XRP Ledger prepares for upgrade to allow token holders to earn income on-chain

- XRP Ledger is preparing for an upgrade to introduce a built-in automated market maker trading platform into the ledger.

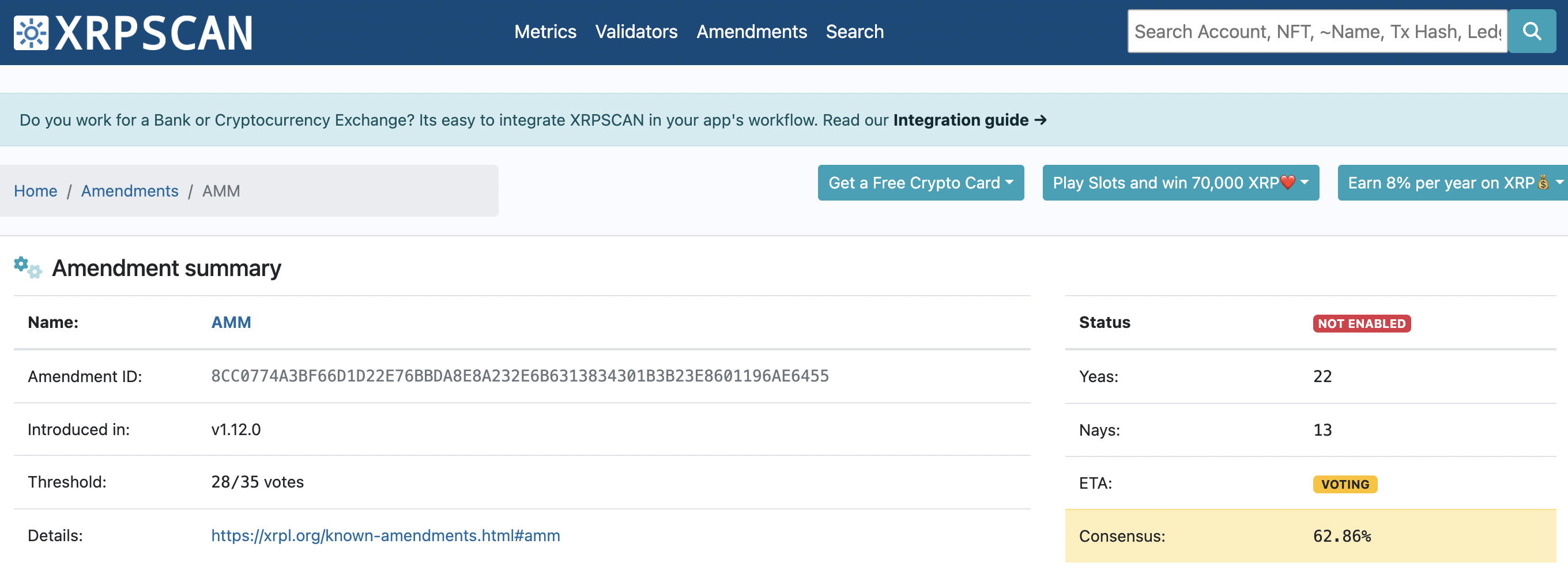

- Validators are currently voting on XRP Ledger’s Automated Market Maker amendment.

- XRP price nosedived 1% on the day, and declined nearly 10% in the past week.

The XRP Ledger is preparing for an upgrade that will introduce an Automated Market Maker (AMM) into the ledger. This AMM will act as an opportunity for XRP holders to earn on-chain income by becoming liquidity providers.

The altcoin’s validators are currently voting on the proposal and data shows that the consensus is 60%.

Also read: Bitcoin price eyes comeback above $40,000, traders unsure of where BTC is headed next

XRP Ledger gears up for upgrade

The XRP Ledger is preparing for an amendment to its blockchain that will introduce a built-in Automated Market Maker (AMM) trading platform into the ledger. The AMM allows for crypto trading using liquidity pools, in a permissionless manner.

The proposal has gained support from validators, since its introduction. According to Panos Mekras, founder of Anados Finance, 20 validators have approved the XLS-30d amendment. The consensus is 62.86% according to data from XRPScan.

Voting on the XRP Ledger amendment

AMMs eliminate the need for order books, thereby reducing both the delay and transaction costs. The amendment will offer traders the opportunity to trade with the liquidity pool, thus making liquidity available irrespective of market conditions.

XRP price is $0.51 at the time of writing. The altcoin’s price is down nearly 2% on the day. XRP price declined over 10% in the past week.