UEFA Champions League Welcomes Crypto.com as First Global Crypto Partner

On August 14, Crypto.com, a crypto exchange based in Singapore, announced a partnership with the UEFA Champions League as the first and exclusive global crypto platform partner.

This multi-year partnership is designed to enhance fan experiences and integrate cryptocurrency into the global sports arena.

From FIFA to UEFA: How Crypto.com is Making Waves in Global Sports

According to the official statement, Crypto.com’s collaboration with UEFA will feature in-stadium activations, broadcast integrations, and unique advertising campaigns. These initiatives aim to drive fan engagement and bring cryptocurrency to the forefront of the football community. Crypto.com’s branding as an official global sponsor will debut at the UEFA Super Cup on August 14, 2024.

Read more: Crypto.com vs. Coinbase: Which Crypto Exchange Is Right for You?

Crypto.com’s latest move also signifies its commitment to establishing a strong presence in sports by leveraging its global reach. Steven Kalifowitz, Crypto.com’s Chief Marketing Officer, emphasized that the UEFA Champions League’s global appeal aligns perfectly with the company’s mission to make cryptocurrency accessible to a broader audience.

“Connecting our brand with engaged sports fans around the world has effectively grown our user base to over 100 million in pursuit of our mission of cryptocurrency in every wallet,” Kalifowitz stated.

This partnership is the latest in a series of high-profile sports sponsorships for Crypto.com. BeInCrypto reported the company became the exclusive crypto sponsor of the FIFA World Cup in Qatar in March 2022. Additionally, it has been a key partner of the Ultimate Fighting Championship (UFC) since 2021.

Between 2021 and 2022, crypto firms accelerated their sponsorships of sporting leagues and teams. This trend, however, faced setbacks when the crypto exchange FTX, which had invested over $300 million in sports marketing deals, collapsed. Furthermore, the prolonged bear market exacerbated the challenges, slowing the momentum of crypto sponsorships in sports.

Despite these challenges, the crypto industry is bouncing back, with companies like Crypto.com leading the way. Their strategic partnership with UEFA demonstrates a renewed commitment to engaging with global audiences through high-profile sports events.

Read more: 10 Best Crypto Exchange Reviews for August 2024

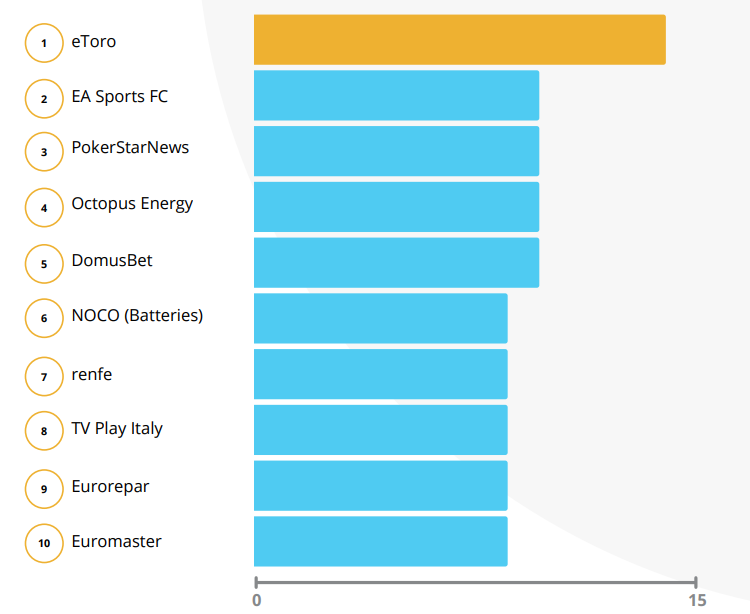

List of Brands with the Most Partnership Deals in the European Football Sector. Source: SponsorUnited

List of Brands with the Most Partnership Deals in the European Football Sector. Source: SponsorUnited

Similarly, eToro has significantly increased its presence in European football sponsorships between 2023 and 2024, distinguishing itself as one of the few crypto firms to grow its sports marketing efforts during this period. According to SponsorUnited, while over 70% of other crypto brands saw stagnation or decline in their sponsorship deals, eToro’s success exemplifies a broader industry trend of leveraging sports partnerships to solidify brand presence.