Grayscale outflows reach $2.8 billion even as GBTC discount contracts to less than 0.3%

- Grayscale Bitcoin Trust (GBTC) is now less than 0.3% away from noting premium for the first time in three years.

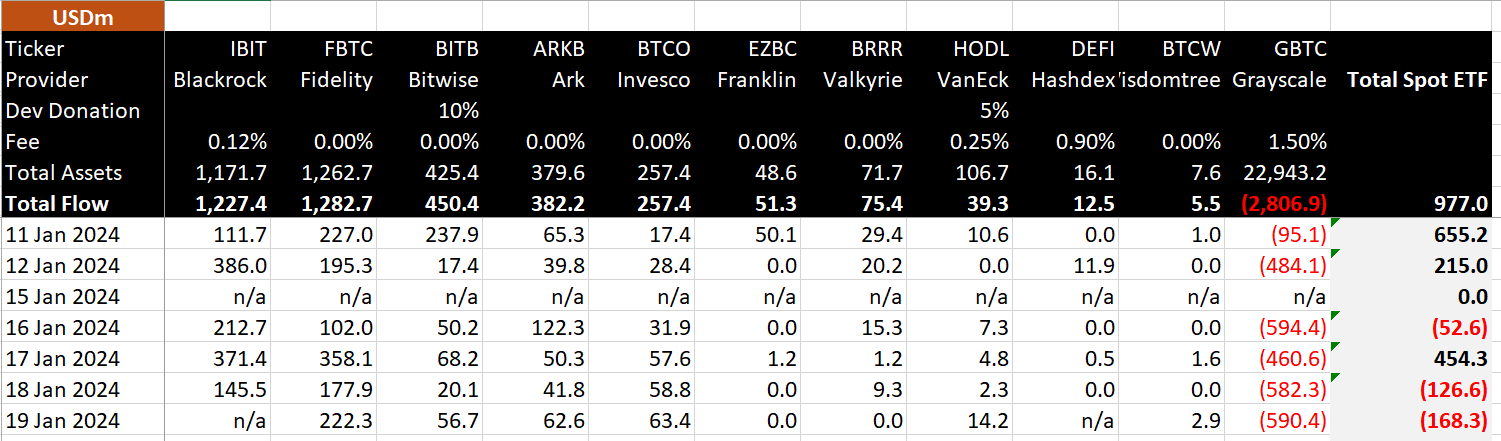

- Per Bitmex Research, the outflows in GBTC extended to $590 million on Day 6 of trading, bringing the total to $2.8 billion.

- At this rate, the asset manager would note an outflow of all its holdings within the next two months.

This is impractical; thus, outflows will slow down in three to four weeks but still result in losses.

Grayscale, the leader of all spot Bitcoin ETF applicants in terms of assets held, is now losing its assets rapidly as investors are moving to sell for profit. This, however, seems to have no impact on the value of Grayscale Bitcoin Trust (GBTC), which is improving day by day thanks to the large transaction volumes representing demand in the market.

Grayscale flows stun the market

With assets worth nearly $23 billion under the belt, Grayscale has a lot to lose, metaphorically and literally. And given the outflows it is witnessing, it may actually lose a lot more quickly. Since trading began, Grayscale has largely been noting outflows, reaching the $1 billion mark on day three and the $2 billion mark by day 5.

As of today, six days later, Grayscale has recorded total outflows worth $2.8 billion. The $590 million worth of assets leaving the ETF on Friday nudged this figure closer to the $3 billion mark, which Grayscale will likely achieve by Monday.

Spot Bitcoin ETF flows | BitMEX Research

At this rate, Grayscale would witness all its holdings flow out within the next two months. Although this is rather impractical to happen, it does signify the intensity of outflows and the impact they could have on GBTC.

But surprising the market, the discount that GBTC has been observing is contracting every passing day. At the time of writing, the discount to Net Asset Value (NAV) is at less than 0.3%, putting it close to moving above the zero line. When this happens, GBTC will be witnessing a premium on NAV for the first time in three years.

Even though the market is still largely consumed by the ETF approval hype, it does not put Bitcoin out of danger of noting further declines, and that might be the only factor impacting the potential of GBTC noting premium again.