3 Reasons Why Bittensor (TAO) Price Breakout May Continue

TAO, the utility token of the decentralized network Bittensor, is among the top gainers in the market today. The altcoin, which was trading as low as $181.79 on August 5, has surged to $316.93 at press time.

This rally represents a 15.61% 24-hour increase. However, a few other interesting things are happening on the network, which this on-chain analysis will discuss.

The Hidden Forces Behind Surging Interest

On August 7, BeInCrypto reported that leading crypto asset manager Grayscale added Bittensor to its new investment trusts. The development came a few weeks after the firm created a decentralized AI trust involving other AI-themed tokens.

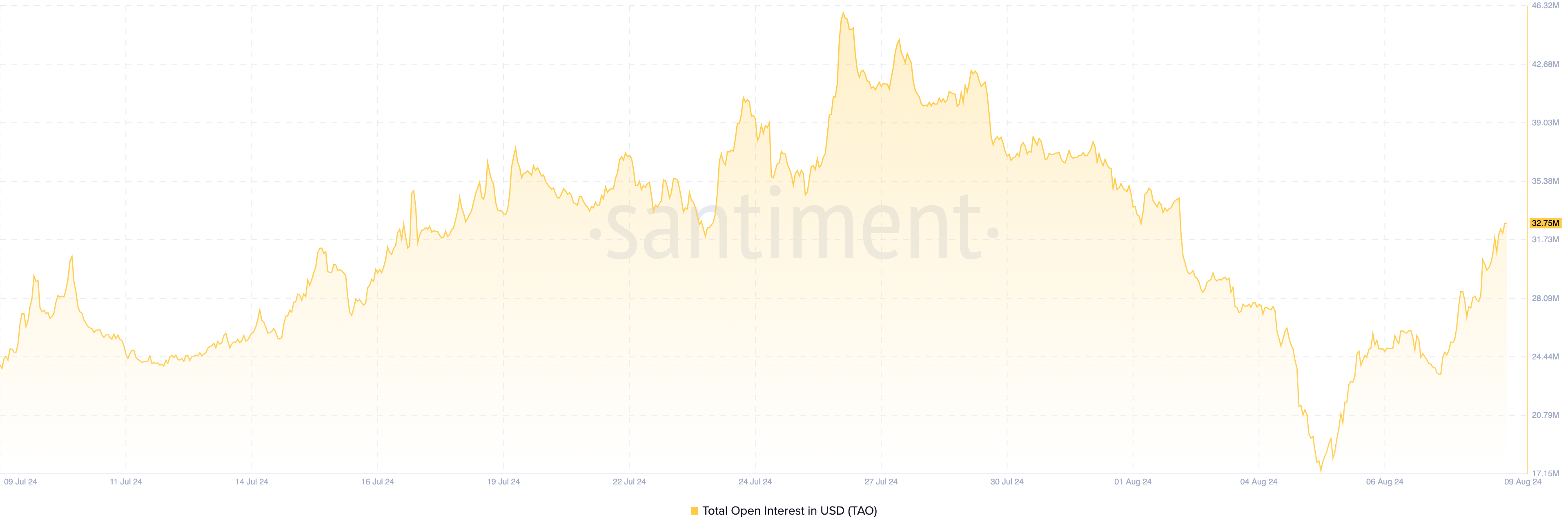

Following the disclosure, traders in the derivatives market increased their exposure to TAO. According to Santiment, Open Interest related to the cryptocurrency was around $17 million. As of this writing, that value has nearly doubled.

Open Interest, often referred to as OI, measures the value of outstanding contracts in the market. An increase in OI indicates that traders are adding more liquidity to contracts, while a decrease signals a reduction in net positioning.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Bittensor Open Interest. Source: Santiment

Bittensor Open Interest. Source: Santiment

When critically analyzed, Open Interest (OI) can indicate whether a trend is likely to continue. If OI and price both move in the same direction, the trend is likely to persist. However, if they move in opposite directions, a trend reversal may occur.

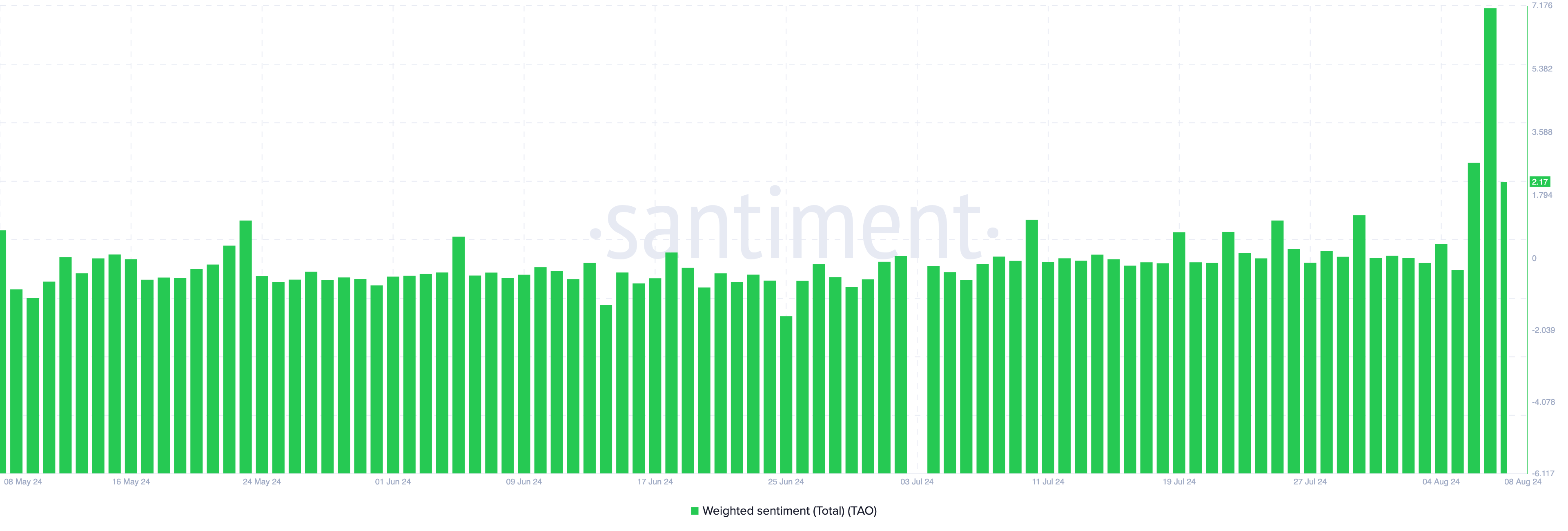

With TAO’s price and OI both on the rise, the token could reach a higher value in the short term. Additionally, on-chain data reveals that Weighted Sentiment spiked on August 7, reflecting extremely optimistic comments about Bittensor.

Bittensor Weighted Sentiment. Source: Santiment

Bittensor Weighted Sentiment. Source: Santiment

Although this sentiment has slightly decreased, it remains positive, suggesting that the broader market still holds a bullish outlook. If this sentiment continues in the positive range in the coming days, demand for TAO may grow, potentially driving the price even higher.

TAO Price Prediction: Can It Break the $360 Barrier?

Before TAO’s recent surge, the daily chart showed it had formed a rounded top. Often viewed as a bearish sign, the inverted bowl-shaped pattern indicates increasing selling pressure.However, the support level at $217.87 prevented a breakdown from happening.

Meanwhile, the Relative Strength Index (RSI) is 54.31, suggesting solid bullish momentum for the cryptocurrency. Typically, the RSI is a technical indicator that uses speed and price changes to determine momentum.

When it increases, buying momentum dominates, while a decrease suggests that sellers are in control. For TAO, the rise in the RSI rating could strengthen the uptrend just like the Open Interest.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Bittensor Daily Analysis. Source: TradingView

Bittensor Daily Analysis. Source: TradingView

Based on the analysis, TAO could target the overhead resistance at $323.18. If it breaks through this level, the price might reach $361.51. However, if bears overpower the bulls, the cryptocurrency’s value could drop to $272.58.