereum Core Research and is committed to privacy and innovation.

For more updates, visit pinai.io, X (formerly Twitter), Telegram, Discord, and Linkedin.

Contact

PIN AI

contact@pinai.io

The post PIN AI secures $10M from a16z CSX, Hack VC, and All-Star angels to launch open platform for personal AI appeared first on Live Bitcoin News.