Crypto investment products record weak inflows amid mixed behavior across asset investors

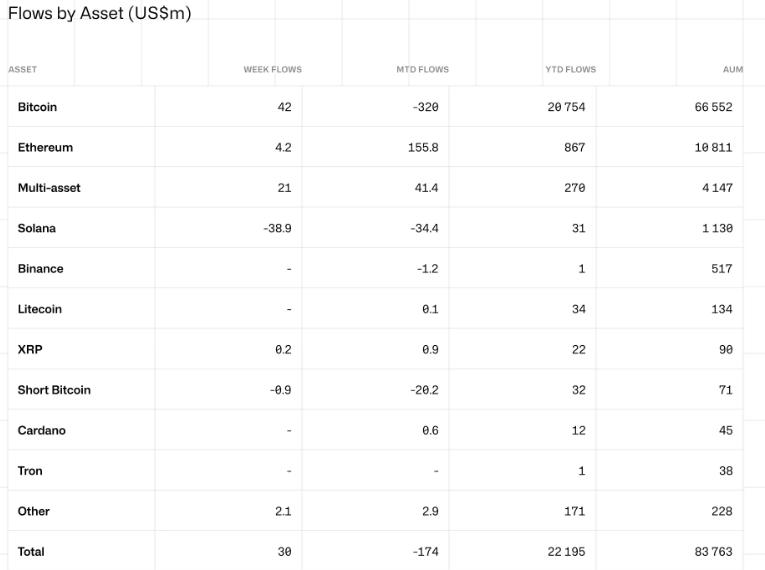

- Digital asset products recorded $30 million in net inflows last week following fears that the Fed wouldn’t cut interest rates in September.

- Bitcoin ETFs saw $42 million in net inflows as investors looked to tighten their holdings last week.

- Ethereum ETFs also saw inflows of $4.2 million, while Solana ETFs witnessed $39 million in outflows.

Digital asset products witnessed net inflows totaling $30 million last week after the release of the July US Consumer Price Index (CPI) data saw Bitcoin ETFs stage a recovery. Meanwhile, Solana investment products were hit with $38 million in outflows as the meme coin market declined.

Digital asset products see inflows as crypto market attempts recovery

The crypto investment landscape saw choppy price action last week, recording net inflows of $30 million as the market looked to recover from the drawdown on August 5, according to CoinShares' digital asset weekly report.

The report suggests that the weak inflows could be due to concerns that the Federal Reserve (Fed) may not cut interest rates by September. This is also evident in a nearly 50% decline in trading activity across crypto ETFs.

The US dominated geographically with $62 million in net inflows, followed by Canada and Brazil, which recorded net inflows of $9.2 million and $7.2 million, respectively. Switzerland recorded outflows for the first time in over a month as investors in the region moved $29.7 million from crypto products last week. Hong Kong and Germany also recorded outflows of $14.3 million and $6.1 million, respectively.

Bitcoin ETFs witnessed the highest inflows among crypto ETFs last week after recording a net inflow of $42 million.

The renewed interest among investors may be due to accumulation behavior among large Bitcoin miners, especially after the US released in-line CPI data for July, according to CryptoQuant's data. The miners may include Marathon Digital, which released senior convertible note offerings worth $250 million as part of its plans to acquire more Bitcoin.

Crypto ETF Flows by Asset

On the other hand, Ethereum-based investment products saw net inflows totaling $4.2 million. In the US spot ETH ETF terrain, new providers saw inflows of $104 million, while Grayscale experienced outflows of $118 million.

Meanwhile, Solana ETFs witnessed outflows last week, totaling $38.9 million, its largest-ever weekly outflow. This may be due to a decrease in meme coin market capitalization and trading volume, which has helped boost demand for Solana in the past five months.