Starknet (STRK) Holders Not Throwing in the Towel Ahead of Major Mainnet Upgrade

Ethereum layer-2 network Starknet (STRK) has struggled since its token launch in February. This issue is one reason only 8% of STRK holders are in profit.

Despite the drawdown, it appears that the cryptocurrency holders have decided to test the waters by steering clear from selling. Meanwhile, this on-chain analysis reveals more.

Starknet Hopes to Reclaim Its Lost Fortunes

A few days ago, Starknet disclosed the successful launch of the Parallel Execution and Block Packing upgrade on Testnet. The upgrade, geared toward gas fee reduction and a two-second block confirmation time, will go live on Mainnet on August 28.

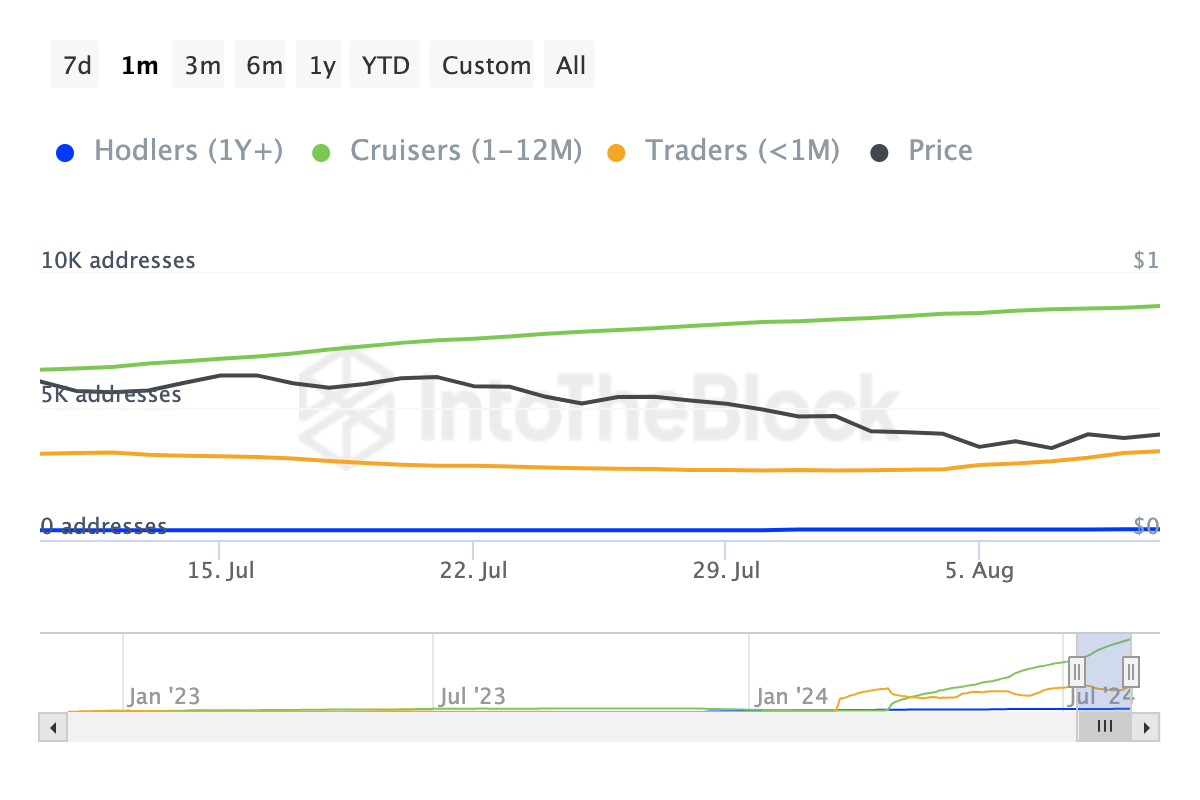

Following the Testnet announcement, IntoTheBlock data shows there is an increase in the number of addresses holding STRK between the last 30 days and the last 365 days.

While the reason for this remains uncertain, the increase clearly indicates that holders remain optimistic about the token’s future potential. Likewise, it suggests that they are not ready to give in to the losses, regardless of the downturn experienced.

Read more: A Deep Dive Into Starkware, StarkNet, and StarkEx

Starknet Addresses by Time Held. Source: IntoTheBlock

Starknet Addresses by Time Held. Source: IntoTheBlock

This resolve could be termed surprising considering the controversies Starkenet has been involved in. For instance, early adopters of the project were unsatisfied with the airdrop distribution in February.

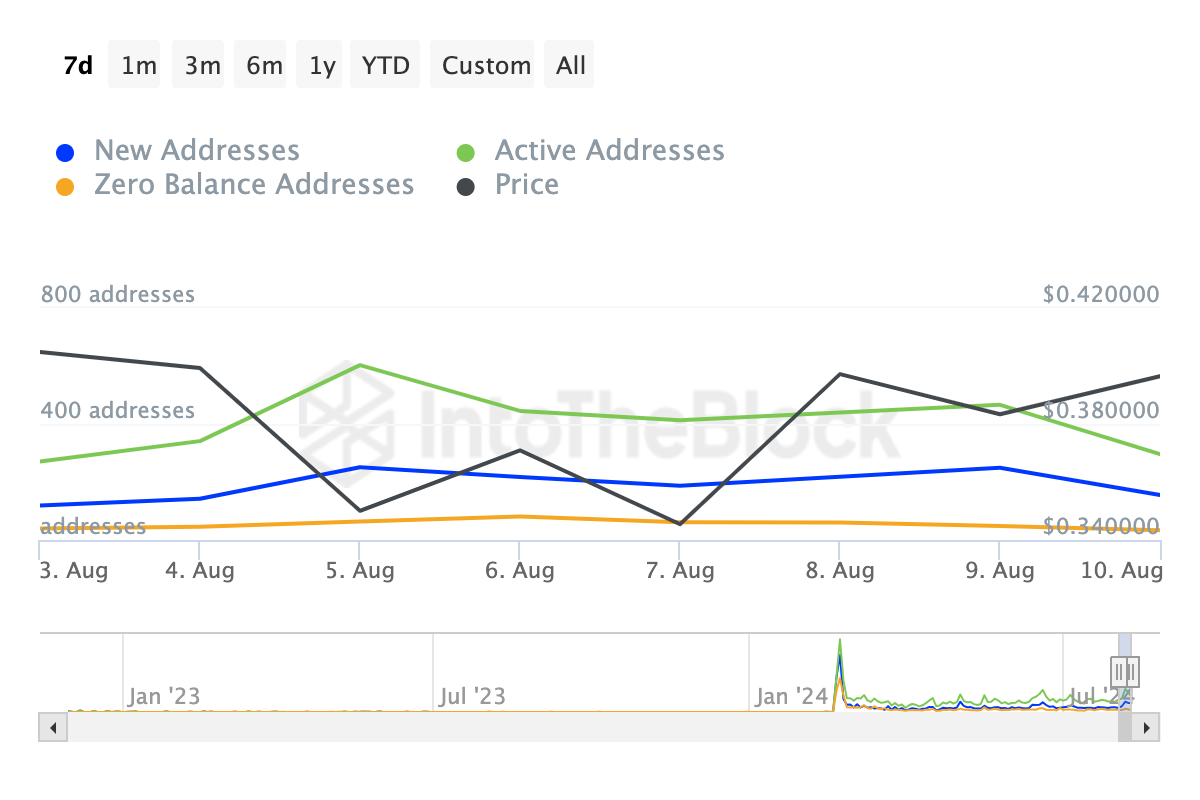

Furthermore, the project experienced a notable plunge in user engagement, and more recently, the CEO stepped down. Interestingly, on-chain data reveals that there has been a notable improvement in network activity.

Specifically, new addresses, which refer to the number of participants completing their first successful transaction, have increased by 30.25% within the past week.

Similarly, active addresses, a metric measuring the number of senders and receivers on a blockchain, also jumped. If sustained, the rise in these figures is a bullish sign for Starknet and its native token.

Starknet New and Active Addresses. Source: IntoTheBlock

Starknet New and Active Addresses. Source: IntoTheBlock

STRK Price Prediction: The Token Eyes the Upper Resistance

At press time, STRK’s price trades at $0.39, making it one of the biggest gainers in the top 100 of the last 24 hours. Based on the daily chart, the cryptocurrency formed a descending triangle between June 5 and August 3.

A descending triangle is a bearish chart pattern characterized by a series of Lower Highs (LH) and a resistance level at the crest. Earlier, STRK broke down below this region, suggesting that the downtrend may continue.

But as of this writing, the cryptocurrency seems poised to rise above the pattern. Signs also emerged that it is in price discovery mode as the Money Flow Index (MFI) reading is 16.20.

Apart from measuring buying and selling volume, the MFI evaluates if a cryptocurrency is overbought or oversold. Values at 80.00 or above mean it is overbought, while those at 20.00 or below indicate that it is overbought.

Read more: ZkEVMs explained: Enhancing Ethereum Scalability

StarkNet Daily Analysis. Source: TradingView

StarkNet Daily Analysis. Source: TradingView

According to this law, STRK’s price is oversold, and a notable bullish reversal could be on the cards. Thus, if buying pressure increases, the token’s value may rally toward the overhead resistance at $0.62 in the short term.

Additionally, the successful completion of the Parallel Execution and Block Packing upgrade on Mainnet, coupled with high demand, could drive the price toward $0.94. However, if confidence drops among holders, selling pressure may come into play, and the price could drop to $0.34.